Parliament is set to begin receiving public and stakeholder input on Monday regarding the proposed privatisation of the Kenya Pipeline Company (KPC).

KPC is a major player in the country’s petroleum transport and supply infrastructure.

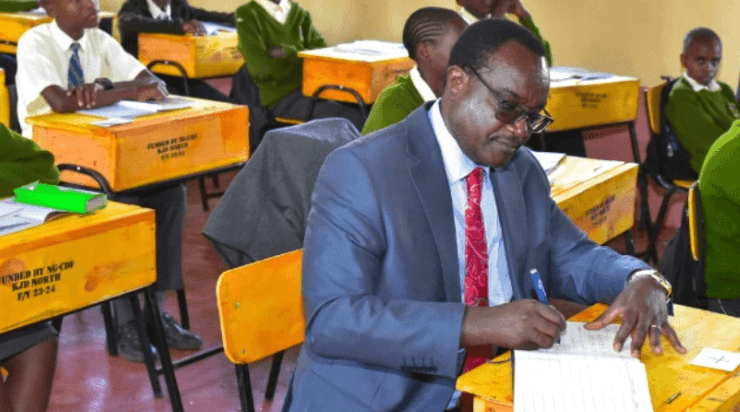

Two key parliamentary committees — the Committee on Energy

and the Committee on Public Debt and Privatisation — will hold joint

stakeholder consultations at the Hilton Garden Inn, Mombasa Road, to deliberate

on the proposal by the National Treasury to list KPC on the Nairobi Securities

Exchange (NSE).

The government aims to raise approximately Sh100 billion from the transaction, with the Treasury stating that proceeds will go toward funding critical public services and infrastructure, as well as reducing Kenya’s reliance on debt.

Officials from the National Treasury, Privatisation Commission, and Central Bank of Kenya are expected to present their views, alongside key industry and oversight stakeholders such as the Nairobi Securities Exchange, Capital Markets Authority, International Budget Partnership, Petroleum Institute of East Africa, Petroleum Outlets Association of Kenya, and the Kenya Civil Society Platform on Oil and Gas.

The Cabinet gave its approval for the sale of KPC during its July 29, 2025 meeting.

The move comes as part of a broader government push to privatise several state-owned enterprises, including the Kenya Literature Bureau (KLB), Rivatex East Africa, National Oil Corporation (NOC), and the New Kenya Cooperative Creameries (NKCC).

According to a sessional paper tabled in Parliament on May 5, 2025, the proposed Initial Public Offering (IPO) of KPC is expected to support the government’s 2025/26 budget, particularly in achieving economic and social development objectives.

The privatisation of KPC was first included in the government’s Privatisation Programme approved by Cabinet in December 2008 and officially gazetted on August 14, 2009.

The programme aims to mobilise investment resources, improve transparency and corporate governance, broaden public ownership, deepen capital markets, and support the national budget.

Stakeholder feedback gathered in the coming days will inform the final parliamentary recommendations on whether the privatisation should proceed.