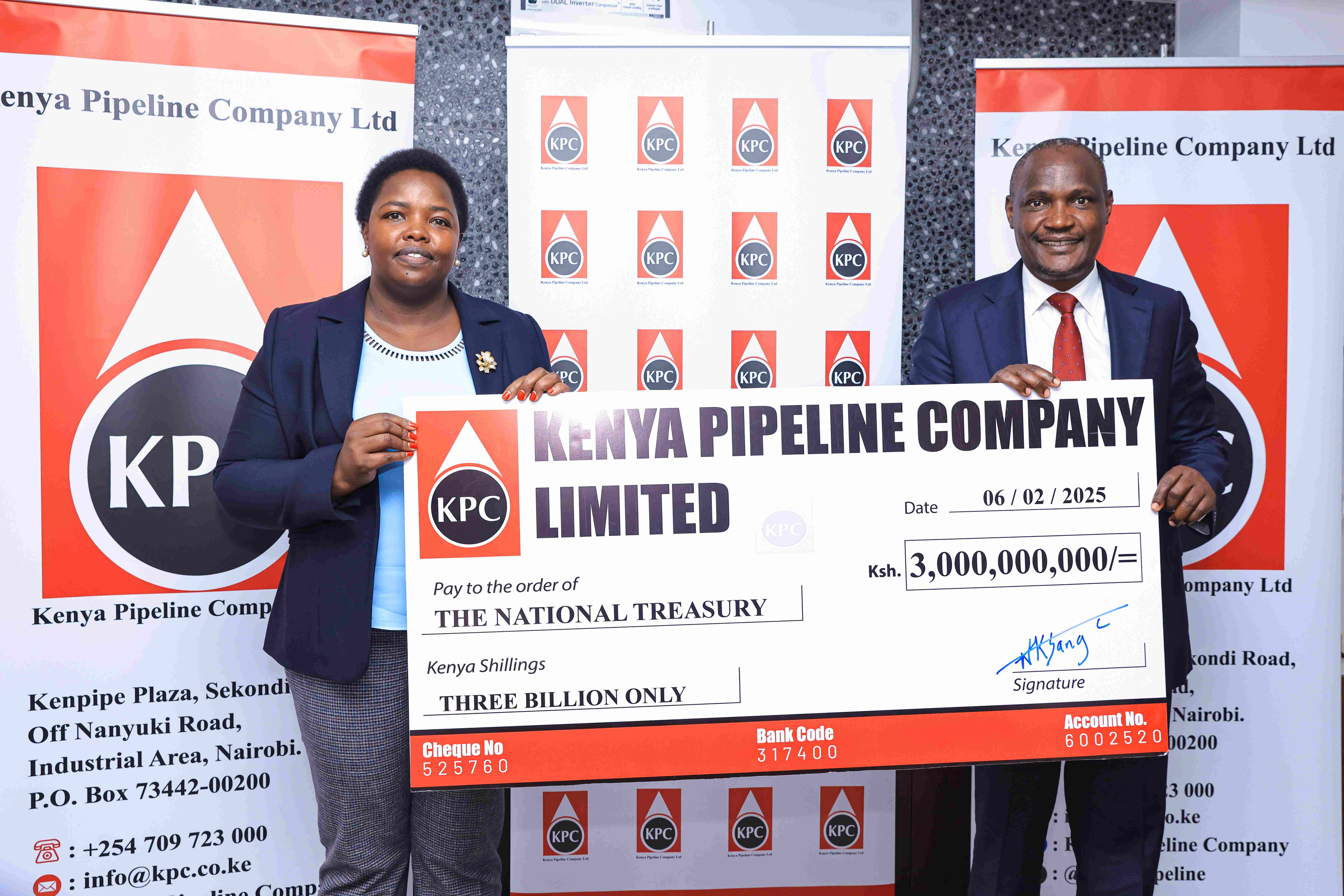

KPC Board chair Faith Boinett (left) hands over an interim dividends cheque for the half year ended December 2024 to the National Treasury CS John Mbadi at KPC headquarters /HANDOUT

KPC Board chair Faith Boinett (left) hands over an interim dividends cheque for the half year ended December 2024 to the National Treasury CS John Mbadi at KPC headquarters /HANDOUTKenya Pipeline Company will be listed on the Nairobi Securities Exchange (NSE) this year through an Initial Public Offering (IPO), President William Ruto has said.

“We plan to list the Kenya Pipeline Company through an IPO in 2025, offering investors a unique opportunity to deploy capital in one of Kenya’s most strategic infrastructure enterprises,” Ruto said.

Speaking during the market opening ceremony at the London Stock Exchange, held as part of the Africa Debate Forum, Ruto described the privatisation drive as a deliberate move to boost investor confidence and expand market participation.

“We have equally made a strategic decision to broaden Kenya’s stock market appeal to both local and international investors by earmarking key State assets for privatisation through Initial Public Offerings,” he said.

Ruto added that the government is committed to a “structured, time-sensitive programme that identifies and prepares a robust pipeline of key government assets” for listing or enhanced private sector participation.

The President used the occasion to highlight the growing role of capital markets in Africa’s economic development.

“Capital markets play critical role as catalysts for sustainable economic growth and expanded shared prosperity across the African continent,” he said.

“They serve as efficient mechanisms for mobilising domestic savings, attracting international capital and channelling resources into long-term investments in infrastructure, innovation and industrial transformation.”

He also praised the UK for its continued support.

“For decades, the UK has been a steadfast partner in Kenya’s and Africa’s development journey, supporting institutional reforms, infrastructure and market development that continue to shape a more prosperous and resilient future,” he stated.

Ruto noted that Kenya’s commitment to developing its capital markets is already showing results.

“Kenya is committed to the development of its capital markets, particularly through strengthening the Nairobi Securities Exchange,” he said.

He credited “strategic reforms and a refreshed, market-focused strategy under the leadership of the new NSE team” with improved performance.

“These reforms helped the NSE emerge as Africa’s top performer in dollar returns in 2024, according to Morgan Stanley Capital International,” Ruto added.

Ruto further welcomed similar reform efforts across the continent and also applauded UK-backed initiatives like Mobilist and FSD Africa, which are supporting the development of inclusive and transparent financial markets.

“These initiatives are unlocking capital for impactful and sustainable projects while improving transparency, investor confidence, and long-term returns,” he said.

On February 7, National Treasury Cabinet Secretary John Mbadi revealed that the government was thinking of listing KPC at the NSE through an IPO.

This was after he received an interim dividend cheque of Sh3 billion from KPC board chairperson Faith Boinett for the half-year ending December 2024.

The dividend payment brought the total dividends paid by KPC to the National Treasury in the last 12 months to Sh10.5 billion.

“We have this feeling that KPC needs to realise the benefits that will accrue from a listing at the Stock Exchange,” Mbadi said.

“Listing will be a good idea especially as KPC expands into the region because it will provide much-needed liquidity and capital for expansion and diversification into LPG, Kenyans will have a chance to own a piece of KPC.”

Mbadi said that the exchequer would support plans to wind

down Kenya Petroleum Refinery and the on-boarding of it into KPC.

![[PHOTOS] KPC signs a service legal agreement with KEBS](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F07%2Fa63c369d-7d4d-4a8c-bef9-34dba4c6d536.jpg&w=3840&q=100)