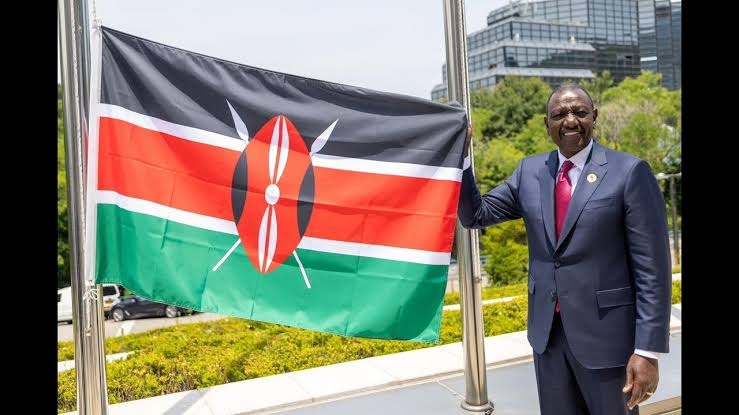

Foreign investors withdrew Sh16 billion from the Kenyan economy between September and December 2024 mostly driven by political tensions.

Data released by the Capital Markets Authority shows that the stability of the Kenyan shilling towards the end of 2024 failed to inject investor confidence in the capital markets as ‘political’ abductions spread fear among investors.

According to CMA, in the three months to December (Q4 ), the equity market saw a net outflow of Sh16.639 billion, much higher than the Sh628 million recorded in the third quarter of 2024.

“The rise in capital outflow is mainly linked to the effects of political instability in the country during the second quarter of 2024, which likely caused foreign investors to pull out of the market,” CMA said in its quarterly Capital Markets Soundness Report released on Thursday.

As the effects of political tensions manifested in the markets, foreign investors were forced to dispose their portfolios and move their money to safer markets.

The heightened capital flight manifested despite government indicators showing that in the fourth quarter of 2024, the economy was stable.

CMA chief executive Wycliffe Shamiah, however, maintains that the domestic market has shown strong resilience, as reflected in the improved performance of market indices during the quarter.

“The fourth quarter of 2024 saw stable economic growth, with a notable reduction in inflation and central bank targets. Looking ahead, the global economic outlook for 2025 is even more optimistic, with projected global GDP growth of 3.3 per cent, up from 3.2 per cent in 2024,” said Shamiah.

CMA noted that it was not all gloom as the percentage of foreign investors actively trading in the market rose slightly from 42.07 per cent to 43.83 per cent showing that foreign investors were still engaged in the market despite the outflows.

“The market volatility for the three market indices, NSE20, NSE25, and NASI, remained low, below one per cent. All indices increased compared to Q3. 2024,” the report reads.

“The improved performance across the three indices is driven by heightened participation in the capital markets from both retail and institutional investors despite increased foreign capital outflow,” added Shamiah in the report.

To address the risks posed by elevated foreign capital outflows, which are considered high at levels exceeding Sh50 million, CMA outlined plans to implement targeted measures aimed at bolstering market liquidity and enhancing investor confidence.

Among these initiatives are proposed margin-trading regulations, which the Authority intends to present to the National Treasury and Economic Planning during the 2024/25 fiscal year.

These regulations aim to manage market volatility and encourage product uptake, such as day trading strategies.

The CMA emphasised that reducing investment barriers for foreign

investors and implementing daily

trading strategies could stimulate

market liquidity, attract foreign investment, and contribute to a more

vibrant and resilient market environment.