A fuel importing company has moved to court, fighting off the

auctioning of its parcels of land in Nairobi and Mombasa over a Sh630 million

loan whose settlement remains in dispute.

Mahadi Energy Limited which imports, stores and distributes petroleum products across Kenya and into the East Africa region, says four of its land parcels were auctioned without its knowledge over the loan, which it took from Premier Bank Limited, formerly known as First Community Bank Limited.

In affidavits by the company’s managing director, Ibrahim Hussein, the company says it borrowed Sh631 million from the bank back in 2011 and had paid back Sh530 million by 2018, when it sought a statement on the remaining balance.

Hussein says the bank did not issue the statement sought but instead demanded payment of the loan amount, which had failed to factor in the repaid balance.

A dispute arose and the bank has since auctioned four properties belonging to the company: a parcel of land along Mtelo Road in South C, Nairobi and another along Juja Road in Pangani, Nairobi. The other two parcels are along Mainland North Road in Mombasa.

Shabeel Project Services Limited, who bought the parcels through the auction, has since evicted Mahadi from the properties after securing court orders.

Mahadi had moved to the Environment and Land Court in Nairobi to lift the orders, saying they were issued without the court being informed about the dispute.

The company says the High Court in Mombasa had already issued conservatory orders for status quo pending a petition it filed against the bank over the disputed loan balance.

“The ex parte orders [orders given in the presence of only one party] were obtained without full disclosure to the court of the pending constitutional petition and the irregularities in the auction process, amounting to material non-disclosure and abuse of court process,” Mahadi says.

Hussein says the court unknowingly accepted an illegal invitation that makes it to act like the Court of Appeal on a matter before a court of equal status.

The company argues that it continues to suffer harm as the properties form part of its business assets and that their possession by the purchaser means business operations have stopped.

“It is in the interest of justice to set aside the orders to preserve the status quo pending the determination of the constitutional petition,” Mahadi says.

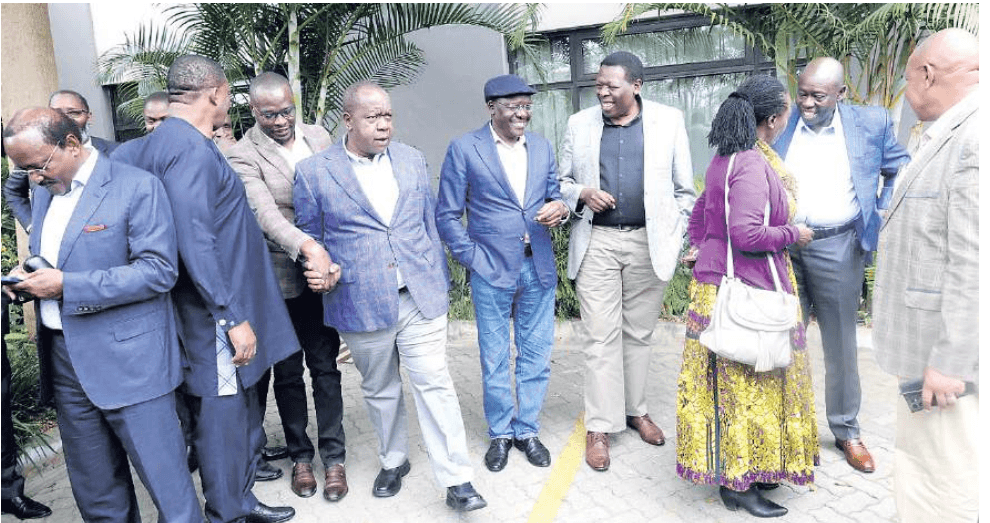

The company’s lawyer, Danstan Omari, told reporters the firm uses the land parcels as its depots for storage and distribution of petroleum products to South Sudan, the Democratic Republic of Congo, Uganda and Rwanda.

“Mahadi is the third largest internal container depot in this country, served by over 50 shipping lines with ships from China, India, Britain, South Africa, among others, putting their containers there. So, it means the order has made those countries to suffocate because they can’t get supplies,” Omari said.

However, Justice Mohamed Kullow, who issued the orders, only certified the case urgent but declined to lift his earlier orders.

The court directed that the application be served on the respondents, who should file their responses within 14 days ahead of mention on December 8.

Mahadi says in its affidavits that Premier Bank wants to charge interest on the loan yet that was not the agreement when the money was loaned out.

“The underlying debt is disputed and not properly established as it involves unjustified ‘profits’ that have no Sharia compliance under Islamic financing,” the affidavit reads.

It claims the bank has auctioned even properties that were not charged as security for the loan, making the auction fraudulent and unlawful.