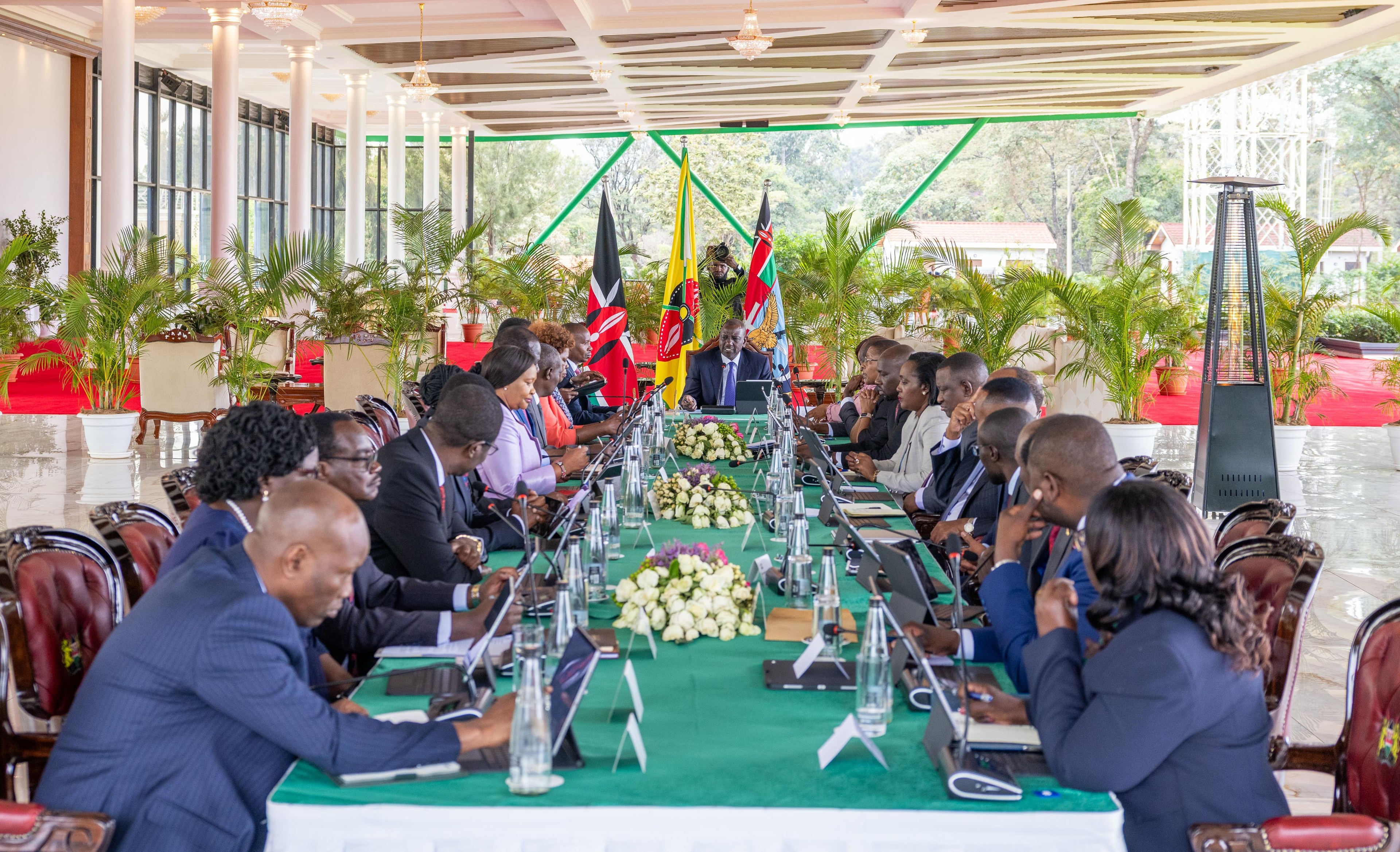

Tourists arriving in Kenya/FILE

Tourists arriving in Kenya/FILE

Kenya’s luxury hospitality sector is experiencing significant growth, spurred by an increasing arrival of international visitors, a stable economy, and a rising middle class.

Industry experts attribute this surge to the country’s unique blend of natural beauty, strategic location, and supportive government policies — all of which are attracting substantial investment in high-end tourism and hospitality.

“Kenya presents a great opportunity for hospitality investment due to its unique combination of untapped potential, economic stability, strategic location, and government incentives,” said the founder and managing director of Aleph Hospitality Bani Haddad.

“Add to that a 35 per cent increase in international visitors and a growing middle class with disposable income. It’s clear that the demand for quality hospitality services will continue to rise, offering promising opportunities for local and international investors.”

According to industry players who will headline the East Africa Property Investment (EAPI) Summit, between May 7-8, 2025, Nairobi’s position as a key economic and transit hub in Africa, coupled with Masai Mara’s global reputation as a premier safari destination, further fuels this investment trend.

The experts agree that despite short-term challenges, the long-term outlook for Kenya’s hospitality sector remains positive.

Knight Frank Kenya CEO Mark Dunford said that improved air connectivity is critical to sustaining this growth and the influx of tourists into Kenya.

“Jomo Kenyatta International Airport must remain a hub for Sub-Saharan Africa region with additional long-haul flights to support along with further investment in the other local airports,” says Dunford.

Fiona Craw, Vice President of the Hotels & Hospitality Group at JLL Africa, pointed out that Kenya’s hospitality sector attracts significant investment, particularly in Nairobi and the Masai Mara area.

This growth is driven by robust demand across sectors including corporate, leisure, MICE (Meetings, Incentives, Conferences, and Exhibitions), and government.

Craw says the ongoing infrastructure development in Kenya, especially in Nairobi, is enhancing accessibility and supporting the country’s efforts to establish itself as a leading MICE tourism destination.

“This strategic positioning is driving demand for high-quality accommodation and state-of-the-art meeting facilities,” says Craw.

Despite promising opportunities, they acknowledged several challenges hobbling the industry’s growth.

“Kenya’s hospitality industry, while exhibiting resilience and growth, faces several challenges such as security concerns, regulatory hurdles, supply chain disruptions, and human resource challenges. The high cost of financing and inflation-driven operational costs further strain businesses,” said Haddad.

The East Africa Property Investment (EAPI) Summit will gather over 450 global investors, developers, and real estate professionals.

Participants will explore opportunities to capitalize on investment potential in Kenya, Tanzania (including Zanzibar), Uganda, Rwanda, and Ethiopia — countries showing promising signs of economic recovery and political stabilisation.