Safaricom has cemented its position as a top earner in East and Central Africa and a major driver of Kenya’s economy, with its contribution to the GDP now at over eight per cent.

This translates to about Sh1.21 trillion that the company is contributing to the Kenyan economy annually, both economic and social value, of the country’s GDP estimated at Sh15.11 trillion as per the Central Bank of Kenya.

This, as M-Pesa continues to play a critical role in households, companies, agents and dealers as the value of transactions hit Sh38.3 trillion for the financial year ended March 2025, up from Sh37.7 trillion last year.

The firm on Friday announced an 11.2 per cent growth in total revenue to Sh388.7 billion ($3 billion) for the financial year ended March, with net income also accelerating by 10.8 per cent to hit Sh69.8 billion.

The $3 billion dollar revenue is the first in the region as the transition to become a purpose-led technology company pays off.

Following these results, Safaricom which made entry into Ethiopia in October 2022 will pay out Sh48.08 billion in dividend to its shareholders for the year, adding a final dividend of 65 cents per ordinary share to the interim dividend of 55 cents per ordinary share already paid out on or about March 2025.

The firm has sustained dividend payment despite the Ethiopian Birr depreciation, with the current financial year’s proposed payout being an addition to the Sh612.12 billion dividends paid to shareholders from financial year 2008-09 to 2023- 2024, including special dividends. Sh254.82 billion was paid over the last five years.

