The price of fuel will not go up just for now after the Kenya Revenue Authority spared a 6.3 per cent inflation adjustment of excise duty on petroleum products.

This means that excise duty for Super petrol will remain at the current rate of Sh21,953.02 per 1,000 litres of the product and Kerosene at Sh11,370.98 per 1,000 litres.

The application of inflation adjustment tax, which was to become effective on October 1, could have seen duty on petrol rise to Sh22,878.60 and Kerosene to 12,087.35, a move that could have further pushed up pump prices.

A 6.3 per cent increase in excise duty on petrol would have pushed prices per litre by at least Sh1.50.

The tax relief is coming weeks after the government ended the fuel subsidy plan that saw fuel prices rise by over Sh20 per litre.

Today, a litre of Super Petrol is currently retailing at Sh179.30 while that of diesel goes for Sh147.94 in Nairobi.

Excise duty takes the lion's share of Sh21.95 of every litre of petrol followed by the Road Maintenance Levy (Sh18), VAT (Sh8) and the Petroleum Development levy (Sh5.40).

Other levies included in the fuel pricing are Petroleum Regulatory Levy, Railway Development Levy, Anti-adulteration Levy, Merchant Shipping Levy and the Import Declaration Fee.

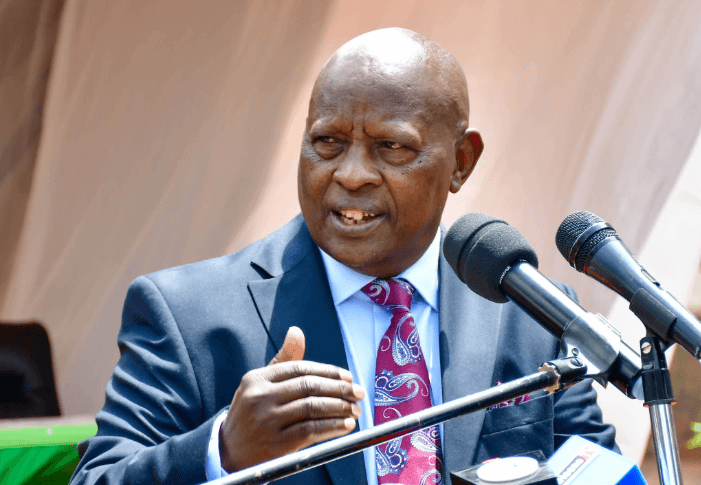

Speaking during the launch of Taxpayers Month, Mburu said that KRA has issued a legal notice for publication and that it ought to have done so today or over the weekend, but did not provide an effective date.

“The only category we are going to leave out is petroleum products because of the current high prices,” Mburu said.

The revenue authority introduced an inflation adjustment tax on fuel products last year but was barred from implementation by the High Court, which cited a lack of public participation.

Justice James Makau on September 28, 2021, issued a temporary freeze on the KRA’s plan, saying that the case challenging the new taxes has a likelihood of success.

Two people had petitioned the court to stop the impending decision by the taxman to increase excise duty on the products by 4.97 per cent in line with average annual inflation.

The 2022 Finance Act amended the Excise Duty Act-inflation adjustment provision which empowered the Commissioner General by notice in the Gazette with approval of the Treasury Cabinet Secretary, to exempt specified products from inflation adjustment after considering circumstances prevailing economy in the year.

The inflation adjustment is expected to see price hikes in various excisable commodities in the country.

The cost of a bottle of water will increase from Sh6.6 per litre to Sh7.02, and the price of juice will go up from Sh13.3 to Sh14.14 for every 12 liters.

Additionally, the tax on sugar confections will increase from Sh40.3 to Sh42.9 for every 36 kilos.

KRA will now charge Sh142.4, up from Sh134, for every two beer bottles or one liter of your favourite beverage, and Sh4.06, up from Sh3.82, for filtered cigarettes.

In addition, the taxman will increase the price of wine to Sh243.4 per 208 liters from Sh229 and the price of spirit to Sh356.4 per 278 liters from Sh335.

“The specific rates will be adjusted using the average inflation rate for the financial year 2021/2022 of six decimal three per centum (6.3 percent), as determined by the Kenya National Bureau of Statistics,” KRA said.

Last week, the Kenya Association of Manufacturers (KAM) unsuccessfully sought to have the inflation adjustment dropped.

The lobby argued that the increase in tax will hurt Kenyans who are already grappling with high costs of everything.

The cost of living in Kenya rose to the highest level in 63- months in September to hit 9.2 per cent up from 8.5 per cent in August.

The Kenya National Bureau of Statistics (KNBS) attributed the high cost of living to a sharp increase in the cost of food, fuel and cooking oil over the past 12 months.