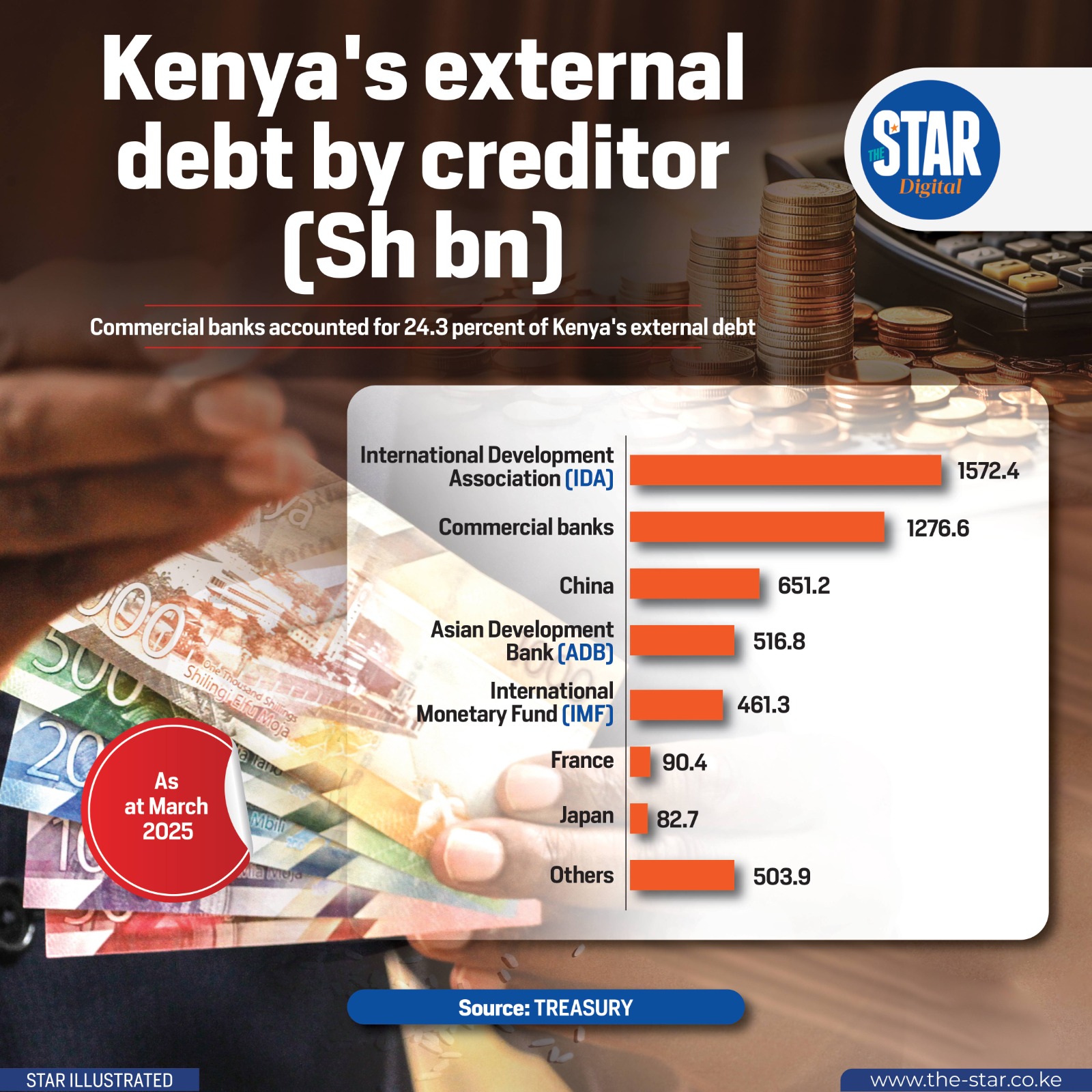

Kenya’s external debt continues to be heavily financed by multilateral and commercial lenders, with the International Development Association (IDA) and commercial banks taking the lead.

As of March 2025, IDA tops the list with Sh1.57 trillion, followed closely by commercial banks at Sh1.28 trillion, which account for nearly a quarter (24.3%) of the country’s external debt burden.

China remains a significant bilateral partner, holding Sh651.2 billion of Kenya’s debt, while the Asian Development Bank (ADB) accounts for Sh516.8 billion.

The International Monetary Fund (IMF) follows with Sh461.3 billion, reflecting Kenya’s growing reliance on policy support and program loans.

Traditional bilateral partners such as France (Sh90.4 billion) and Japan (Sh82.7 billion) contribute smaller shares compared to newer sources of debt. Other creditors collectively hold Sh503.9 billion.

The figures underline Kenya’s delicate balance between development financing and debt sustainability, as repayments increasingly pressure the country’s fiscal space.