CPF Financial Services has invested into Africa Finance Corporation in a move that will see the two entities fund targeted infrastructure investments in Kenya.

The move, the two firms said, is set to cushion Kenya and other African economies from the effects of the devaluation of currencies that make foreign loans expensive.

Signed on the sidelines of the Africa Climate Summit in Nairobi, the agreement commits AFC and CPF to collaborate in identifying, developing, and co-financing priority infrastructure projects aligned to Kenya's development roadmap.

They partnership will leverage on the combined technical expertise of both firms and access to domestic and global capital.

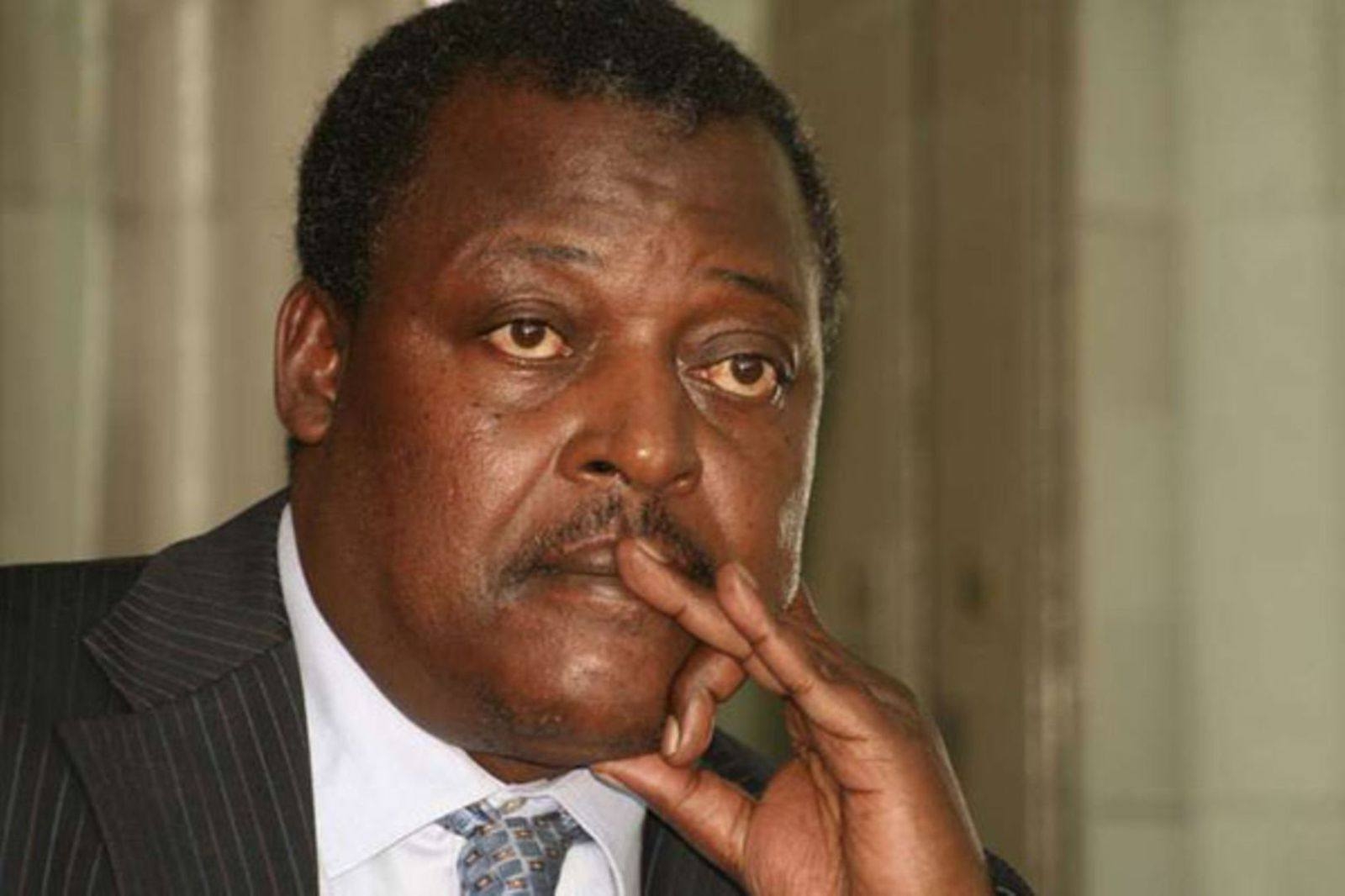

"African institutional investors are one of the single largest sources of investable capital and will play a catalytic role in bridging Africa’s infrastructure gap,” said AFC CEO Samaila Zubairu.

The tightening of monetary policies in major economies has had a spillover effect on Africa impacting interest rates and pushing up debt servicing.

“It is with this immense potential in mind that we are partnering with CPF Financial Services. Our combined expertise and access to capital will accelerate progress towards achieving economic prosperity and job creation for Kenya and, ultimately, the African continent,” added Zubairu.

African institutional investors, including pension funds, insurance companies and asset managers, hold nearly US$1trillion dollars of assets under management, equivalent to a third of the continent’s combined GDP and more than 5 times the annual infrastructure and climate financing needs of the continent.

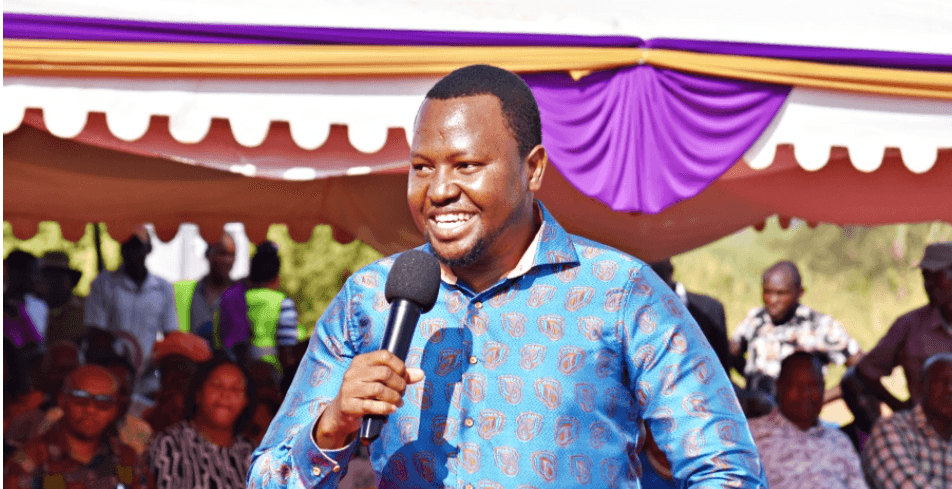

“This alliance aligns perfectly with our goals of creating value-driven solutions and supporting Kenya's infrastructure agenda. By working together, we aim to unlock new opportunities and facilitate sustainable economic growth," said CPF chief executive Hosea Kili.