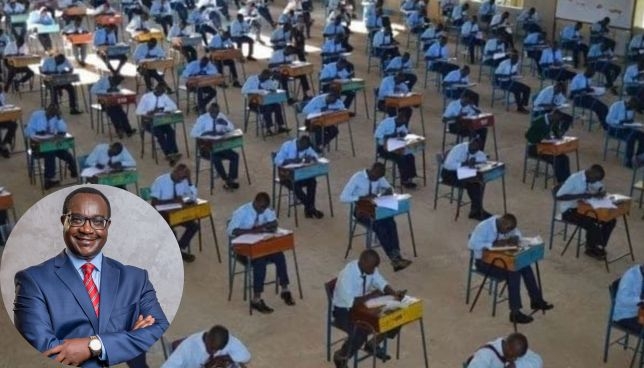

Mwalimu Sacco chairman Joel Gachari, CEO Kenneth Odhiambo and Family

Bank chief commercial officer John Ndugi during the launch of a joint

cheque book deal /HANDOUT

Mwalimu Sacco chairman Joel Gachari, CEO Kenneth Odhiambo and Family

Bank chief commercial officer John Ndugi during the launch of a joint

cheque book deal /HANDOUT

Kenya's savings and credit cooperatives (Saccos) are being forced to rethink their business models as shrinking household incomes and a tough economic environment take a toll on member deposits

For decades, Saccos have relied heavily on member savings and loan repayments to drive growth, but persistent inflation, job losses and rising cost of living are now eroding disposable incomes.

This has left many financial institutions grappling with slow deposit growth, delayed loan repayments and increased pressure to find alternative sources of revenue.

In an effort to tap into alternative revenue sources, Mwalimu National Sacco says it has unveiled a new checkbook service and a contact centre as part of a wider strategy to diversify its revenue streams and grow its non-funded income.

Mwalimu Sacco chief executive officer Kenneth Odiambo said the Sacco is seeking to reduce reliance on member deposits by expanding transactional and service-based income.

“Our non-funded revenue currently stands at 11 per cent. With these new initiatives, we intend to push this to 18 per cent in the first year, 25 per cent in the second year and eventually hit 30 per cent within three years,” Odiambo told the Star.

The Sacco holds that alongside the unveiling of its cheques, it is doubling down on full digitisation in the next three years, as it fights to stay ahead in an increasingly competitive financial services market marked by shrinking margins, rising member demands and aggressive incursions by commercial banks and fintechs.

However, the Sacco’s unveiling of its cheque comes at a time that many businesses and individuals have been shifting to other payment options.

Data by the central bank of Kenya showed that last year, the value of cheque transactions fell 15.1 percent to Sh182.25 billion in June, nearly matching the level last recorded in a similar month in 2020, as businesses and individuals switched to digital deals to lower the risks of contracting the Covid-19 virus through physical contact.

According to Odiambo, the product is designed to meet the needs of members in the teaching fraternity as well as those in business, including MSMEs, who prefer check transactions for large payments.

“This initiative responds directly to our members’ There are those who still believe that checkbooks actually are more convenient in terms of driving their business but of course there are other generations that believe that the digital platforms are better in terms of transacting with the circle. So it's a mixed bag and that's what we are pursuing,” Odhiambo added.

Mwalimu National Chairman Joel Gachari said the shift in customer dynamics is being driven by changing member demographics.

“Over 30 per cent of our members are now drawn from outside the teaching fraternity. Their incomes have grown, and they are seeking bigger and more convenient solutions. The checkbook gives them an additional option alongside our digital and cash withdrawal channels,” Gachari said.

Odhiambo further revealed that the Sacco has been building up its mobile lending platform, which currently allows members to borrow up to Sh500,000 with a target to push that ceiling to Sh3 million by the end of the year.

Family Bank Chief Commercial Officer John Ndugi said the partnership allows Saccos like Mwalimu to adopt innovative banking solutions while retaining their identity.

“This check solution enables Mwalimu members to issue and clear checks within banking timelines while maintaining the Sacco’s brand presence,” he said.