Base Titanium might not extend mining activities in Kwale beyond 2024 after exploration in an area adjacent to its current operations established that it is not commercially viable.

It has discontinued exploration activities at Kwale East, the group announced on Monday, in what could mark the end of its prospecting and future investments in Kwale County, unless granted pending permits by the government.

According to parent company Base Resources, the decision follows the conclusion of a drilling programme under exploration licence number 2018/0119 secured in 2018, before the government moratorium (currently partially lifted), came into force in 2019.

The company was exploring an area adjacent to its current operations site, which it now says has no sufficient volume or heavy mineral grade to support an economically viable mining development.

Kwale East was considered a near-term mine life extension opportunity due to its close proximity to Kwale Operations’ infrastructure.

However, findings have not revealed any commercially viable minerals, according to the company.

The decision followed an evaluation of the likely mineralisation using the results from both Phase 1 and Phase 2 drill programs and applying optimistic assumptions on the continuity of mineralisation in the Magaoni and Zigira targets, areas that could not be drilled.

“Even on these optimistic assumptions, the evaluation concluded that there is unlikely to be sufficient volume or heavy mineral grade to support an economically viable mining development,” Base Resources said in an operations update.

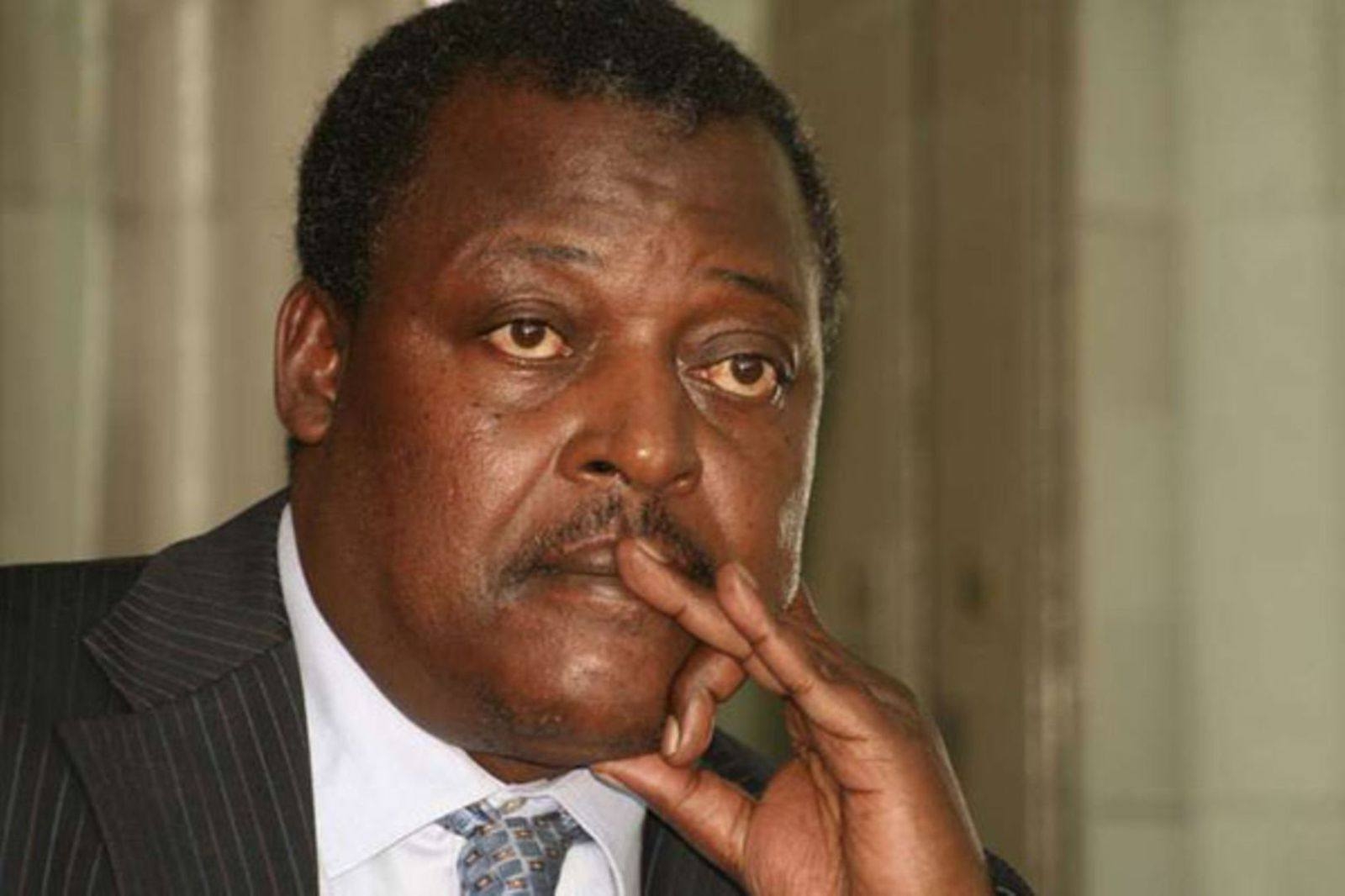

Yesterday, Base Titanium's general manager External Affairs, Simon Wall, told the Star that the focus is now on working towards the end of mine life in December 2024, followed by rehabilitation and mine closure.

“Unfortunately the exploration work carried out in Kwale East has not identified sufficient minerals to warrant mining - the economics don't add up. All mine life extension opportunities for Base's Kwale Operations have now been exhausted,” Wall said.

The company is however likely to consider exploration activities in other regions, including the Taita Taveta-Kwale border, Tana River and Lamu, if it secures permits from the government.

Prospecting licence applications lodged for an area totalling 722 km2 in the Kuranze region of Kwale County, about 70 km west of Kwale operations, together with applications for an area south of Lamu, totalling 888 km2, are still pending.

The Lamu, Tana River explorations are however long-term plans, as it would take between five to 10 years, if not longer, to establish the existence of adequate resources before making heavy investments.

Closing shop could hit Kenya’s mining sector as Base accounts for 65 per cent of the country’s mineral exports.

Cabinet in a sitting held on October 3, agreed to a phased lifting of the moratorium placed in 2019, to allow the mapping of the country’s mineral deposits.

The move, which has begun with construction and industrial minerals, has given hope to industry players, as they seek to invest in the sector.

"We hope to continue contributing to the growth of Kenya's mining sector," Wall had told the Star in an earlier interview.

Base has reported a drop in both production and minerals sales in the September quarter.

Production of ilmenite dropped to 38,800 tonnes compared to 55,500 tonnes in June, rutile went down to 9,600 tonnes compared to 15,800 tonnes while that of zircon reduced to 3,800 tonnes compared to 5,500 tonnes the previous quarter.

Volumes sold also dropped to 11,100 tonnes from 74,600 for ilmenite, 5,500 tonnes compared to 19,600 for rutile and 3,900 tonnes for zircon compared to 6,600 tonnes sold in June.

"Market conditions became increasingly challenging through the September quarter due to growing economic uncertainty and softening property sectors across all key markets,” the firm said in its quarterly report, yesterday.

However, firm demand continued for Base Resources’ products through the quarter and sales were in line with expectations, management said.

Prices held up well for ilmenite and rutile, but zircon prices moderated due to the sluggish conditions that emerged during the latter part of the June quarter.