A new player in the Kenyan remittance space is betting on free transactions to increase penetration in the local market.

LemFi, a Nigerian Fintech dealing in cross-border money transfer service has formally entered the Kenyan market and will be targeting over 500,000 Kenyans abroad with zero remittance fees.

Lowering the cost of sending money amid inflationary pressures on households remains a key factor in driving diaspora remittances this year, according to World Bank and industry players.

A CBK survey on diaspora remittance breakdown last year showed that to send money to Kenya using an international money transfer provider, the fees range from $6 (Sh834) to $39.75 (Sh5524) but traditional banks may charge more.

On average Kenyans abroad are spending Sh2.4 billion per month in costs when sending money home to their relatives, with those using banks to remit cash, paying more compared to the ones utilising digital channels.

This is due to the fact that the cost of remittances to Kenya is averaging about seven percent, which is slightly below the average of eight percent for sub-Saharan Africa but well above the ideal target of three percent.

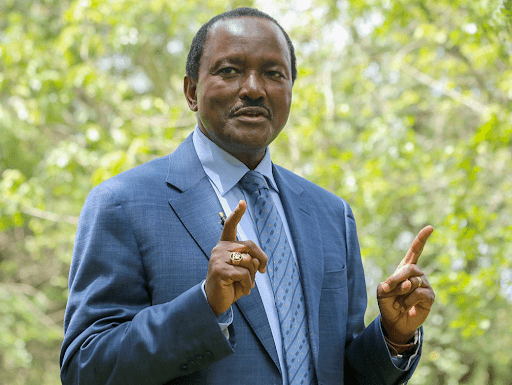

LemFi Country Manager Kakea Mbacha said United States, United Kingdom and Canada will be the most popular destinations targeted with the expansion into Kenya.

“When Africans leave their countries to work, study or live abroad, they still maintain family, business and friendship connections back home. Our services will not attract any fees as we strive to ensure that Kenyans in the diaspora can send money home instantly, at the best rates,” said Mbacha.

The elimination of the transaction fees comes at a time that Cash from Kenyans abroad fell for the third straight month in April, underlining the continued contraction of key foreign exchange inflows.

The remittances fell for the first time since 2010 as inflation hit multi-decade highs in many countries, squeezing household budgets.

North America remains dominant in the amount of money sent by Kenyans, followed by Europe and the rest of the world.

Currently the US remains the largest source of remittances into Kenya, accounting for 57 per cent.

The expansion into Kenya has been done in partnership with Pesa Swap – a local online and mobile payment solutions company based in Nairobi.

“Our operations in Kenya will be supported by Pesa Swap that provides locally relevant and alternative payment methods for global, regional and local merchants,” added Mbacha.

According to LemFi customers in the UK, US and Canada can access the services by downloading the app which enables them to send funds directly into bank and mobile money accounts of local recipients.

Pesa Swap CEO Chris Munyasya observed that diaspora remittances have grown tremendously in the last financial year with 50% of the money being sent by women.