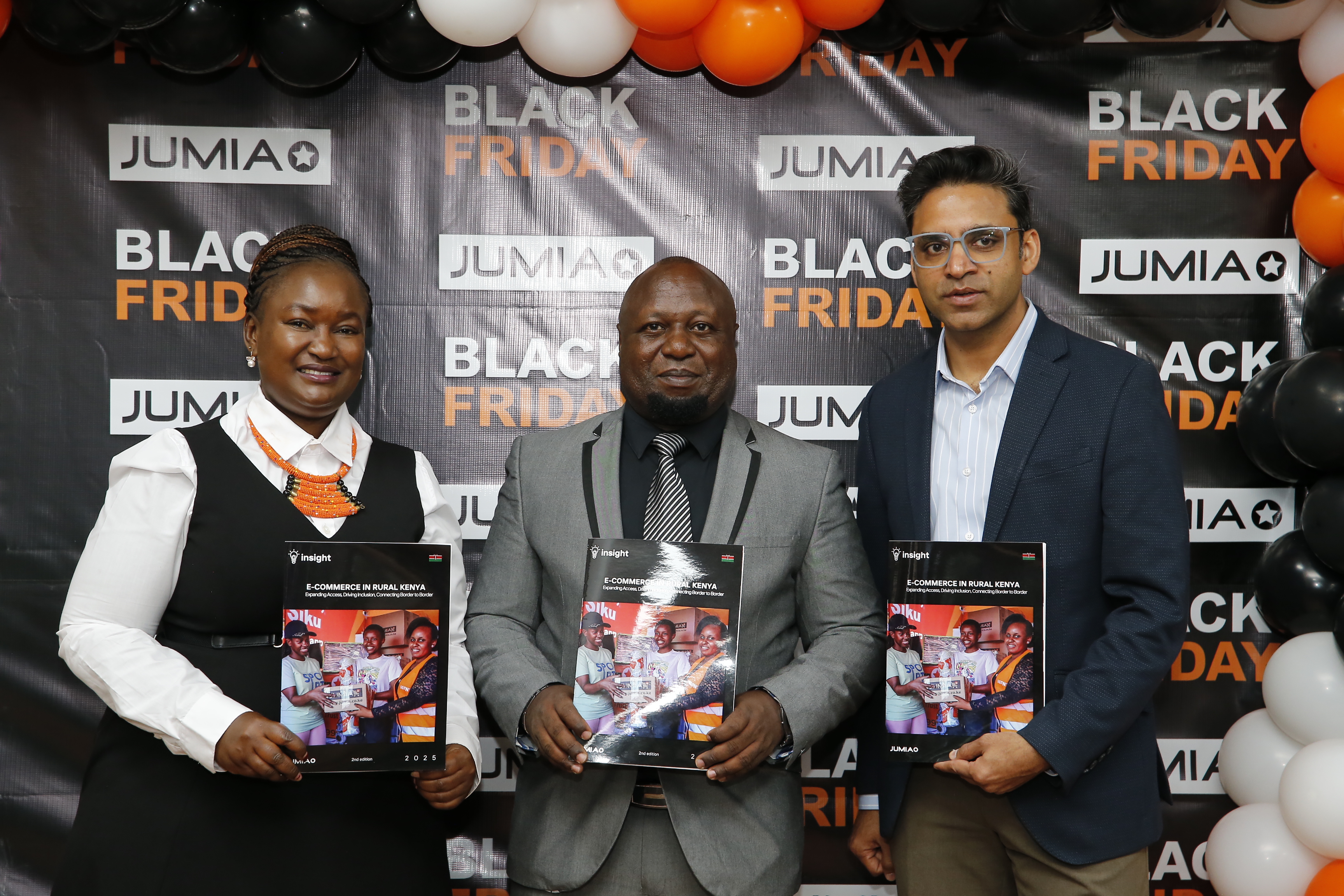

Jumia Vendor

Joy Karemesi,

Director

E-Commerce at

the ICT Ministry, John Kiria and

Jumia East

Africa regional

CEO Vinod Goel, during the launch of Jumia’s report dubbed E-commerce in

Rural Kenya: Expanding Access, Driving Inclusion, Connecting Border to Border/ HANDOUT

Jumia Vendor

Joy Karemesi,

Director

E-Commerce at

the ICT Ministry, John Kiria and

Jumia East

Africa regional

CEO Vinod Goel, during the launch of Jumia’s report dubbed E-commerce in

Rural Kenya: Expanding Access, Driving Inclusion, Connecting Border to Border/ HANDOUTThe proposed introduction of a five per cent withholding tax for online marketplaces is threatening to push thousands of micro-small and medium-sized enterprises (MSMEs) away from regulated digital marketplaces and back into the informal world, a new report has warned

The E-Commerce in Rural Kenya Report 2025 says that regulated platforms such as Jumia, which have formalised online retail, are likely to lose out to unregulated social media platforms like TikTok, WhatsApp and Facebook selling.

The industry players argue that the five per cent Withholding Tax (WHT) on goods sold through digital marketplaces could trigger a mass seller exodus, reversing years of progress in formalising trade, boosting rural inclusion, and creating digital livelihoods.

“A key concern is the proposed Withholding Tax (WHT) on goods sold via digital marketplaces in the Tax Laws (Amendment) Bill 2024. While aimed at broadening the tax base, it risks unintended fallout,” the report reads in part.

Under the Tax Laws (Amendment) Bill 2024, platforms would be required to withhold 5 per cent tax on all sales made by resident vendors.

This is in addition to the existing 1.5 per cent Turnover Tax (TOT), squeezing MSME margins already strained by inflation, high logistics costs and slowing consumer spending.

“Applying WHT solely to compliant resident platforms creates an uneven playing field,” the report warns, adding that this would discourage local innovation and investment while benefiting non-resident platforms that do not maintain local tax registrations or consumer protection standards.

Unlike formal platforms, TikTok Shops, WhatsApp sellers, and Facebook marketplace traders are not subject to such obligations, and many do not pay tax at all.

If the WHT is implemented without a differentiated framework, sellers could simply shift their stock to these unregulated spaces where tracking sales is nearly impossible for authorities.

The report further shows that Kenya’s e-commerce ecosystem, though still small at 2–five per cent of total retail penetration, has been expanding rapidly, particularly in rural regions where digital platforms are enabling access, lowering prices and building new income streams.

But sector players say the new tax could hand an advantage to unregulated social commerce platforms where sellers pay no tax, operate anonymously, and offer little consumer protection.

This coming at a time that Rural Kenya has overtaken major cities as the country’s e-commerce growth engine, now accounting for 60 per cent of all Jumia orders, according to a new report that highlights the sector’s expanding economic impact across the counties.

“E-commerce is widening market access for small businesses and giving rural households affordable choices. To protect that progress, policies should recognise the role of marketplaces, support SMEs, and create a level playing field for both local and global digital platforms,” said Goel.

The study further says that continued growth will depend on supportive policies that encourage small-business digital adoption and protect consumers, especially as discussions around marketplace taxation continue.

Goel added that supportive regulation — coupled with growing connectivity, improved logistics and mobile-money adoption — could position Kenya as one of Africa’s most inclusive digital economies within the next five years.

The report shows that the share of SMEs on the platform has grown from 40 per cent to 60 per cent in 2025.