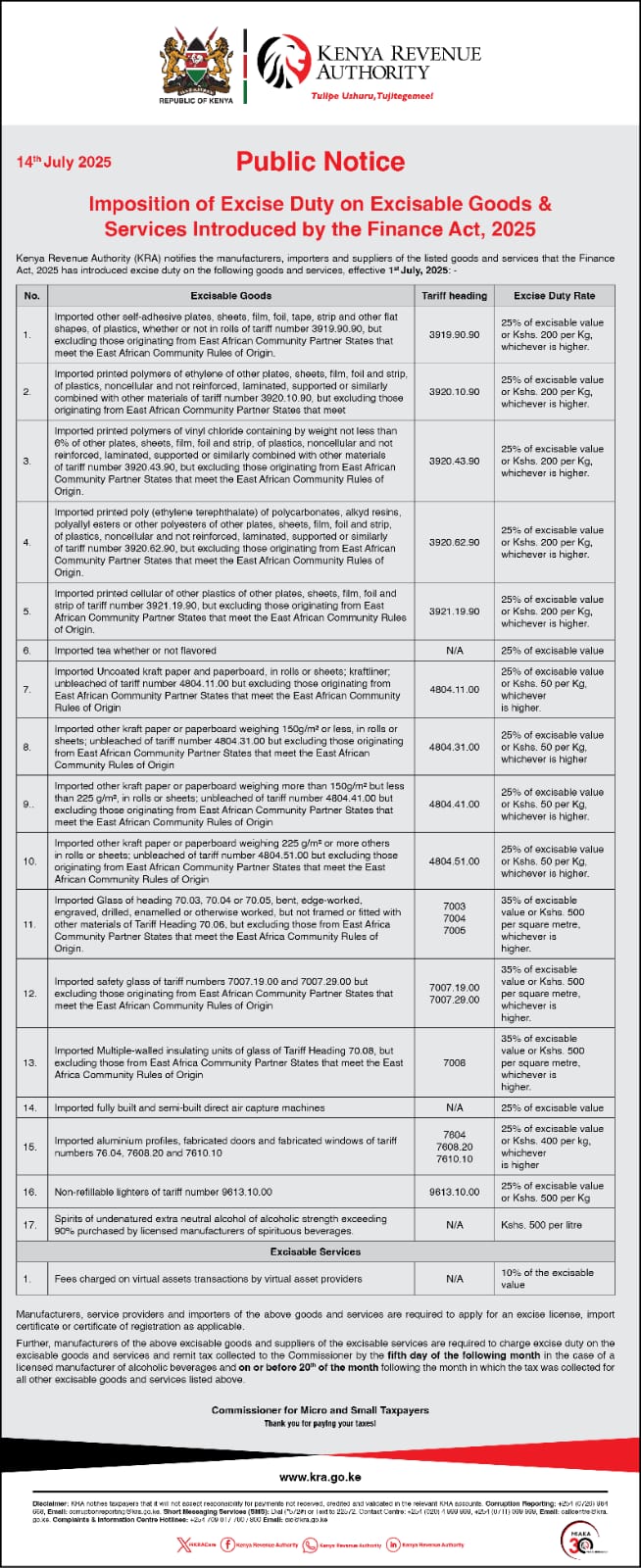

The Kenya Revenue Authority has shared a list of imported goods that will start attracting between 25 and 35 per cent excise duty from July 1, introduced by the Finance Act, 2025.

The excise value will not be imposed on goods originating from East African Community partner states.

The taxman said manufacturers, importers and suppliers of the affected goods are required to apply for an excise duty licence, import certificate or certificate of registration as applicable.

Furthermore, KRA stated that manufacturers and suppliers of excisable goods and services are required to remit the tax collected to the Commissioner of Revenue by the 20th day of the following month.

For licensed manufacturers of alcoholic beverages, the deadline is the fifth day of the following month.

Among the goods that will attract a 25 per cent excise duty or Sh50 per kg (whichever is higher) are imported tea (flavoured or not) and non-refillable lighters.

Others include imported kraft paper, printed cellular sheets, film and foil, self-adhesive plates, polycarbonates, laminated polymers, tapes, and flat plastics.

Imported, fully built, and semi-built direct air capture machines, as well as aluminium profiles, fabricated doors, and windows, also fall under this tax bracket.

Imported goods that will attract a 35 per cent excise duty include glass of heading 70.03, 70.04, or 70.05, but not glass-framed or fitted with other materials of tariff heading 70.06.

KRA said the 35 per cent tax will be imposed on these goods or Sh500 per square metre, whichever is higher.

