Kenya’s total budget expenditure for the year starting July

1, 2026, is projected to hit Sh4.65 trillion, Sh400 billion more compared to the

current financial year.

The National Treasury, indicating that the expenditure will rise by 9.7 per cent or 22.2 per cent of the country's Gross Domestic Product, reveals this in the draft Budget Review and Outlook paper published.

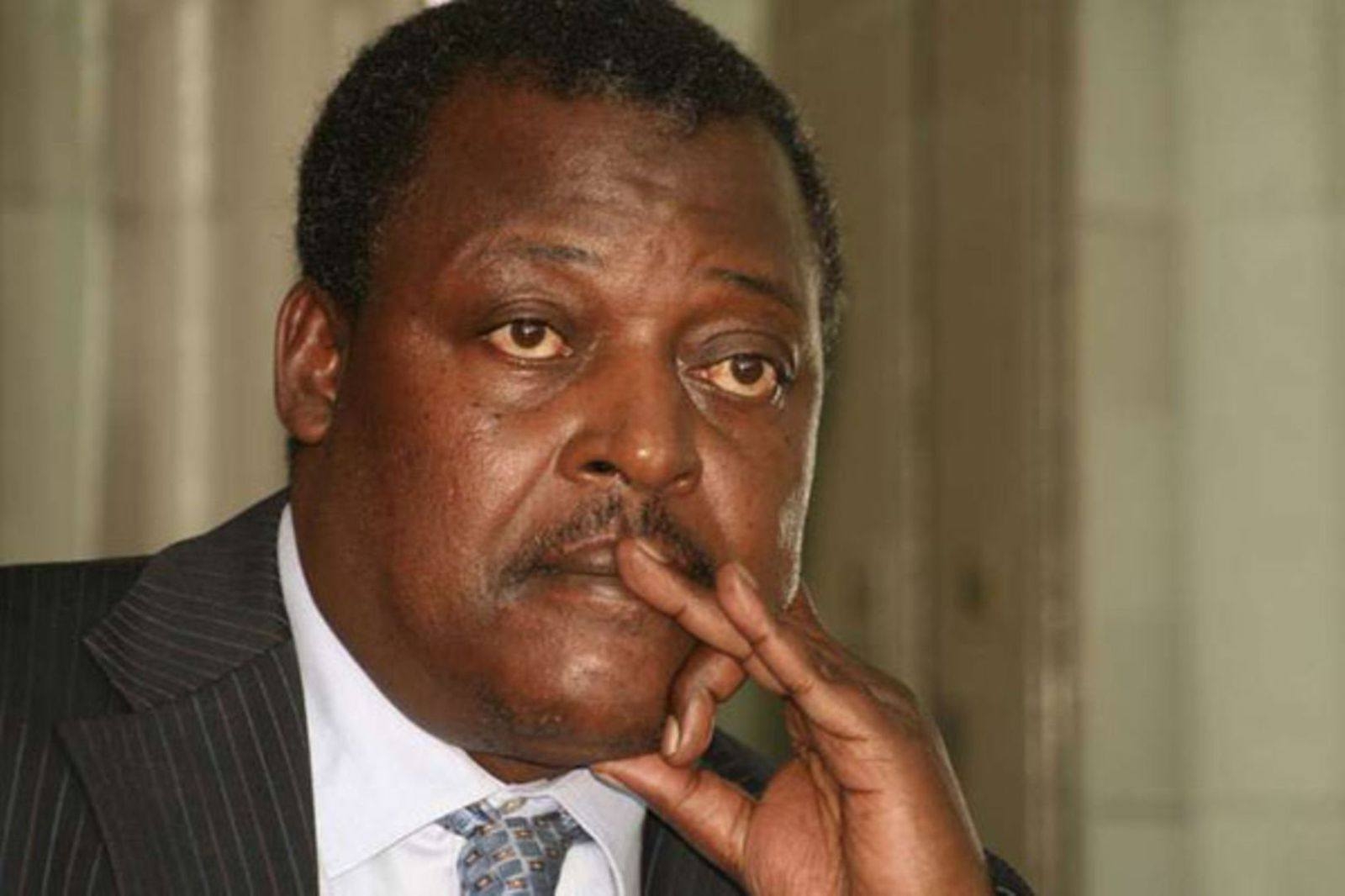

The record high expenditure could see the country borrow up to Sh1.02 trillion to fill the deficit, bringing President William Ruto’s pledge that his government will live within its means into question.

“The total revenue for 2026/7 including Appropriation in Aid (AIA), is projected at Sh3.6 trillion or 17.1 per cent of GDP,’’ the report reads.

The head of state has consistently indicated that his government will not pile more pressure on the country’s total debt, which has since crossed the Sh11 trillion mark through prudent use of available resources and embracing Public Private Partnerships (PPPs).

In August, for instance, while gracing an interdenominational service in Siaya, Ruto said, “In less than 20 years, Kenya will undertake development projects without having to rely on external debts.”

Even so, available data from the National Treasury shows that Kenya’s borrowing spree shows no signs of slowing, with the government taking loans equivalent to Sh32.4 million every hour over four months.

The debt report tabled in Parliament early this month indicates that the country is borrowing Sh23.9 billion per month, Sh776.6 million per day, Sh539,321 per minute, and nearly Sh9,000 per second.

In total, the Kenya Kwnaza government has borrowed between Sh3.2 -3.5 trillion since it came to power, almost double and triple the rate of borrowing by the previous two regimes.

