Kenya’s inflation rate has fallen to a two-year low of 3.8 per cent in May 2025, down from a peak of 9.6 per cent in October 2022.

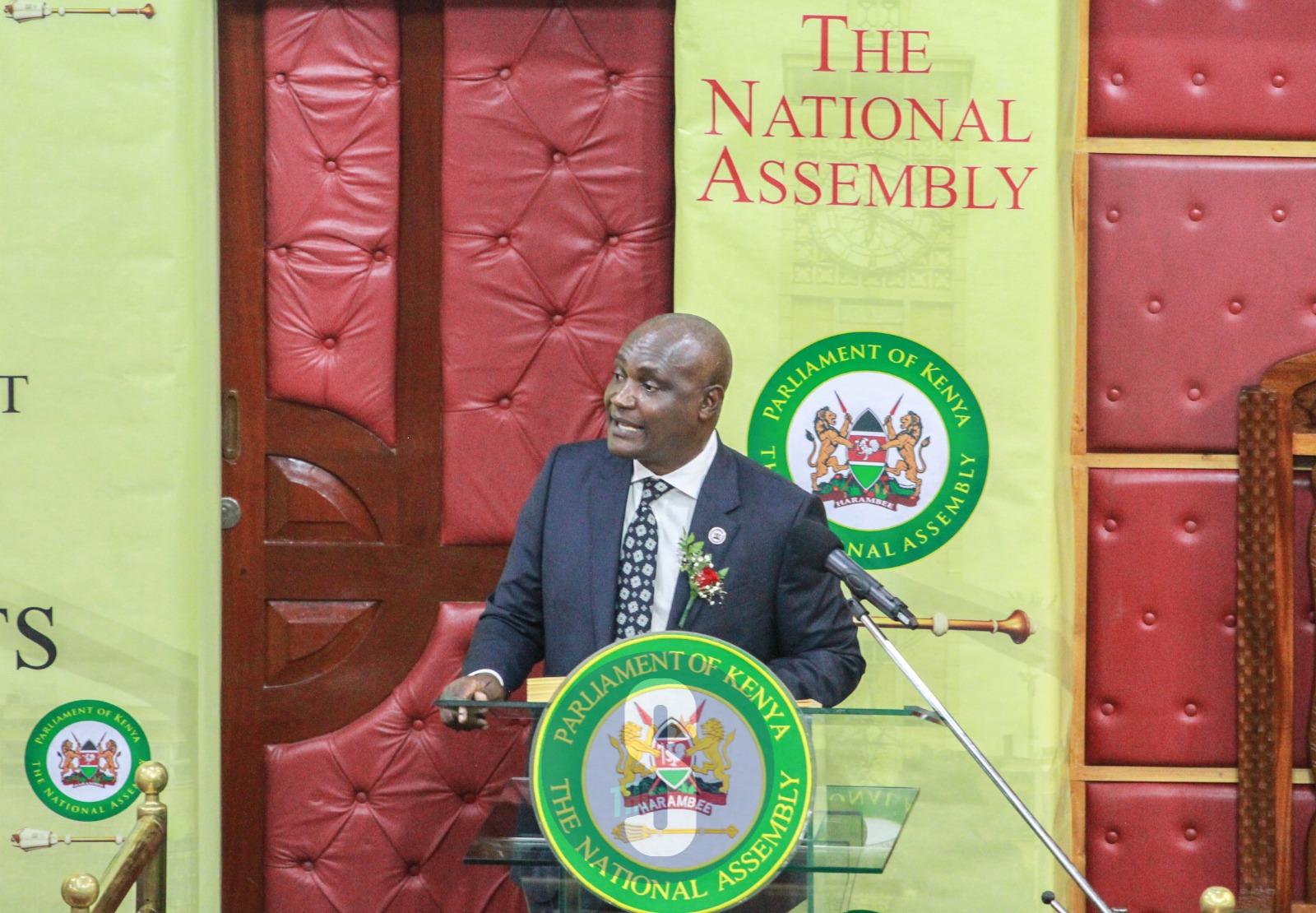

National Treasury Cabinet Secretary John Mbadi, while presenting the 2025/2026 national budget at Parliament Buildings in Nairobi on Thursday, attributed the decline to a series of targeted government policy interventions.

Presenting his first budget as Treasury CS under President William Ruto’s administration, Mbadi credited the improved economic indicators to prudent fiscal and monetary management, which he said had strengthened Kenya’s macroeconomic fundamentals.

“In response to the decline in inflation, the Central Bank of Kenya has gradually eased monetary policy, lowering the bank rate from 13 per cent in August 2024 to 9.75 per cent in June 2025,” said Mbadi.

He noted that the easing inflation had led to a reduction in the prices of essential food commodities, including maize flour, sugar, milk, bread, wheat flour, and rice.

“For example, the cost of a 2-kilogram packet of sifted maize flour has dropped from Sh177 in October 2022 to Sh156 in May 2025,” Mbadi stated.

The CS also highlighted a decline in energy and power costs over the same period, further contributing to a more stable cost of living.

Lower inflation and monetary easing have driven down interest rates across the board.

Mbadi noted that the 91-day Treasury bill rate has dropped significantly from an average of 15.9 per cent in 2024 to 8.3 per cent in May 2025.

Similarly, average commercial bank lending rates, which peaked at 17.2 per cent in November 2024, have decreased to 15.7 per cent.

“This decline has not only reduced the cost of government borrowing but is also expected to stimulate increased lending to the private sector,” he added.

The budget seeks to balance economic recovery, development spending, and fiscal consolidation in line with the Kenya Kwanza administration’s economic blueprint.

This year’s budget is the second under President Ruto’s government and marks Mbadi’s debut as Treasury boss after succeeding Njuguna Ndung’u earlier this year.