Kenya's economy, like the global one, experienced slower growth in 2019.

The sluggish growth was attributed to international pressures such as the US-China trade war and the interest cap law that shrunk credit to the private sector.

In October, both international and local experts slashed the country's economic projection by at least 20 basis points, with the International Monetary Fund cutting it to 5.6 per cent compared to 5.8 per cent in April.

The World Bank, on the other hand, forecasted Kenya's growth to hit 5.8 per cent for 2019, down from 6.3 per cent in 2018 on lower agricultural output and considerably weak private sector investment.

Locally, the National Treasury projected the economy to grow six per cent in the year to June, a lower scale compared to last year's 6.3 per cent.

According to the Kenya National Bureau of Statistics, the economy grew by 5.6 per cent in the second quarter of this year, compared to 6.4 per cent in the same period a year earlier.

CREDIT CRUNCH, JOB CUTS, AUCTIONS

A credit crunch, high tax regime and tension in the international market affected both corporates and small businesses. Some were forced to close shop, rendering thousands of people jobless.

At least 15 listed firms issued profit warnings during the year, the latest one being CIC Insurance.

Tax disputes saw several betting firms including SportPesa and Betin close shops.

The tough economic year for the country was worsened by huge pending bills by both the government and private sector, choking money supply to suppliers.

As a result, many small-scale businesses that contribute heavily to the country's economy auctioned, closing shops.

Lending to the private sector, however, improved during the year, despite the existence of the interest cap law, which forced lenders to focus investments in stable options like government securities starting 2016.

Credit to the private sector improved from 4.2 per cent in January to six per cent in November according to the Central Bank of Kenya.

Despite poor rainfall which saw the Food and Agriculture Organisation (FAO) in July project the country's food production for the year to dip further, inflation was manageable, hitting a year low of 3.83 in September.

The global economy is also expected to drop further without sparing advanced, emerging and developing nations.

Global growth is forecast at three per cent for 2019, the lowest since 2008–09 and a 0.3 percentage point downgrade from the April 2019 World Economic Outlook. The growth is projected to pick up to 3.4 per cent in 2020.

The international lender said trade wars between China and US and other uncertainties will take away at least 0.9 per cent of the world's gross domestic product (GDP).

BRIGHTER 2020

Kenya's economy is expected to grow at a faster rate next year, thanks to a number of positive factors.

A major factor is the repeal of the interest cap law in November. Others are heavy rainfall experienced during the last months of the year and favourable government policies that support small businesses.

The scrapping of interest rate law, for instance, is expected to enhance credit flow to the private sector, brewing economic activities, job creation and improved income for households.

President Uhuru Kenyatta's order to state agencies and counties to clear pending bills is also expected to increase capital supply in the economy, boosting the expansion of businesses.

In November, the government in partnership with prime lenders in the country launched Stawi, a credit product targeting micro and small businesses.

The government has also invested heavily in infrastructure including road network, railway and technology, a move that is likely to support business operations.

The growing trade effectiveness in the country saw it climb the ladder in the World Bank's ease of doing business in 2019 to position 56 out of 190.

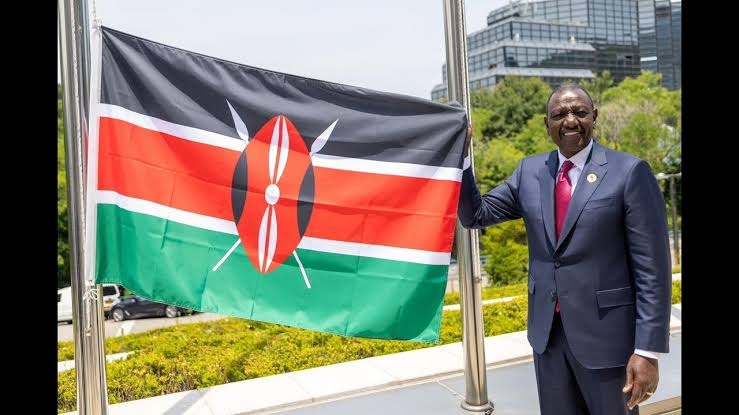

Kenya's economy is also expected to reap dividends of the calm political environment, flowing from the Building Bridges Initiative (BBI), a peace pact between President Uhuru Kenyatta and opposition chief Raila Odinga.

The fact that the country has not planned any major social or political event that might disrupt the relative peace next year, the number of tourists and investors is likely to surge, bringing in the much-needed forex.

The global trade tension is also likely to ease as the US forges for a trade working relationship with China.

There is also stability in the global oil market as the sector recovers from the Aramco bombing.

The country is however expected to continue reeling from adverse effects of corruption, a high wage bill that takes up to 54 per cent of domestic revenue and high debt obligation as part of its Sh5.9 trillion debt matures.

(O.O)