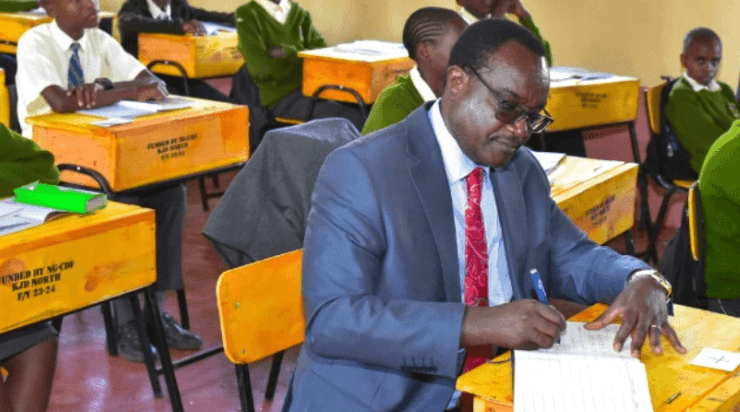

CAK’s director for competition and consumer protection Amenya Omari when he appeared before the Trade committee on October 2.

The Competition Authority of Kenya (CAK) has dismissed claims that it approved the contentious sale of East African Portland Cement Company (EAPCC) shares to Kalahari Cement, insisting it's role was purely advisory and not regulatory.

Appearing before Parliamentary Committee on Trade, Industry and Cooperatives, the regulator said no formal merger notification was filed for approval, and therefore the transaction did not require its authorisation.

The authority's, director for policy and research Adano Wario said their role was restricted to advisory as other agencies like Capital Markets Authority were to issue the clearance.

“The document before us was a request for an advisory opinion, and that is what we provided in accordance with the Competition Act. We were not required to allow or disallow,” Wario told MPs, adding that the sale of Holcim’s 41.7per cent stake in EAPCC did not amount to a change of control under the law.

“The document before us is seeking advisory opinion and that is what we provided in accordance with the CMA Act.”

MPs pressed the Authority on why Portland Cement’s buyback request was ignored, and raised concerns that selling shares at nearly half the Nairobi Securities Exchange market price could dilute the value of government and public holdings.

Led by the committee deputy chairperson Aldai Member of Parliament Marianne Kitany, the MPs accused the Authority of aiding “grabbers” to acquire strategic Kenyan companies on the cheap.

“Does it concern you that selling of the shares at half the price of current trading value at the NSE will dilute the value of the government and public shares at Portland Cement?” paused Kitany.

However, the competition regulator maintained that it could not respond to questions of pricing or shareholder dilution, stressing that its role was confined to assessing whether a transaction met the legal definition of a merger.

CAK’s Competition and consumer protection director Amenya Omari, while holding that “this was not a notifiable merger,” held that the authority's notification thresholds only extends to the sale and acquisition of substantial shares that could result in a party establishing market power.

“And to achieve this, the authority has developed procedures and guidelines that guide the defining of the relevant market in the notified merger transactions and assessing the merger's likely effect on competition and public interest in the economy,” said Omari.

The Authority found itself on a tight spot after it failed to convince members of parliament why it allowed a foreign entity to proceed with the deal yet Portland Cement was willing to buy back the shares.

“Why did you approve Holcim to sell to Kalahari yet Portland wanted to buy back?” asked Funyula MP Wilberforce Oundo.

The regulator however, held that its decisions were tied down to whether the merger could create a dominant player, revealing that it is undertaking a sector-wide market study on Kenya’s cement industry to examine pricing trends, market concentration and possible violations of competition law.

The study is expected to be completed by the end of October.

“We are looking to collect historical data, the trends regarding prices, production, output, and the demand, and also to establish if there are any forms of violations to the Competition Act in that industry,” said CAK’s merger and acquisitions manager Raphael Mburu.

Kenya’s cement industry is dominated by established players including Bamburi, Mombasa Cement, Savannah Cement, National Cement, Rai Cement, and imports from Uganda and Tanzania.

While production and consumption have generally risen, the sector has seen recent export surges and cost pressures that could affect local supply and prices.