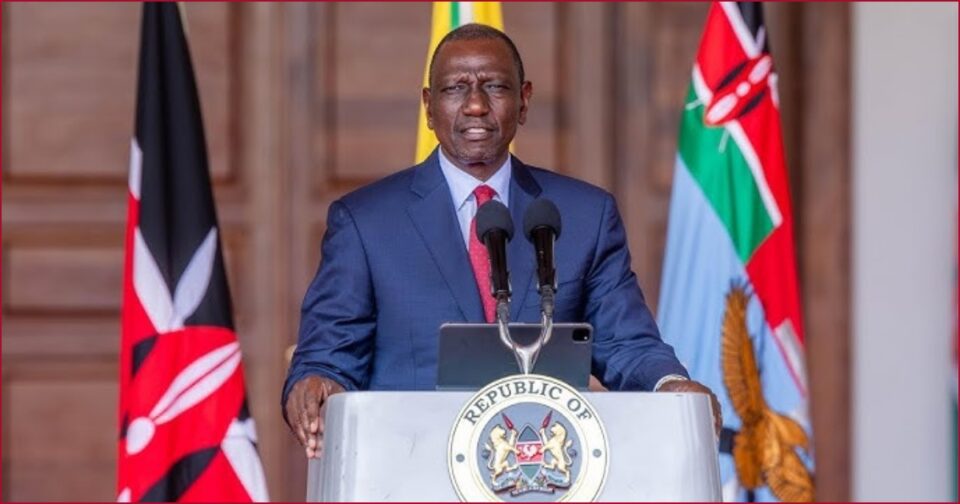

President William Ruto /FILE

President William Ruto /FILE

The

government is ready to inject up to Sh20 billion into concessional financing

and investment risk-sharing mechanisms to boost industrial growth, President

William Ruto has said.

Speaking

during a round table session with the private sector in Nairobi, Ruto said his

government, through the Kenya Development Corporation (KDC), is prepared to

support industries with non-commercial credit and equity investments in critical

sectors.

In remarks

aimed at encouraging greater collaboration between the public and private

sectors, he called for deeper engagement between the private sector and

government to align with available support structures and explore growth opportunities.

“This is

credit that we are making available that is not commercial – it is

concessionary financing to support industry, we can even de-risk some of the

investments you want to do by taking a stake, even if it is 20 per cent, and

putting in our money,” the president said.

He further

noted that apart from resources being mobilised through development partners,

the government is also willing to commit its funds to help scale industrial

investments, particularly in areas where investors are hesitant due to high

risks or uncertain returns.

“We should

be able to do that, especially in the critical sectors where the industry may

not be very comfortable. Once the investment is stable and the sector is

comfortable, we can work out an exit.”

The proposal

includes the possibility of approving Sh10 billion to Sh20 billion for

concessional lending through KDC, alongside risk-sharing arrangements to build

investor confidence and expand Kenya’s industrial base.

The head of

state praised the private sector for its indispensable and facilitative role in

delivering public goods and services.

“One such

example is the Affordable Housing Programme, a flagship initiative that is transforming

lives and reshaping our urban landscape. It has already created over 320,000

jobs across the building and construction value chain,’’ Ruto said.

He said that

his government has ring-fenced Sh11 billion for the Jua Kali sector to

manufacture key housing components from doors, windows and hinges to fittings –

stimulating grassroots enterprise, strengthening livelihoods, and anchoring economic

growth in the communities that need it most.

He added

that the private sector anchors core value chains, including agriculture, which

employs over 40 per cent of Kenyans, ICT and financial services, in which Kenya

leads in innovation, and tourism, where accommodation and food services grew by

26.6 per cent in Quarter 2 of 2024; a powerful indicator of economic rebound.

He praised

the recovery and growth of the country’s economy, with the shilling having stabilised

at Sh129 to the US dollar for over a year.

“Foreign

exchange reserves have grown from $6.5 billion to $11.8 billion, equivalent to

five months of import cover, while the Nairobi Securities Exchange (NSE), a key

barometer of economic confidence and investor sentiment, has recorded a robust recovery.”

Market capitalisation

now stands at Sh2.5 trillion, reflecting renewed investor optimism and policy consistency.

Although several

bodies have criticized the Hustler Fund, Ruto said he takes pride in the

initiative, saying that it has improved financial inclusivity.

He said that in just under three years, it has disbursed over Sh72 billion to 26 million Kenyans, mobilised over Sh5 billion in savings, and provided vital working capital to millions of micro-entrepreneurs, proving that even the smallest businesses can thrive with the right support.

![[PHOTOS] How ODM@20 dinner went down](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2F99d04439-7d94-4ec5-8e18-899441a55b21.jpg&w=3840&q=100)