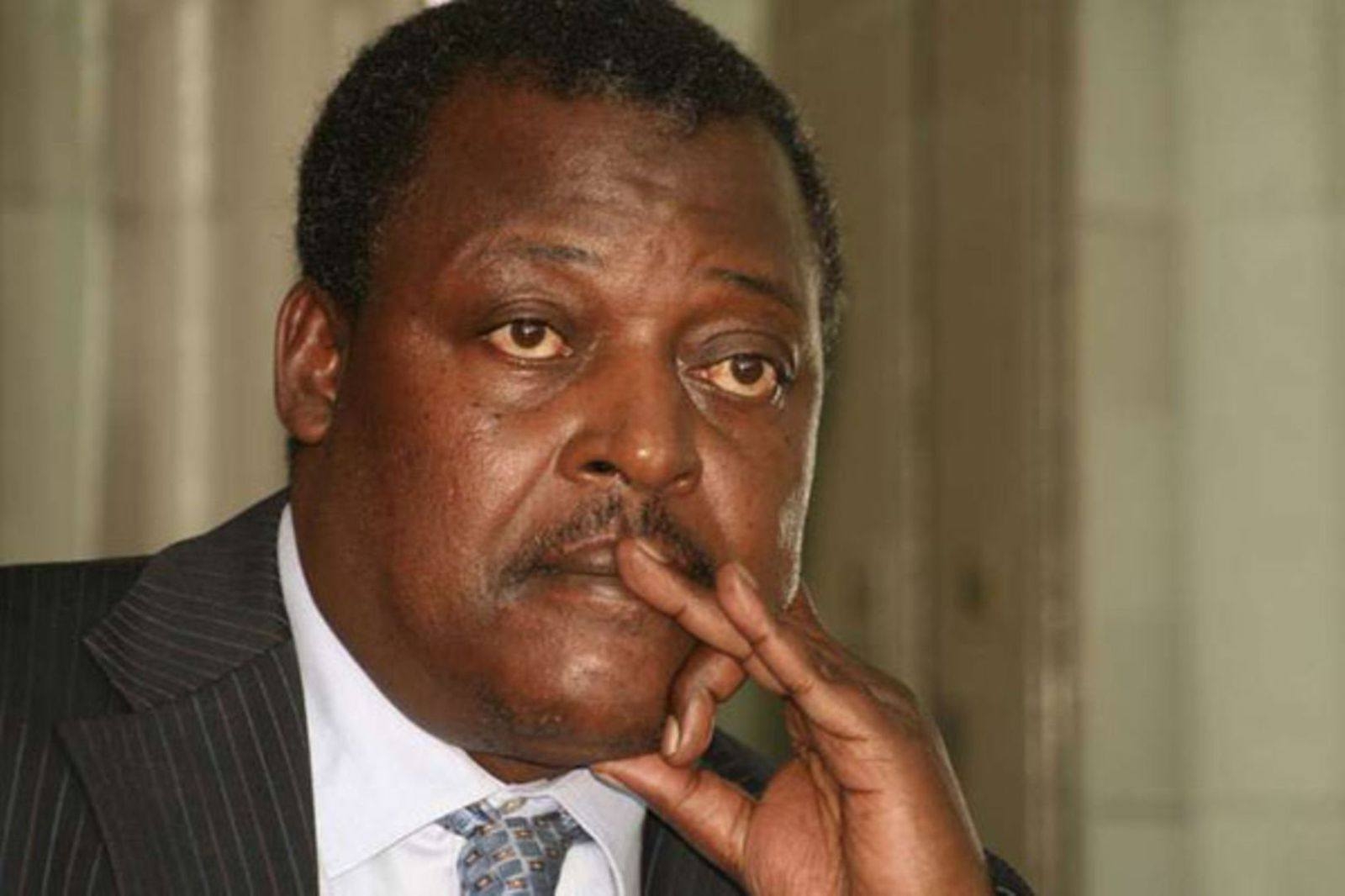

“We have delivered excellent group performance with double digit growth on both top and bottom line. This strong set of results reflect the dedication of our teams, the loyalty of our customers and the strength of our strategy,” CEO Peter Ndegwa said during an investor briefing in Nairobi on Friday.

The firm supports more than 1.2 million jobs in the Kenyan market with more than one million jobs sustained annually through the eco-system; dealers, agents and developers.

The telco, which is the most valuable company at the Nairobi Securities Exchange, controlling a lion share of the market capitalisation, has achieved 75 per cent Agile implementation.

“Agile” generally refers to the ability to move quickly and easily or to be mentally quick and adaptable. In the context of software development, Agile is a methodology that emphasises flexibility, collaboration and continuous improvement to respond to changing requirements and deliver value incrementally, including tapping fresh talent and inclusivity.

Launched in March 2007, Safaricom has revolutionised Kenya’s financial landscape with over 38 million customers on M-Pesa, more than 200 IMT Corridors (integrat-ed networks), supporting 55,000 integrations, more than 100,000 developers, with capacity to support 4,500 transactions per sec, and has driven formal financial inclusion in Kenya to 84.8 per cent as of 2024, from 19 per cent in 2006.

“Our foundations has invested Sh18.4 billion, impacting 13 million lives in the past five years,” Ndegwa said.

Total investment in education is to the tune of Sh12.4 billion, reaching 1.1 million beneficiaries.

Total investment in health is at over Sh3.6 billion reaching 10.3 million beneficiaries, while humanitarian response totals Sh800 million with over 232,000 beneficiaries.

Environment, water and livelihood total investment is at above Sh1.4 billion touching more than 1.4 million lives, with more than 200 million going into other programmes.

“We have remained true to our purpose of transforming lives through our belief, behaviour and language. With a footprint in all 47 counties in Kenya, we continue to lead the charge in transforming the lives of the communities in which we operate in,” Ndegwa said.

Current shape of the Kenyan business In Kenya, Safaricom has a GSM market share of 66 per cent with 98 per cent of the country’s population covered by its 4G network while 30 per cent are on 5G which has about 1.1 million customers.

There are 23 million 4G+ devices on its network, 37 million 30-day active customers, more than 1.9 million M-Pesa merchants (medium, small and micro), over 299,000 active M-Pesa agents and18,300km fibre optic footprint. The firm is playing a critical role in supporting Kenya’s drive towards the UN Sustainable Development Goals (SDGs) with an overall customer base of above 45.9 million.

Over the next five years, the firm has set six major priorities focusing among others, the consumer, financial services including intuitive AI driven progress, enterprises, public service mainly on digitisation partner and growth in Ethiopia.

