Insurance brokers at

the AIBK annual conference in Mombasa on Thursday / BRIAN OTIENO

Insurance brokers at

the AIBK annual conference in Mombasa on Thursday / BRIAN OTIENO Senior counsel

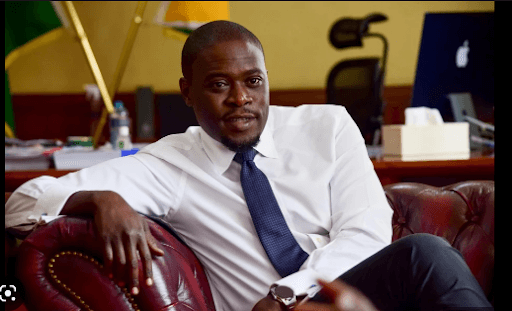

Mohamed Nyaoga at the AIBK annual conference in Mombasa on Thursday /

BRIAN OTIENO

Senior counsel

Mohamed Nyaoga at the AIBK annual conference in Mombasa on Thursday /

BRIAN OTIENOKenya’s status in

the Financial Action Task Force grey list can be changed only by improving its

cybersecurity, a conference heard on Thursday.

Kenya was placed in

the FATF grey list in February last year due to deficiencies in its anti-money

laundering and counter-terrorism financing frameworks.

This means the

country is under increased monitoring and must work with the FASTF to improve

its regime.

This could scare

away potential investors if not taken care of.

On Thursday, senior

counsel Mohammed Nyaoga said as the industry embraces technology, threats are

shifting from physical to digital, requiring enhanced safeguards.

He said insurance brokers need to strategically

invest in cybersecurity to curb the risks of

money laundering and terrorism financing

“You are the people

who can help us exit the FATF grey list,” he told the Association of

Insurance Brokers of Kenya (AIBK).

He spoke during the AIBK’s 19th annual

conference in Mombasa.

The four-day conference brings more than 500

insurance practitioners together under the theme, ‘The Future of Insurance:

Igniting Innovation, Securing Tomorrow.’

“If clients are to have confidence and trust in a

digitally driven system, then we must put in place adequate safeguards to

guarantee the safety of the systems that hold their data,” Nyaoga said.

AIBK national chairman John Lagat said the

insurance sector is at crossroads as the forces of technology, customer

expectation, regulatory change, global risks, and local realities are

converging, offering both a challenge and an opportunity.

“In Kenya, the interplay of mobile-money

infrastructure, fintech, and insurance is yielding new models of inclusive

insurance. Pay-as-you-go, peer-to-peer insurance, micro-insurance, and embedded

insurance are being deployed more widely,” Lagat said.

The AIBK chair said insurers are now adopting

artificial intelligence, and many are leveraging on data analytics to tailor

products to specific geographies, customer segments, and risks.

“Individual companies are stepping up. We have

strong examples of Kenyan insurers leveraging data, digital partnerships, and

new distribution models. This not only strengthens their businesses but also

the ecosystem as a whole,” Lagat said.

Nyaoga said the growing integration of technology

in the insurance sector has the potential to enhance efficiency and improve

customer satisfaction.

He said over 70 per cent of insurers in the

country are accessible through mobile applications, portals, and chatbots, where

customers can buy policies, submit and track claims and obtain personalized

customer care support from the comfort of their homes.

“This means tasks are performed much faster and at

lower costs. This, in turn, leads to improved customer satisfaction,” Nyaoga

said.

He said artificial intelligence and machine learning

have transformed key aspects of underwriting, risk assessment, and fraud

detection.

“Overall, they make it easier to detect fraud more

accurately, thereby limiting the exposure that would have resulted from a

manual approach,” he explained.

Technology, he said, has led to innovative

products to cover new approaches, such as telemedicine and micro-insurance

models like daily or weekly payments that have lowered the threshold of access

to insurance and consequently supported programs like Universal Health Coverage

and promoted financial inclusion.

“For insurance sector players to thrive in this

digital ecosystem, there is a need to anticipate the challenges and reconfigure

our strategies and approaches,” he said, urging Insurers to retool their

boards, management and staff for optimal performance

AIBK chair Lagat, however, noted that the country’s

insurance penetration has remained significantly below global averages.

Statistics show penetration levels under three per

cent for Kenya, versus global averages of over seven per cent.

“But the good news is that the sector is not

static. It is evolving. According to recent industry reports, growth is

consistent, and across many listed insurance companies, there is positive net

income growth,” he said.

“Moreover, the structural foundations are being

laid for sustainable growth with digital channels, data analytics, inclusive

models, and regulatory reform.”

He, however, raised concerns about the reporting

structures and penalties intended to be imposed on brokers who do not comply

with the provisions and demands of the Financial Reporting Centre (FRC).

Insurance Regulatory Authority (IRA) CEO Godfrey

Kiptum urged the brokers to lead efforts in ensuring that the country is

removed from the grey list.

“It is not a matter of the IRA or Central Bank. It

is for the public good. We want to encourage you to ensure you meet the

requirements,” he said.

He noted that Kenya in East Africa could be the

only remaining country on the grey list.

INSTANT ANALYSIS:

The FATF notes that Kenya has a high-risk profile but cannot demonstrate successful investigations or prosecutions of money laundering or terrorist financing offenses. The FATF also points to an unregulated non-profit sector that poses a risk for terrorism financing.