Nairobi's massive water losses annually are because of poorly maintained infrastructure inherited from previous administrations, Governor Johnson Sakaja has said.

The Senate’s County Public Investment Committee summoned him earlier this week to explain the huge scale of unaccounted-for water in the capital as residents grapple with water rationing.

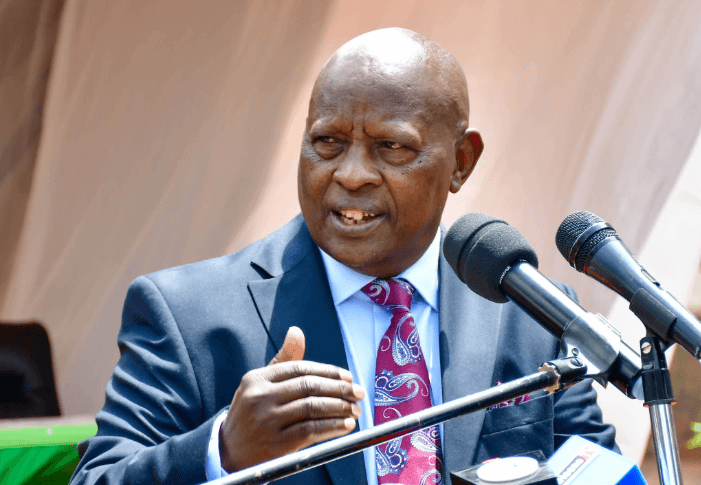

“Governor, auditors say 51 per cent of water produced, worth Sh8.6 billion, simply vanished. How do we explain this to the rate-payers?” the committee chair Godfrey Osotsi asked Sakaja during the hearing.

Sakaja, who succeeded Mike Sonko and Evans Kidero, acknowledged the gravity of the situation but blamed years of neglect.

“We inherited antiquated pipes and deferred capital works,” he said.

"We have now ring-fenced Sh9.2 billion in the 2024-25 budget for meter sealing, leak detection and pipeline rehabilitation."

He said his administration has earmarked Sh9.2 billion in the new financial year 2024-25 budget to address the problem.

The funds will be directed towards fixing leaking pipes, improving meter accuracy and rehabilitating dilapidated pipelines.

His response painted a picture of a system long overdue for overhaul, with years of underinvestment compounding the county’s woes.

The senators also scrutinised the county’s revenue management, especially the accumulation of unpaid bills, which currently stand at a staggering Sh11 billion and have remained outstanding for more than 480 days.

Nairobi Senator Edwin Sifuna was particularly scathing in his assessment.

“Sh11 billion sits in receivables over 480 days. Demand letters alone won’t cut it. Where is the recovery plan?” Sifuna asked, pressing the governor for a concrete strategy to improve debt collection.

Sakaja outlined steps already taken to recover some of the debts, including the establishment of two new revenue zones and the launch of a GIS billing platform in February aimed at improving billing accuracy.

He added that debts exceeding Sh1 million had been referred to legal teams for recovery, and 1,938 previously unbilled accounts were now being invoiced.

Despite these measures, the committee’s concerns extended beyond water loss and revenue recovery. The county’s salary expenditure was flagged as another major financial challenge.

Currently, salaries take up about 65 per cent of Nairobi’s revenue, far exceeding the recommended cap of 35 per cent, raising serious questions about financial sustainability.

In response, Sakaja said his administration had implemented strict cost-saving measures to rein in wage bills. These include a hiring freeze on non-essential positions and decentralising services to cut down on overtime payments, which had inflated salary costs.

Additionally, Sakaja said the county has submitted a cost-recovery tariff proposal to the Water Services Regulatory Board. The aim is to reduce the wage-to-revenue ratio to 45 per cent within the next year, a move that could significantly improve Nairobi’s financial health.

While the governor’s responses provided some reassurance, the session revealed the scale of Nairobi’s water and financial challenges.

INSTANT ANALYSIS

With billions lost annually through leaks and unpaid bills, and a bloated wage bill draining resources, Nairobi’s water crisis is as much a management issue as it is an infrastructure one. The coming months will be critical as the county seeks to turn its fortunes around.