Directline Assurance has confirmed that is fully operational, echoing the regulator’s sentiments late last month.

In a statement, the firm, which commands the largest share of the Public Service Vehicle (PSV) insurance in the country, said that it is still honouring underwriting business and paying non-fraudulent claims arising from the same.

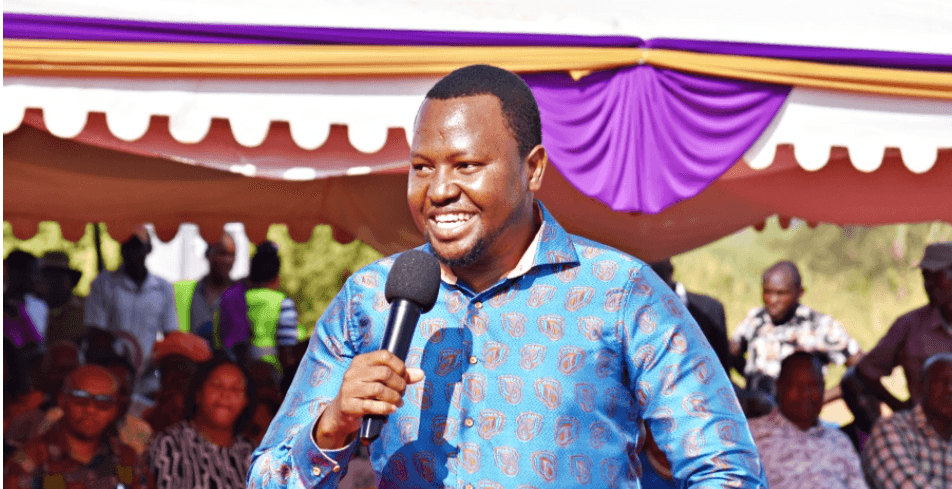

"The Company wishes to reassure its customers that all insurance covers it has issued are valid. Directline paid Sh2.88 billion worth of claims in 2024, with Sh275.2 million paid in December 2024 alone,’’ Directline Acting Principal Officer, Sammy Kanyi said.

He thanked the company’s stakeholders including intermediaries, insured customers and business partners for their continued trust and partnership, adding that claims paid from January 1-5 amount to Sh19.1 million.

“The business is fully operational despite a shareholder dispute at the company, with the matter currently with the courts. The Company confirmed that it has and will continue to abide by all court rulings on the same.”

The statement by the firm follows another one by the Insurance Regulatory Authority (IRA), which dismissed communication by Royal Credit Limited purporting to wind up Directline’s operations as null and void.

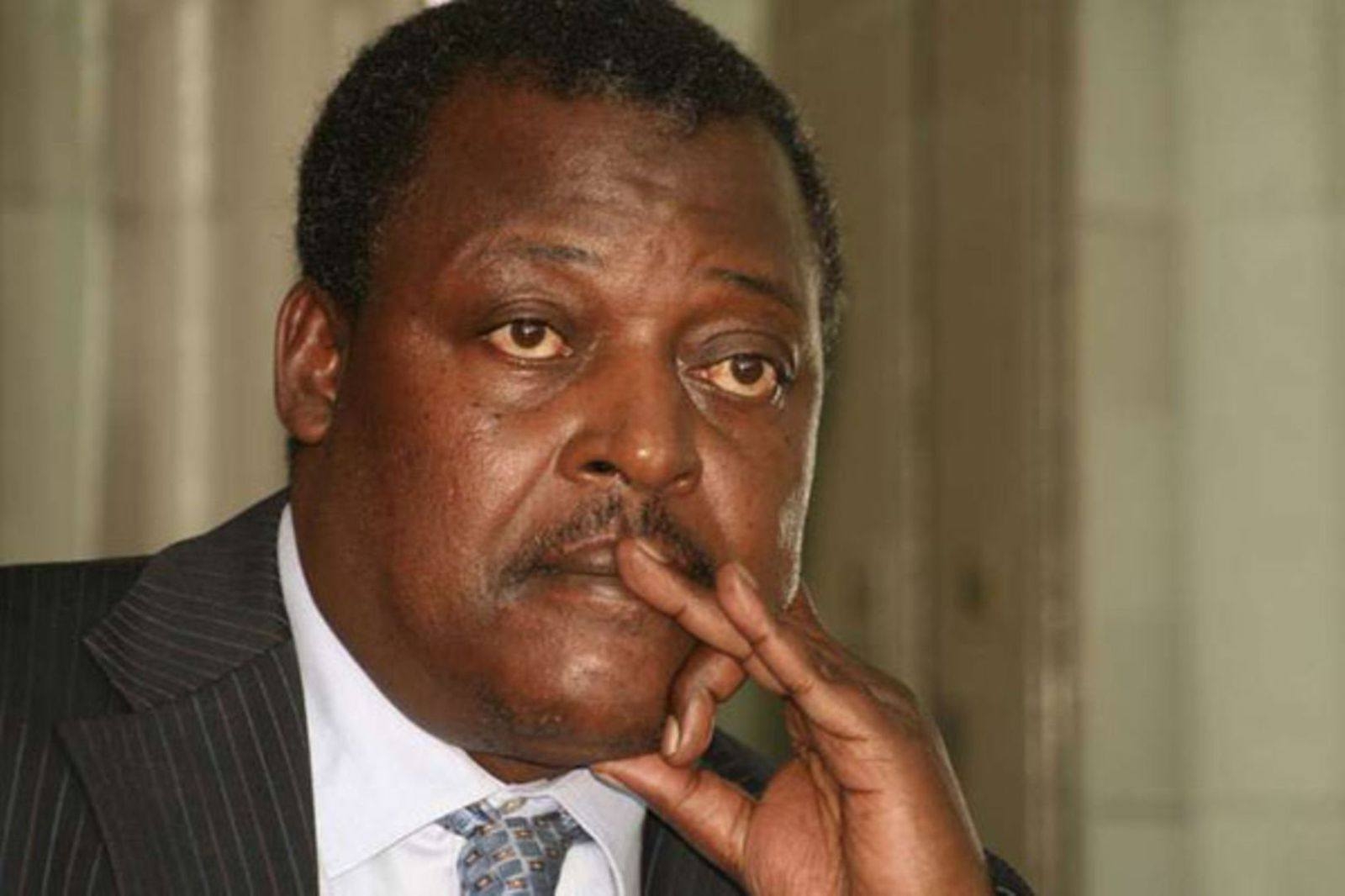

IRA CEO Godfrey Kiptum said that the purported actions are null and devoid of any legal effect, and as such, the insurer continues in full operation as licensed and approved by the Authority.

“All policies issued by Directline Assurance Company Limited remain in full force and effect and the insurer remains liable for any claims arising there from,” said Kiptum.

The IRA CEO directed all policyholders of the insurer to continue with their operations in accordance with their insurance contracts.

He added that the IRA has the sole statutory mandate to approve, suspend, or cancel the operations of any insurance company in Kenya and any unauthorized party cannot usurp this duty.