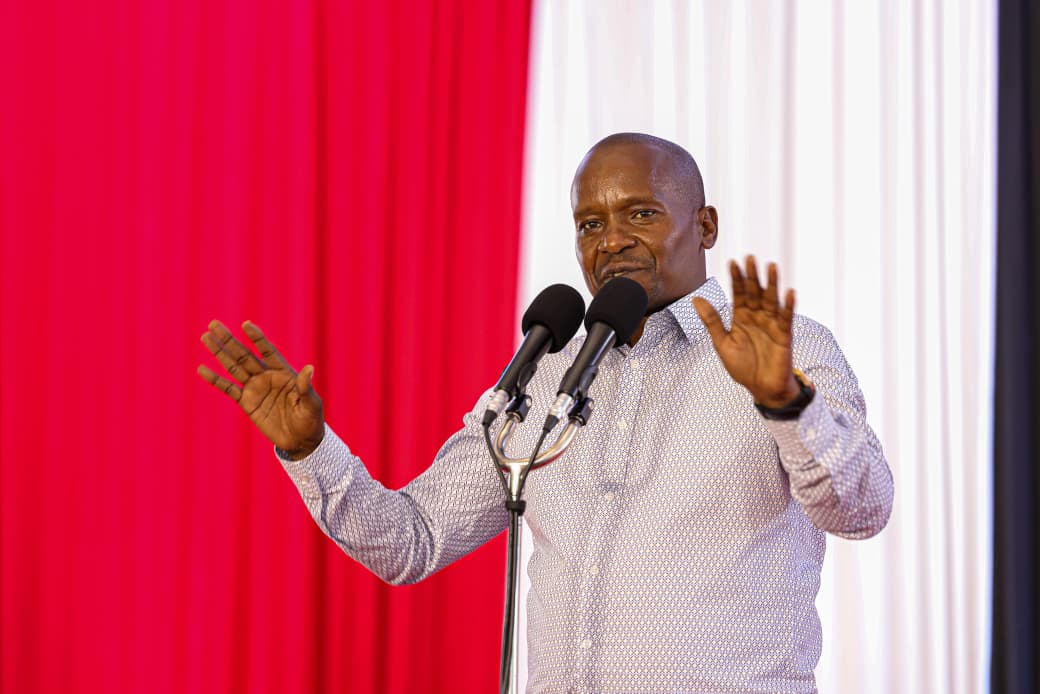

Deputy President Kithure Kindiki has welcomed the Central

Bank of Kenya’s (CBK) decision to lower its benchmark lending rate to 9.5 per cent.

Kindiki in a statement praised the move as a sign of renewed

economic stability and growth.

He said the adjustment reflects a turning point for the

economy, which has faced years of sluggish growth due to high interest rates

and external shocks.

“Kenya has turned the corner of macro-economic instability

that had been occasioned by external and internal shocks. Kenya is on the

rise,” the Deputy President said.

Kindiki noted that Macroeconomic indicators have shown

steady improvement, with Inflation remaining low, ranging between 3 and 4 per cent

over the past six months, down from 9.6 percent in 2022.

The shilling, he added, has also stabilised at 129 to the US

dollar for a year and a half, recovering strongly from 165.

According to the DP, Import cover is also approaching a

record six months, reflecting strengthened resilience in the external sector.

Kindiki went on to say that recent International Monetary

Fund (IMF) data shows Kenya has risen to become the sixth-largest economy in

Africa, overtaking Ethiopia and Angola.

The country has moved up two places from eighth,

underscoring its growing economic weight on the continent.

He emphasised that while the macroeconomic picture looks

promising, the government’s next challenge is to ensure the benefits trickle

down to households through job creation, higher incomes, and increased savings.

“With the general macro-economic indicators on a positive

trajectory, the hard work ahead involves acceleration of government policies,

programmes and projects that will boost micro-economic indicators,” he said.

The CBK’s latest move is expected to make borrowing cheaper

for businesses and households, potentially unlocking new investments and

stimulating economic activity.

The CBK on August 12 cut the rate by 25 basis points,

marking the first time in almost a decade that commercial lending rates have

fallen below double digits.

The latest reduction is the seventh since the regulator

began easing rates two years ago, down from a peak of 15.75 percent.