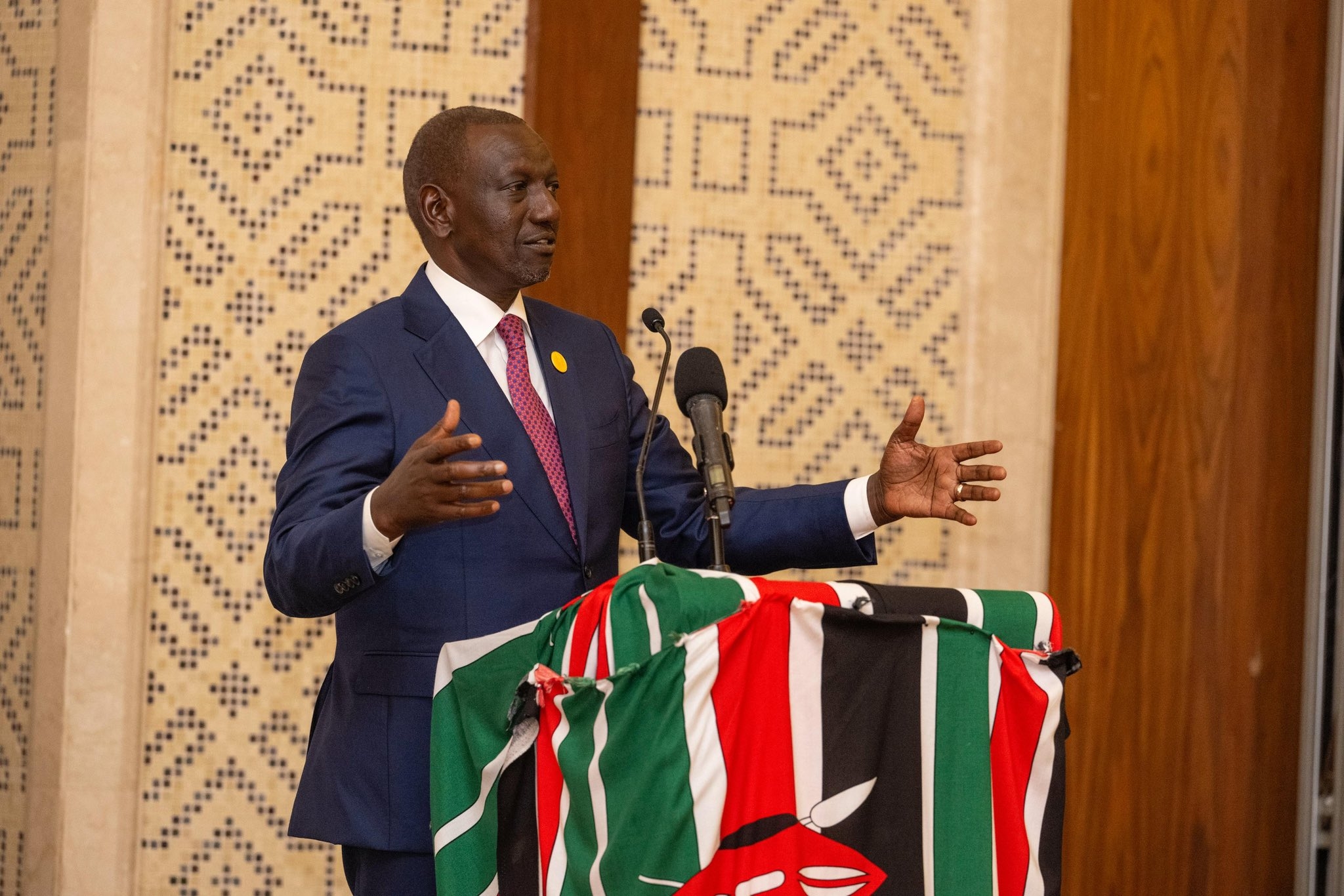

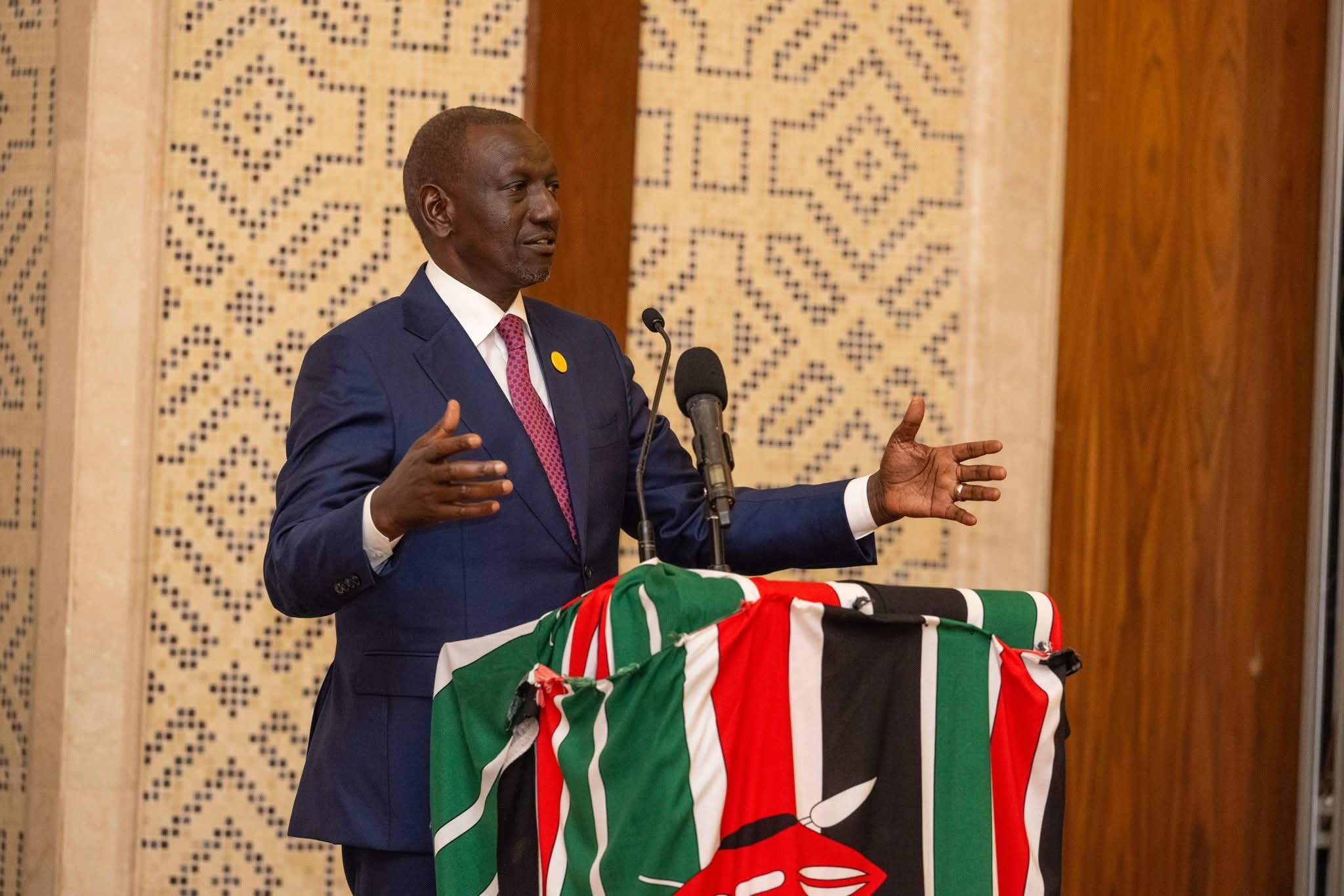

President Ruto at the Paternoster Square in London during the bell ringing ceremony at the London Stock Exchange on July 2, 2025. /PCS/X

President Ruto at the Paternoster Square in London during the bell ringing ceremony at the London Stock Exchange on July 2, 2025. /PCS/X In the heart of London’s financial district, President William Ruto stood at Paternoster Square, taking part in the symbolic bell-ringing ceremony that marked the start of trading at the London Stock Exchange.

But it wasn’t just a ceremonial gesture—it was a declaration of intent.

In his address, President Ruto shared a compelling vision for Kenya’s economic future, grounded in the belief that domestic capital markets are key to building financial resilience.

“They reduce dependence on external debt and diversify investment opportunities,” he said, underscoring the value of looking inward to stabilise the economy.

He noted that global trends are increasingly pointing to the rising influence of equity and debt markets, and that now is the time to strengthen and deepen these financial ecosystems.

For Kenya, he said, that means continuing to draw inspiration from one of the world’s most established trading platforms.

"With rich experience drawn from the London Stock Exchange, we will make Nairobi Securities Exchange more robust and vibrant to further this vision,” the President affirmed.

The push to transform Kenya’s capital markets isn’t just aspirational.

President Ruto revealed that strategic reforms and a renewed market-driven strategy have already started to pay off.

“These reforms helped NSE emerge as Africa’s top performer in dollar returns in 2024,” he said with evident pride.

But he’s not stopping there. The President said his administration is actively working to broaden the appeal of the stock market to both local and international investors.

A key part of this effort is the plan to privatise major State-owned enterprises through listings on the Nairobi Securities Exchange.

“We are committed to a programme that identifies and prepares a pipeline of key government assets to be privatized through the Exchange,” he explained.

One of the centrepieces of that programme is the upcoming Initial Public Offering (IPO) of the Kenya Pipeline Company (KPC)—a move that could reshape investor participation in Kenya’s infrastructure sector.

“This will offer investors a unique opportunity to deploy capital in one of our most strategic infrastructure enterprises,” President Ruto concluded.

As the trading bell echoed through London’s financial heart, it symbolised more than the start of another trading day.

For Kenya, it signalled the beginning of a renewed journey to financial self-reliance, powered by bold reforms and a strong belief in the potential of domestic capital markets.

![[PHOTOS] Ruto at the 2025 Africa Debate in UK](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F07%2F1d398f68-2e8d-439a-964f-d560399cd49c.jpeg&w=3840&q=100)