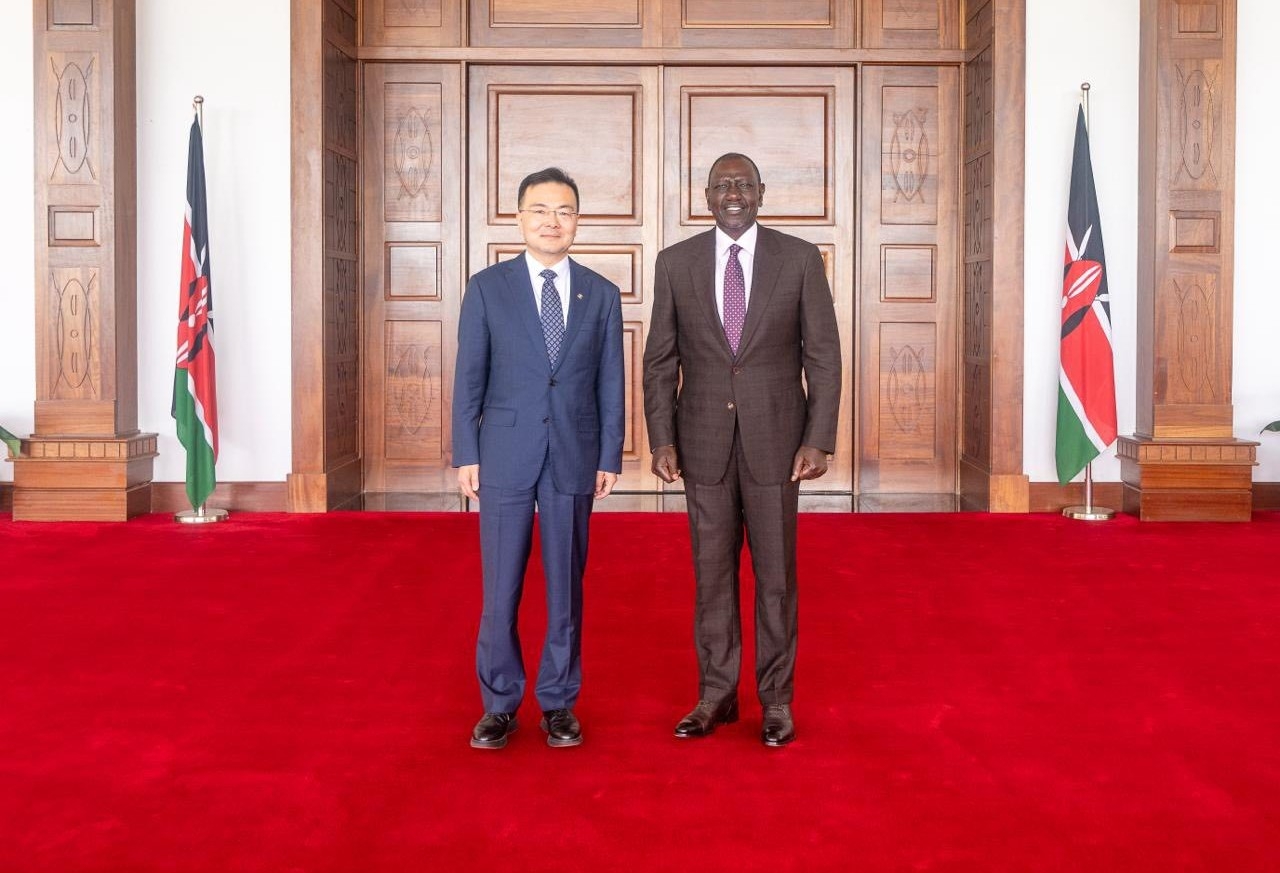

Larry Cooke- Africa Head of Legal, Binance/HANDOUT

Larry Cooke- Africa Head of Legal, Binance/HANDOUT

The first Africa Stablecoin Summit has brought together financial and technology leaders from across the continent to discuss how digital currencies could strengthen Africa’s economy and ease cross-border trade.

The two-day meeting, held in Johannesburg, South Africa, drew more than 300 participants, including representatives from central banks, regulators, commercial banks, and fintech companies.

Delegations attended from Kenya, Ghana, Nigeria, Uganda, Zambia, and South Africa. Global organizations such as the United Nations, the International Monetary Fund (IMF), and the Pan-African Payment and Settlement System (PAPSS) were also represented.

The summit, themed “Harnessing Stablecoins for Africa’s Economic Resilience,” focused on how stablecoins—digital currencies whose value is tied to traditional money such as the US dollar—could make financial systems more efficient and accessible.

Binance’s Africa Head of Legal, Larry Cooke, said stablecoins could make cross-border payments faster and more inclusive.

“Stablecoins are more than a technological innovation—they are a pathway to inclusive, cross-border financial systems that can empower businesses and individuals across Africa,” he said.

Shahebaz Khan, Senior Vice President at Visa CEMEA, added that traditional payment networks are already adapting to the rise of digital currencies.

“As money itself evolves, we’re extending our trusted infrastructure to stablecoins, making payments faster, more accessible, and more secure for everyone,” he said.

Paul Neuner, CEO of Telcoin, said telecom firms could help expand access to digital money.

“Telcos can play a major role in running the internet of money, just as they run the normal internet today,” he said.

Recent data shows that Africa is emerging as one of the fastest-growing regions for digital money use.

According to a report by Yellow Card, stablecoins accounted for 43 percent of cryptocurrency transactions in Sub-Saharan Africa in 2024.

Nigeria, which leads the region in adoption, recorded nearly 22 billion US dollars in stablecoin transactions between July 2023 and June 2024.

The Center for Global Development has also estimated that stablecoin flows now represent about 6.7 percent of GDP across Africa and the Middle East.

Experts at the summit said the growing use of stablecoins reflects their potential to address long-standing challenges such as currency instability, high remittance costs, and limited access to formal banking.

Sessions during the summit discussed regulation, infrastructure, and the future of digital transactions.

Topics included South Africa’s Project Khokha, interoperability among African payment systems, and opportunities for startups in the blockchain space.

Participants called for stronger collaboration between governments, regulators, and private companies to ensure that the growth of digital currencies supports financial stability, transparency, and inclusion.