Elevated insurance fraud, negative perceptions and low financial literacy coupled with product awareness are among factors hurting uptake of insurance cover in Kenya and the region, experts say.

Rapid evolution of technology has aggravated the situation, forcing underwriters to continuously shift strategies to drive uptake even as the region comes together to push for cross-border products and services.

The East African Community member states’ sector regulators, under the East African Insurance Supervisors Association (EAISA), have said high fraud especially in motor and medical insurance classes pose a significant challenge for market growth.

Geopolitical tensions and political instability also creates uncertainties in the business environment, with political realities related to international relations and trade agreements directly influencing matters within the insurance sector.

Other factors affecting the sector include global economic uncertainties and challenges in balancing regional economic and trading blocs.

“Trade policies, international treaties, and diplomatic relations impact cross-border insurance operations and regulatory harmonisation,” EAISA says in its five-year strategic plan 2024/25 – 2028/29 being fronted for adoption by the EAC.

These challenges have curtailed growth of the insurance sector in Kenya and other EAC member states.

While insurance provides a vital safety net for customers at risk of external threats, including health issues, economic disruptions, and natural disasters, it has, for many Africans, been unavailable–only three per cent of Africa’s GDP is driven by insurance, less than half the world average of seven per cent.

Africa’s aggregate insurance penetration rate is at a paltry 2.78 per cent, compared to the global average insurance coverage rate of 7.23 per cent.

In the EAC, Kenya leads, albeit with a paltry 2.43 per cent penetration.

Rwanda follows it with a 1.70 per cent penetration, Uganda (0.84 per cent), Burundi(0.77 per cent) while Tanzania has a 0.53 per cent penetration.

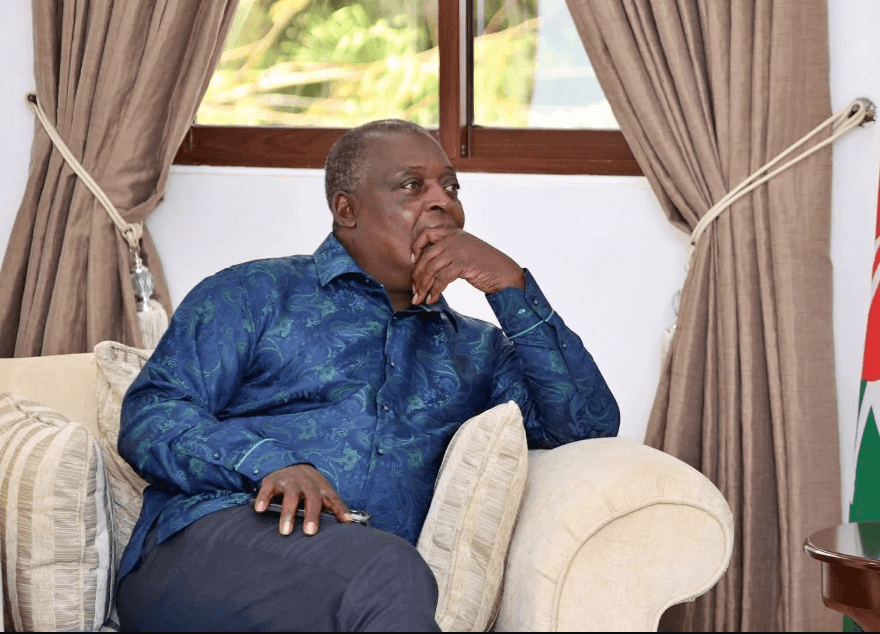

“The low level of insurance awareness and low public confidence in insurance services within member states pose a significant threat. This undermines insurance uptake and industry growth,” Kenya’s Insurance Regulatory Authority (IRA) Commissioner of Insurance and CEO, Godfrey Kiptum, said.

A slowdown in economic growth within the EAC insurance sector also led to reduced demand for insurance products.

To address some of the key challenges, the regulatory bodies are pushing for legislations that will streamline the industry, amid calls for political good-will from governments to support insurance sector development and regulatory cooperation.

This comes as insurance firms navigate the technology world amid demographic changes, where the presence of a young and dynamic population in EAC States is pushing the sector to develop insurance products tailored to the specific groups.

Social and cultural risk coping mechanisms are also influencing the uptake of insurance, alongside increased urbanisation and migration patterns in the EAC which are leading to differences in insurance needs and preferences between urban and rural areas.

The availability of effective and standardised Information Technology (IT) systems for insurance supervision is crucial for enhancing regulatory efficiency, according to the experts.

The rapid evolution of technology, including the use of mobile devices, the internet, insurtech solutions, mobile and digital platforms, AI, big data, and the internet of things also creates opportunities and challenges.

The East African insurance supervisors have resolved to jointly promote the development of cross-border insurance products and services to address the challenges of low insurance uptake and penetration in the region.

EAISA is a regional Association of Insurance Supervisors, which has been in existence since 2010, bringing together regulatory bodies of Kenya, Burundi, Democratic Republic of Congo, Rwanda, Uganda and Tanzania.

“EAISA have to explore strategies to introduce micro-insurance and reach underserved markets, thereby expanding the insurance industry’s footprint within EAC,” EAISA Exco chairman Alhaj Kaddunabbi said.

Kaddunabbi who is also Uganda’s Insurance Regulatory Authority CEO also said the association is keen to have coordinated regional initiatives relating to research and development for effective policy development and implementation.

The East African insurance supervisors who met in Eldoret (Kenya) last week have agreed to coordinate joint innovation initiatives relating to insurance development in member states.

Kenya has agreed to employ a joint approach in supervising systemically important insurance groups, monitor cross border industry stability and coordinate the establishment of insurance supervisory colleges.

Member states have up to June 2025 to develop and adopt risk management and solvency standards, to ensure that insurers across the region maintain adequate financial reserves to cover potential risks and solvency requirements.