Alcohol manufacturers have stated their opposing stance on the move by the government mandating them to pay excise duty within 24 hours upon removal of goods from the stockroom.

They say the move which allegedly, was meant to help prevent illicit alcohol trade without prompt consultations with stakeholders, is more likely to end up promoting it.

“The proposal was not taken through public participation, it was only inserted in the Finance Bill by the National Assembly’s Finance Committee after a submission by the illicit alcohol prevention taskforce,” Alcoholic Beverages Association of Kenya (ABAK) says in a statement.

It further says the move will punish innocent players due to failures by the state in managing illicit alcohol.

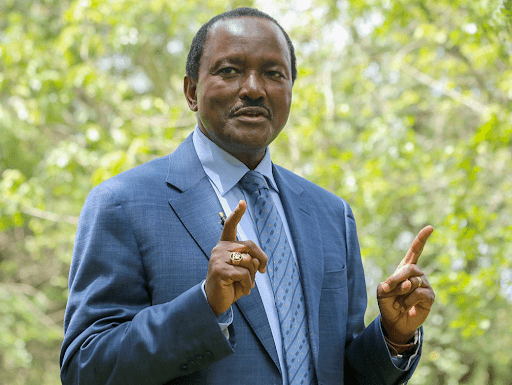

According to ABAK chairman Eric Githua, introduction of the provision is unnecessary, as the current model, where manufacturers remit the tax after the reconciliation of sales, is working.

“Our members have remained compliant in remitting Excise Duty, implementing the advance payment scheme is a counterproductive, unperceptive move that will hurt legal manufacturers,” Githua said.

He adds that Excise Duty is a consumption tax that needs to be charged at the point of consumption, and the alcohol industry just like other industries, the product passes through a value chain comprising of distributors and the outlets before it is consumed.

The organisation argues that the proposal ought to have been subjected to public participation, and the views of industry players sought as it demands that they make major changes to their ways of working yet it was not in the original Finance Bill.

“You do not stop errant alcoholic beverage dealers by making it harder for legal manufacturers. The government should be doing all it can to unearth the source and movement of ethanol and eventual making of this harmful alcohol,” Githua added.

The 2022 Economic Survey by the Kenya National Bureau of Statistics, shows the government collected Sh44.7 billion from locally manufactured beer, wines and spirits in 2021.

An extrapolation of this amount by factoring inflation at an average of 6.3 per cent gives an estimated Sh47.5 billion from locally manufactured beer, wines and spirits in 2022.

Consequently, Githua says implementation of the new requirement to remit excise duty in advance will require local manufacturers to finance a total Sh130 million daily before they actualize a sale.

"The move will also force manufacturers to review their contracts with distribution networks, including outlets such as bars and restaurants, for upfront payment on all orders to sustain compliance by alcoholic manufacturers.”