The Capital Markets Authority has invited the public and stakeholders to give heir views on proposed amendments to proposed trading regulations

The 'Margin Trading' regulations seek to enhance market liquidity in securities trade.

They further seek to enhance responsiveness to changing dynamics, market developments, technological advancements and emerging stakeholder expectations

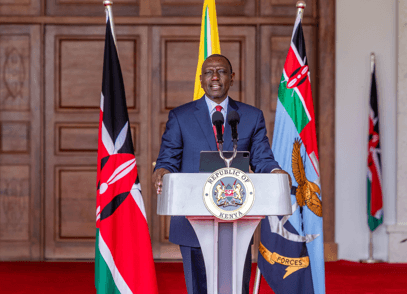

CMA chief executive Wyckliffe Shamiah says the margin financing seeks to enable investors buy large quantities of securities seen as undervalued or their price has been impacted by negative news or investor sentiments but have potential for recovery.

"The provision will be crucial in the market as it makes investors active on both the demand and supply side hence improving investor sentiments, in turn attracting more investors to the stock market," Shamiah says.

If introduced, the trading will be limited to participants approved by CMA.

The rules according to CMA will increase the supply and demand for securities and maintain the stability and integrity of financial markets.

Margin trading was recommended as one of the measures to improve liquidity in the equity market in the 2015 World Bank report on potential measures for the improvement of liquidity in the Kenyan equity markets.

Other recommendations included Securities Lending and Borrowing (SLB) and market making.

The capital markets (Securities Lending and Borrowing and Short Selling) regulations were gazetted in 2017, which permit SLB and short selling.

The Authority also approved the rollout of day trading in 2021 to support the enhancement of market liquidity.

Margin trading has been implemented in the USA, China, Nigeria, Japan, Thailand and India.

Also under review are the guidelines on financial resource requirements for market intermediaries, and amendment of the commodity markets regulations.

The financial resource requirements for market intermediaries have been amended to include new license categories not addressed in the current guidelines.

The new license categories include intermediary service platform providers, broker-dealers, trustees, custodians and money managers.

On the other hand, the commodity markets regulations 2020 have been amended to introduce fees to support regulatory oversight over licensed entities in the commodities sector.

The deadline for comments and feedback submission on the draft proposals has been set for April 11, 2024.

![[PHOTOS] Ole Ntutu’s son weds in stylish red-themed wedding](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2Ff0a5154e-67fd-4594-9d5d-6196bf96ed79.jpeg&w=3840&q=100)