The government has effected 100 per cent increment on loan limits for Hustler Fund borrowers.

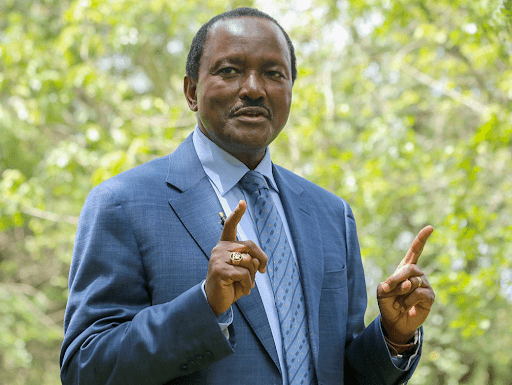

Cooperatives and MSMEs cabinet secretary Simon Chelugui, however, said that this only applies to those who have been borrowing consistently and repaying promptly.

Chelugui said the increment is based on individual’s record.

The loan limit, he said, is reviewed based on how regularly one borrows and repays the facility.

“The increment will apply to only those who have borrowed repeatedly and dutifully repaid their loans meaning, therefore, that the changes will be implemented on a case-by-case basis,” the CS said in a statement.

The announcement by the CS, it notes, is in line with the pronouncement by President William Ruto a week ago.

“As we speak, many Kenyans have already seen their limits double up because we effected the changes in the last couple of hours; for instance, those who were getting, let’s say, Sh3,000 are now getting Sh6,000,” it reads.

Those who were getting Sh5,000, it adds, are now getting Sh10,000 with the maximum limit of Sh50,000 set to be attained by June.

From the statistics, Sh18.5 billion has so far been disbursed from some 30 million transactions.

Debt repayment is now inching towards Sh10 billion while savings account stands at Sh912 million.

The number of Kenyans who have borrowed more than once is 6.1 million.

The review of the limit will be done every four months and individuals will be rated according to their repayment history.

At the same time, the CS said revealed that the National Treasury has disbursed the Sh1.8 billion required for the trust accounts.

"We have wallets held in two banks, KCB Bank and Family Bank, and they are the ones who now inject liquidity into the mobile money wallets of borrowers," he said.

The second product is set to be launched soon.