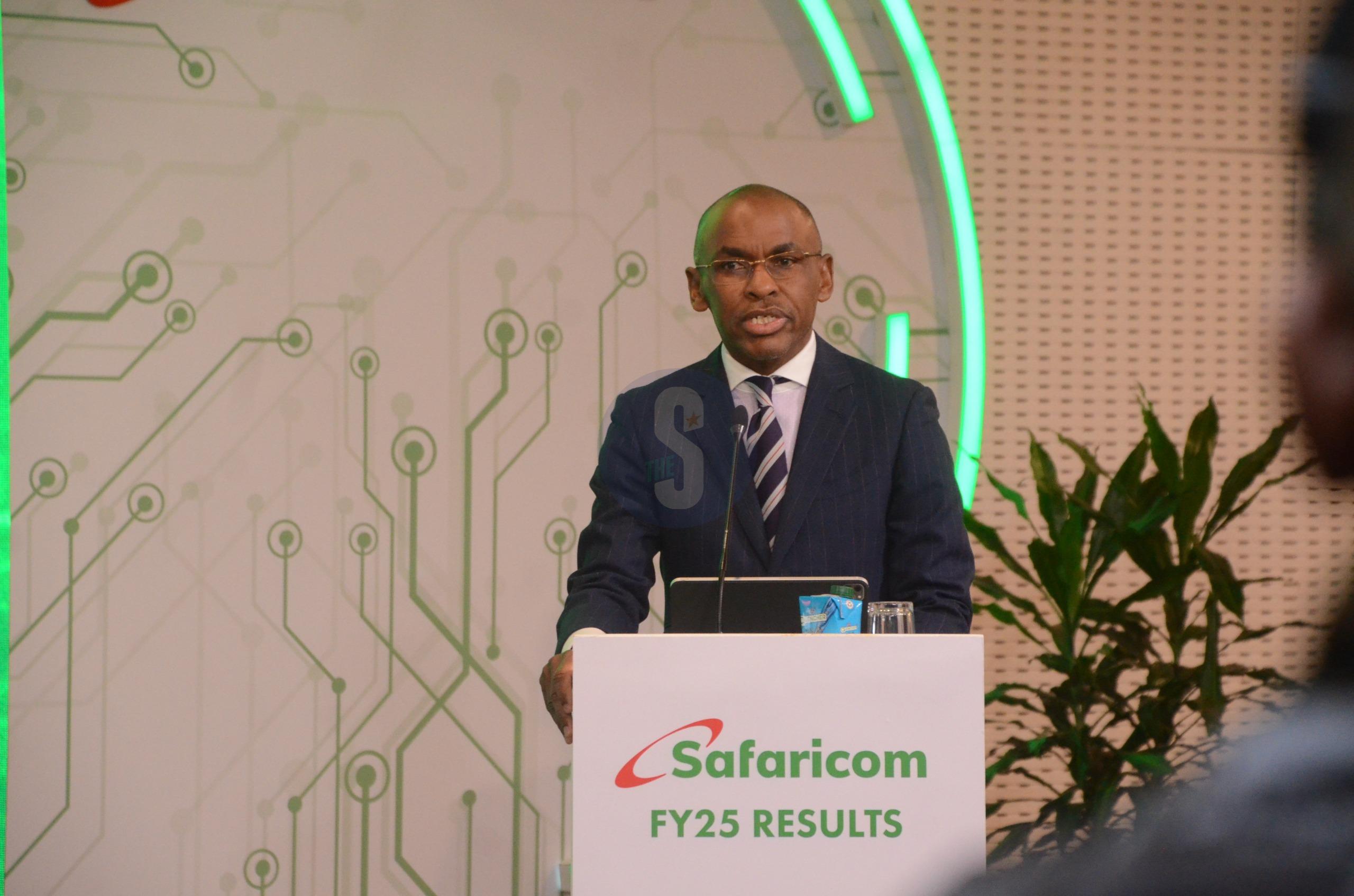

Safaricom PLC, on May 9, 2025, announced it will pay out

Sh48.08 billion in dividends to its shareholders for the year ending March 31.

This follows the telco's report of Sh69.8 billion in net income for the full year, driven by double-digit growth in both mobile money and broadband services.

The net income represented a 10.8 per cent increase compared to the

previous financial period.

The company also posted an 11.2 per cent growth in total revenue, reaching Sh388.7 billion in the financial year ending March 31, 2025.

The total dividend includes a final dividend of 65 cents per ordinary share, in addition to the interim dividend of 55 cents per ordinary share already paid out.

On May 9, 2025, Safaricom attributed the strong performance to sustained innovation across its TechCo product portfolio, expansion into Ethiopia, and continued support for community initiatives.

Safaricom has invested more than Sh18 billion in education, health, environment, and economic empowerment initiatives over the past five years.

The reporting period also marked the conclusion of Safaricom’s five-year strategy cycle, during which the company transformed from a telecommunications firm into a technology company through accelerated technology adoption and a stronger focus on digitising Kenya and Ethiopia.

“We have delivered excellent group performance with double-digit growth on both the top and bottom line. This strong set of results reflects the dedication of our teams, the loyalty of our customers, and the strength of our strategy,” said Dr. Peter Ndegwa, Safaricom PLC CEO.

The group’s earnings before interest and taxes (EBIT) grew impressively by 29.5 per cent to Sh104.1 billion.

Ethiopia contributed nearly 10% to the group’s revenue, with management noting that the business has moved past its peak investment phase and is expected to turn profitable by the financial year 2027.

In Kenya, service revenue grew by 10.5 per cent to Sh 364.3 billion. M-PESA, which turned 18 last year, delivered Sh 161 billion, contributing 44.2 per cent of Kenya’s service revenue.

The YoY growth of 15.2 per cent was driven by diversification beyond payments, with a growing focus on wealth management and credit solutions.