Opposition leaders and economists have called for urgent action to curb borrowing and review the fiscal framework, warning that continued accumulation could strain public finances and limit resources for critical development projects.

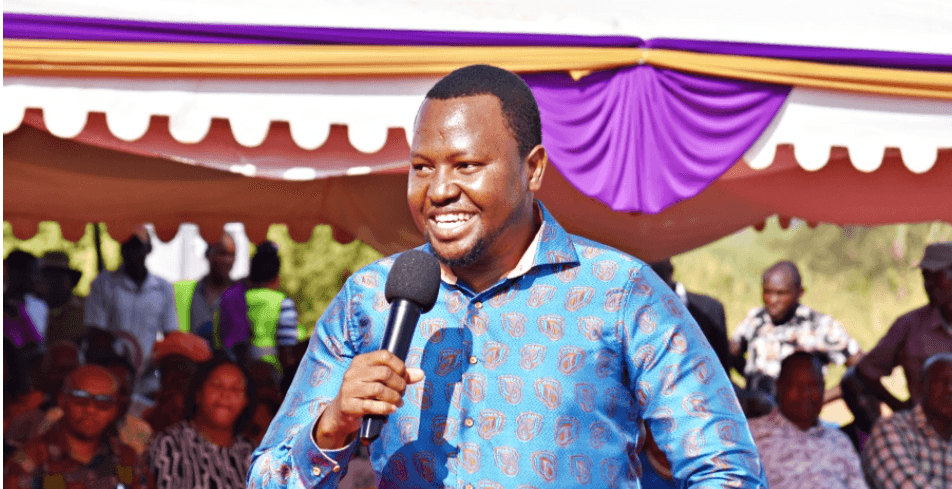

Kiharu MP Ndindi Nyoro recently cautioned that the nation risks “dire economic consequences” if borrowing continues unchecked.

He revealed that between May 1 and August 31, 2025, the country secured Sh95.5 billion through four new loan facilities from bilateral, multilateral, and commercial lenders to support development projects and operational needs.

According to the outlook, if the proposed expenditure plan is maintained, the exchequer will pile more pressure on taxpayers, with the Kenya Revenue Authority (KRA) expected to collect at least Sh3 trillion in ordinary revenue.

The ambitious revenue target for the upcoming financial year is coming at a time when the revenue man is struggling to meet targets for the current financial year, blamed on dwindling economic activities.

Last week, KRA reported that it had missed the collection target for the first three months of the year by close to Sh50 billion, managing Sh657.2 billion against a target of Sh707 billion, blamed on political instability that rocked the country in June and July.

The taxman now faces a tough challenge to collect close to Sh2.13 trillion by June 30 to hit this year’s target of Sh2.75 trillion.

The budget review report shows that the country will have to borrow at least Sh775.8 billion domestically and Sh241.8 billion externally to finance a deficit, which is a 10.13 per cent increase compared to the current financial year.

The draft spending plan is, however, still in the formative stages and is bound to several changes.

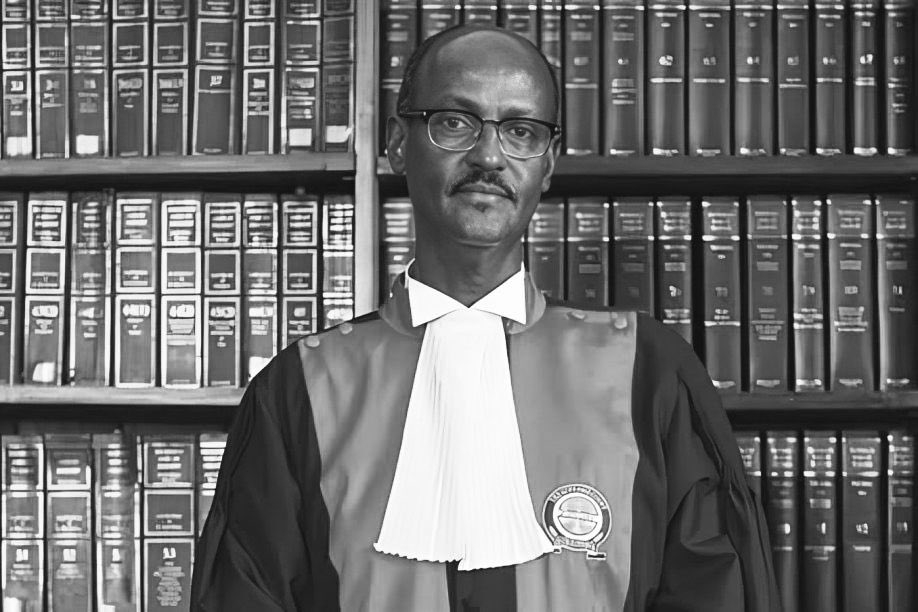

The budget-making process in Kenya involves four main stages: formulation, approval, implementation, and audit and evaluation.

It begins with the Cabinet Secretary issuing budget guidelines and ends with the Auditor-General releasing reports.

Key steps include preparing the Budget Policy Statement, submitting estimates to the National Assembly, enacting the Appropriation Bill, and implementing the approved budget.

So far, the National Treasury CS has issued budget circulars, which are done by August 30th, guiding for the next fiscal year. The government will then prepare the BPS, outlining its priorities and policies. This must be submitted to Parliament for approval by February 15th.

A final Budget

Review and Outlook Paper will follow this before ministries submit detailed

budget estimates.

After approval, the Treasury CS will then submit the budget estimates and the Finance Bill to the National Assembly and public participation before actual approval, including enacting the Appropriation Bill, which authorizes government spending.