Debt in developing countries has soared to a 50-year high, gobbling about 250 per cent of government revenues as interest rises due to currency devaluation.

Global financial leaders at the ongoing Spring meeting by the International Monetary Fund (IMF) and World Bank now say the debt situation is a perfect storm for developing countries.

According to IMF Kristalina Georgieva, about 60 per cent of countries that were eligible for the pandemic-related G20 Debt Service Suspension Initiative(DSSI) are experiencing or at high risk of debt distress.

"A common feature of debt crises has been a sudden jump in debt levels, often driven by large exchange rate depreciations in countries with foreign currency debt,'' Georgieva said.

She said since since the crises are associated with slower growth, higher inflation, and setbacks in the fight against poverty and other development goals, protracted defaults are damaging to the economic and social fabric of the debtor country.

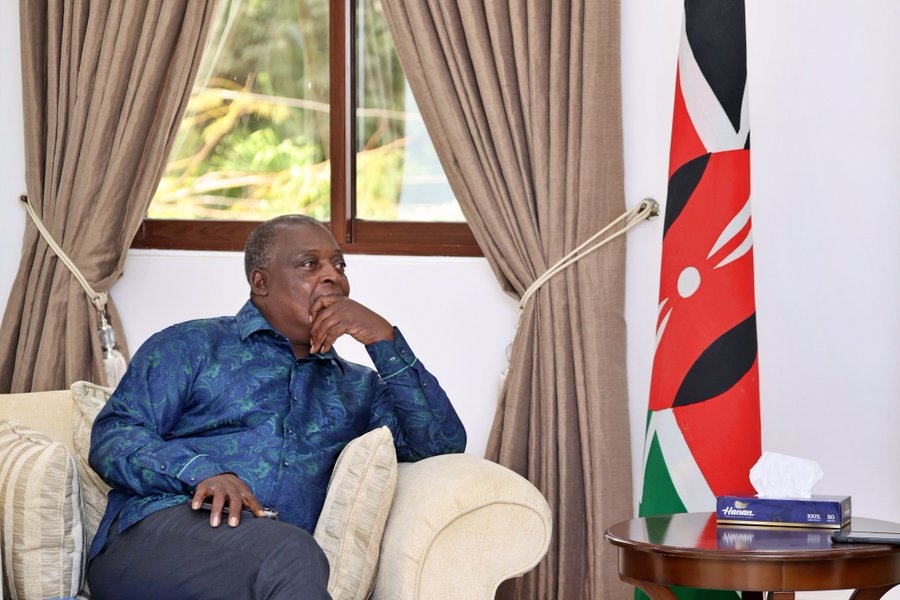

Several countries are currently grappling with currency devaluation, among them the Kenya shilling that has recoded historic lows against the greenback, which accounts for 70 per cent of their external debt portfolio.

On Wednesday morning, the Kenyan shilling san to a new low against the US trading at 115.60 when the market opened.

The shilling's devaluation had already pushed up Kenya's obligation on external debt by Sh271 billion since last June last, despite dropping to $36.9 billion from $37.06 billion.

The country's debt increases by Sh40 billion any time the shilling drops a unit against the US dollar.

Most of Kenya's external debt which accounts for 51 per cent of the country's total public debt is denominated in US dollars, with the latest data from the National Treasury showing that it accounts for 71 per cent of external debt.

Other currencies including Euro, the Japanese Yen, the Chinese Yuan, and the Sterling Pound hold debts of 18.0 per cent, 6.6 percent, 5.4 per cent and 2.5 per cent, respectively.

Wold Bank on other hand said that the global financial conditions are set to deteriorate as central banks in advanced economies tighten policy to fight unexpectedly persistent inflation pressure.

This is as the US considers continuing to hike Federal Reserve Rate in the coming months.

The Fed raised the target for the fed funds rate by a quarter-point to 0.25 cent-0.5 per cent during its March 2022 meeting for the first time in three years and signaled ongoing rate hikes ahead.

The Fed now sees rate hikes at each of the six remaining meetings this year, with the fed funds rate reaching 1.9 percent by year's end.

According to World Bank President David Malpas, the declining overseas lending by China is poised to escalate the global debt crisis as the country deal with its own property sector bankruptcies.