Hass Petroleum Group, an oil marketing company, has sold a 40 per cent stake to Oman Trading International, a government-owned firm, for undisclosed value.

Hass said in a statement yesterday it will be seeking to invest in new service stations as part of the firm’s strategic expansion plans into East, Central and Northern Africa, following the injection of new capital.

The oil marketer said the partnership will increase competitiveness. Hass founder and chairman Abdinasir Ali Hassan said OTI will boost supply and trading capabilities of Hass, which will strengthen the firm’s service offering, enhance customer service and contribute to regional growth.

“I am convinced that this partnership is a major step in ensuring Hass’ continued competitiveness across the region and I am confident that with OTI we can achieve our mutual long-term growth aspirations,” Hassan said.

The completion of the transaction is subject to approval by the relevant regulatory authorities in the various countries in which Hass operates in.

A 2015 report by Bloomberg News showed that Oman, the largest oil producer in the Middle East outside of Organisation of Oil Exporting Countries, was planning to push growth by establishing US and African footholds. The firm planned to invest at least $50 million (Sh5.17 billion at current exchange rate) in the expansion plan, Bloomberg had reported.

“We are delighted to move onto the next phase of growth for OTI, agreeing our first major investment into Africa with Hass,” OTI chief executive Talal Al Awfi said.

The acquisition, which is in line with the respective companies’ long-term growth strategies, will see Hass’ work closely with OTI to grow and continue long-standing relationships with customers, suppliers and regulators.

OTI is a regular supplier of refined products to the East and Southern African regions, data shows.

Hass has a presence in Kenya, Tanzania, Uganda, Rwanda Zambia, South Sudan, Somalia, Somaliland and the DR Congo.

The transaction is geared towards enabling OTI and Hass expand footprint on the continent.

“Hass is a unique business with substantial scale and growth potential where we have enjoyed a long-standing relationship, (and) most importantly we share a common understanding and vision of the African energy market,” Awfi said.

Standard Advisory London Ltd, a member of the Standard Bank Group of South Africa, acted as exclusive financial advisers to OTI, and KPMG Advisory Services Ltd Kenya acted as exclusive financial advisers to Hass.

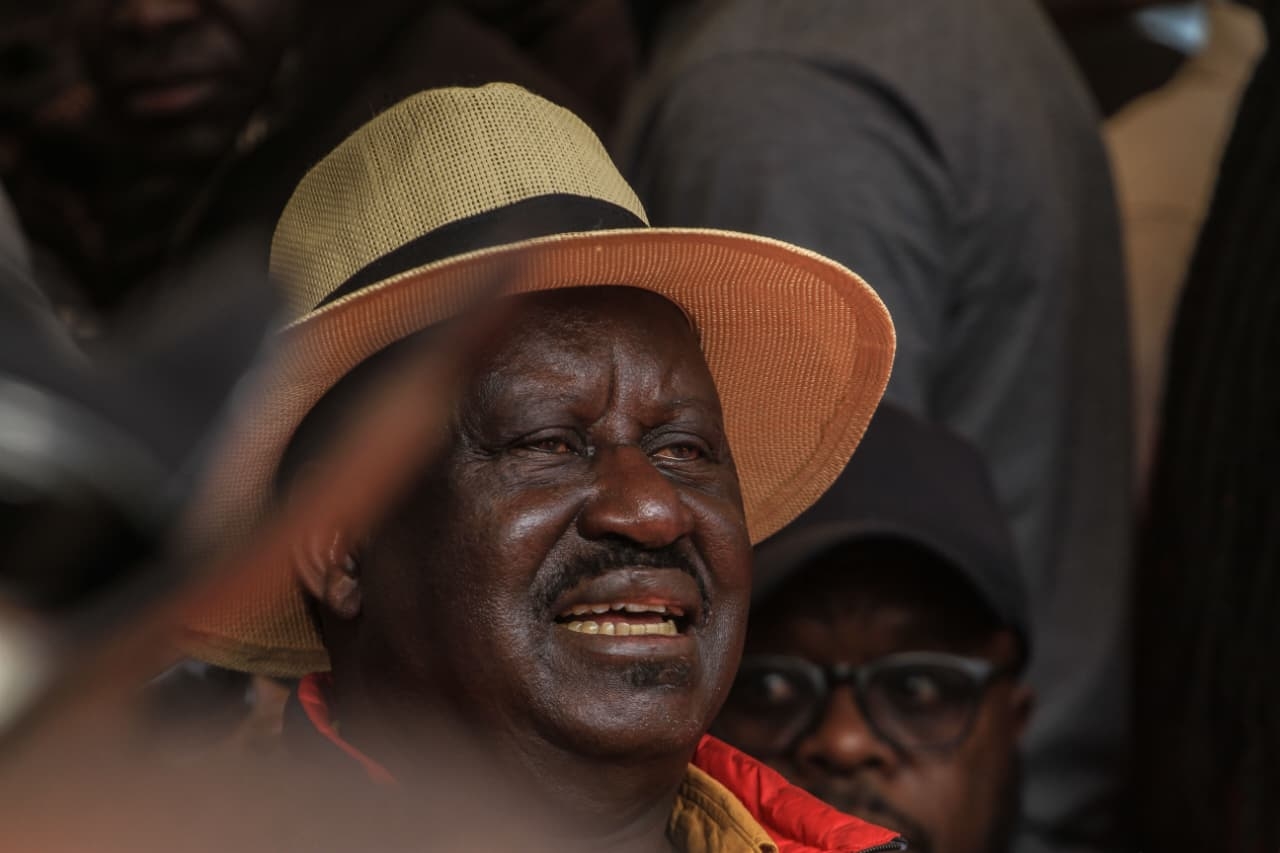

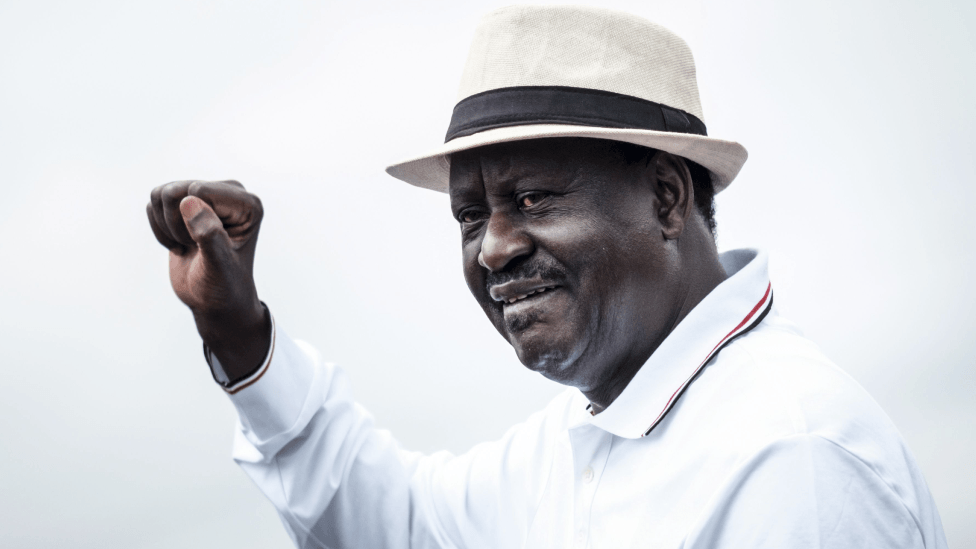

![[PHOTOS] Baba has left us orphans - Kisumu residents mourn Raila](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F10%2F910325a1-f207-4932-b9bb-eae6f91fdead.jpg&w=3840&q=100)