“We continue to be purpose-led so we think about community, we think about impact on businesses, we think about individuals. So it is the role technology plays to improve people’s lives, but also to empower business,” Ndegwa said during a post-investor briefing interview at the Michael Joseph Centre, Nairobi.

Strong financial performance and Ethiopia The 11.2 per cent growth in total revenue to Sh388.7 billion for the financial year ended March 2025, with a net income of Sh69.8 billion were achieved through sustained innovation across the TechCo’s product portfolio, expansion into Ethiopia and continued support to communities which has impacted over 13 million in the last five years, management said.

The reporting period also marked the end of Safaricom’s five-year strategy cycle, which saw the company transform from a telecommunication business to a Technology Company through accelerated technology adoption and a greater focus on digitising Kenya and Ethiopia.

The group's Earnings Before Interest and Taxes reported an impressive growth at 29.5 per cent to Sh104.1 billion.

Ethiopia contributed almost 10 per cent to the group’s revenue, with management noting that the business has moved past the peak investment phase and expected to turn to profitability by financial year 2027.

On the subscriber numbers, Safaricom Ethiopia has more than doubled the customer base to 8.8 million with over 3,141 sites in operation. A total of 2.4 million customers are actively using M-Pesa services in Ethiopia, transacting over Sh20.6 billion over the year in review.

In Kenya, service revenue grew by 10.5 per cent to Sh364.3 billion.

M-Pesa, which turned 18 last year, grew 15.2 per cent year-on-year to Sh161.1 billion, contributing 44.2 per cent of Kenya’s service revenue.

According to management, the growth in M-Pesa was driven by diversi cation beyond payments, accelerated consumer and business payments with a growing focus on wealth management and credit solutions.

In January this year, Safaricom in partnership with two fund managers, Standard Investment Bank and ALA Capital Limited launched Ziidi Money Market Fund (MMF) that leverages the convenience of M-Pesa to give customers a simple, faster and smarter way to invest and grow wealth.

Ziidi assets under management have so far grown to above Sh7.5 billion, with M-Pesa customers investing as low as Sh100 from their M-Pesa and earn competitive daily interest.

Funds can only be invested or withdrawn via M-Pesa with invested funds instantly accessible. Kenya’s connectivity business grew by 6.5 per cent to Sh185.2 billion, contributing 50.8 per cent of service revenue.

This was driven by mobile data revenue which grew by 15.2 per cent to Sh72.9 billion as a result of increased 4G uptake, while voice revenue bucked global trends to grow by 1.6 per cent to Sh80.8 billion.

“This year’s results are more than a reflection of past performance; they are a foundation for our vision of becoming Africa’s leading purpose-led tech company by year 2030. We are entering a new phase of growth, and we will continue harnessing innovation for social good and shaping the future of Kenya, Ethiopia and beyond,” Ndegwa said.

Safaricom Chief Finance Officer, Dilip Pal, said, “We are pleased with our performance in the financial year ended March 31, 2025.

This has been delivered on the backdrop of various challenges faced in the period, from our operating environment including economic disruptions, slowdown in GDP growth and impact of foreign exchange regime reforms of Ethiopian currency.

To drive further growth in the Kenyan and Ethiopian markets, the company has set the group’s capital expenditure (Capex) at between Sh72 billion and Sh78 billion.

This includes Sh54 billion to Sh57 billion for Kenya and between Sh18 billion and Sh21 billion for Ethiopia, as it expects to cut losses in the 2026 financial year.

It will be launching the Fuliza overdraft in Ethiopia this week even as it drives other services, with a target of hitting between 15 million and 17 million customers in the short term.

In Kenya, the value of disbursed funds under Fuliza hit Sh981 billion as of March this year, up from Sh801.6 billion in 2024, with a value repayment of Sh996.7 billion, up from Sh801.6 billion.

“If we go to 17 million customers in Ethiopia, that is about half of what we have in Kenya in just a couple of years so it shows that our franchise, both in Kenya and Ethiopia, is very healthy and strong and growing,” Ndegwa said.