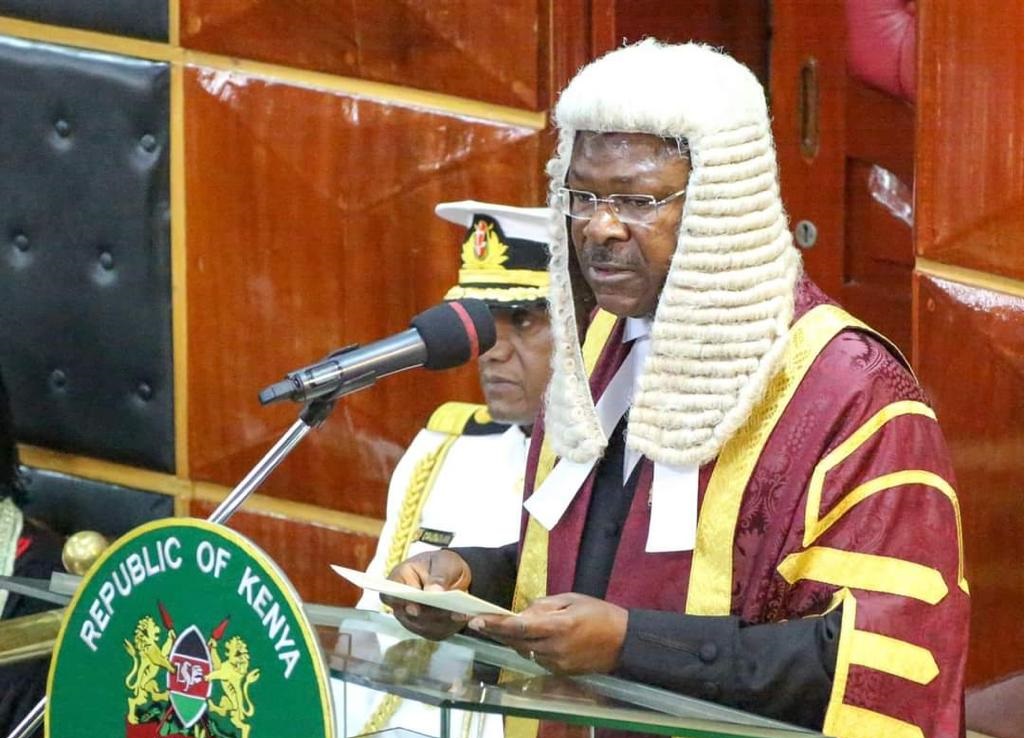

National Assembly Speaker Moses Wetang’ula / FILE

National Assembly Speaker Moses Wetang’ula / FILEThe Finance Bill 2025 has been officially referred to the Departmental Committee on Finance and National Planning for consideration, following its designation as a priority Bill.

The move follows a resolution passed by the National Assembly on February 13, 2025, allowing the Speaker to refer priority Bills to the relevant committees for processing during both the Short and Long Recesses.

The resolution empowers the Speaker to act under Standing Order 127, which governs the committal of Bills to committees and public participation.

The Finance Bill, which proposes amendments to laws relating to various taxes, duties, and associated matters, has now become due for its First Reading.

Upon determination of its priority status, the speaker has acted in line with the House resolution to facilitate its early review.

“The Finance Bill (National Assembly Bill No. 19 of 2025) now stands referred to the Departmental Committee on Finance and National Planning for consideration," the notification issued by National Assembly Speaker Moses Wetang'ula states:

He said the Leader of the Majority Party has requested that the Finance Bill be included among the priority items for discussion when the House resumes from the long recess on Tuesday, May 27, 2025.

The Speaker acceded to this request.

He directed Members of Parliament and the general public to note that the Committee is required to expeditiously review the Bill and submit a report once regular sittings resume.

He said the House Business Committee will expedite the Bill’s consideration upon resumption of the House and that the Clerk of the National Assembly should notify all members and ensure that the Committee undertakes necessary public participation activities.

The process now ensures that the Finance Bill will be considered without delay once the House reconvenes, in line with procedures to maintain legislative continuity even during recess periods.

The Bill was published on May 6, 2025, and designation as a priority Bill by the National Assembly.

The Bill, which proposes amendments to various tax laws including the Income Tax Act, VAT Act, Excise Duty Act, and the Tax Procedures Act, was tabled in Parliament on April 30, 2025, after receiving Cabinet approval.

It aims to amend laws relating to multiple taxes and duties, with provisions largely set to take effect on July 1, 2025, except for certain measures such as Advance Pricing Agreements and penalty waivers, which will commence on January 1, 2026.