Also set to attract the same excise duty or Sh500 per kg are imported multiple-walled insulating units of glass, tariff heading 70.08.

Spirits of undenatured extra neutral alcohol of alcoholic strength exceeding 90 per cent will attract excise duty at the rate of Sh500 per litre.

The Act has also introduced a 10 per cent excise duty on all virtual assets transactions (cryptocurrency) by virtual assets providers.

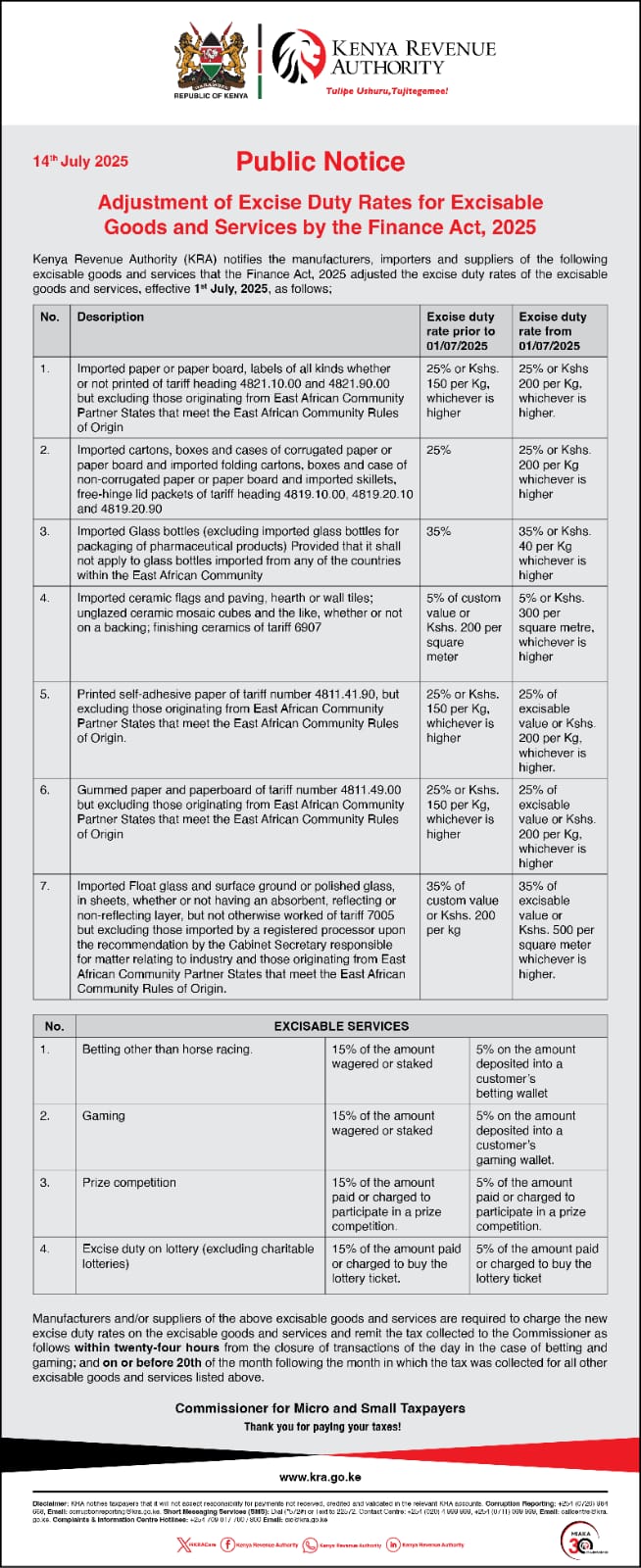

On the positive side, the Finance Act has adjusted excise duty rates for excisable services, including betting, gaming, prize competitions, and lotteries (excluding charitable lotteries).

The excise duty on betting other than horse racing has been reduced from 15 per cent on the amount wagered or staked to 5 per cent of the amount deposited into a customer's betting wallet.

The same applies to amounts deposited into a customer's gaming wallet, the amount paid or charged to participate in a prize competition, and the amount paid or charged to buy a lottery ticket.

KRA said providers of the above excisable services should remit the tax collected within 24 hours from the closure of the transactions of the day in the case of betting and gaming.

The remittance deadline is the 20th of the month following the month in which the tax was collected for all other excisable services.

List of goods that will attract excise duty from July 1, 2025. /KRA

List of goods that will attract excise duty from July 1, 2025. /KRA Adjusted excise duty rates for goods and services from July 1, 2025. /KRA

Adjusted excise duty rates for goods and services from July 1, 2025. /KRA