Digital Lender Tala plans to borrow more than Sh1.3 billion for its next phase of expansion in the country.

The fundraising will be through debt financing which involves raising money by selling fixed income products, such as bonds, bills, or notes.

This as the company announced an ambitious plan to grow its customer base from the current 3.5 million to 15 million in less than two years.

Digital lenders have been on a funds drive since the revision of the operation guidelines by Central Bank of Kenya and the introduction of government backed Hustler Fund.

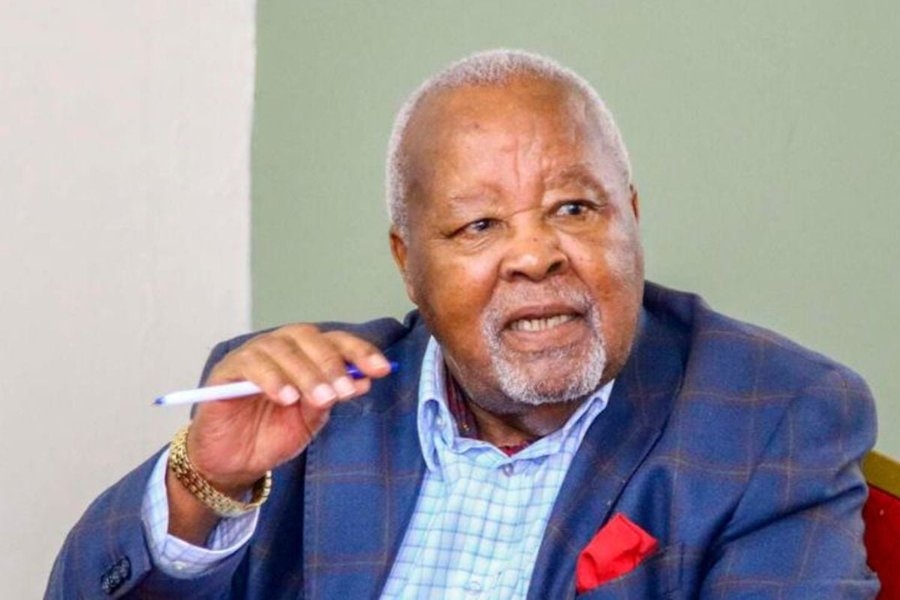

Tala’s General Manager, Munyi Nthigah says the firm is looking to increase its investments in the SME sector since consumer lending is almost getting into saturation level.

“The amount we are looking for is not less than $10 million (Sh1.3 billion). With this we will be looking to grow our customer base by about three to five times in the next 18 months,” said Munyi.

The lender says it has disbursed $1.9 billion (Sh240 billion) in loans since inception in Kenya with repayment rate of 90 percent.

Munyi however downplayed the impact the introduction of Hustler Fund has had on Tala's operations saying they serve different clientele

“The government has been lending to individuals seeking between Sh500 and Sh1, 000, while our ticket size is between Sh13, 000 and Sh15, 000 so basically we are lending to a different category of people,” said Munyi.

Kenya has a market gap of $19 billion (Sh2.4 trillion) for SME financing, which Tala says creates a huge opportunity for expansion.

With the government’s plan to launch the second phase of Hustler Fund in the next two weeks targeted towards financing businesses the lender is wary.

“If the government start lending above Sh5, 000 then it will come into our space and impact the customers that we serve,” he added.

The tough regulations put in place by CBK for the lenders certification has seen an increased number of players seeking funding to scale up operations.

Mycredit Limited announced plans to tap Sh325 million from Oiko Credit in a deal announced on February 1 with the proceeds expected to spur the lender’s medium-term lending programme to small and medium enterprises.

According to reports, M-Kopa Loan Kenya Limited is also expected to fund raise.

Currently there are 22 digital lenders in the country that have been granted licenses.

![[PHOTOS] Three dead, 15 injured in Mombasa Rd crash](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2Fa5ff4cf9-c4a2-4fd2-b64c-6cabbbf63010.jpeg&w=3840&q=100)