It is trite that Foreign Direct Investment (FDI) plays a key role in a country’s developmental agenda, and more so to lower and middle-income economies. However, to attract optimal FDI, key considerations ought to be made with respect to underpinning institutional and regulatory frameworks.

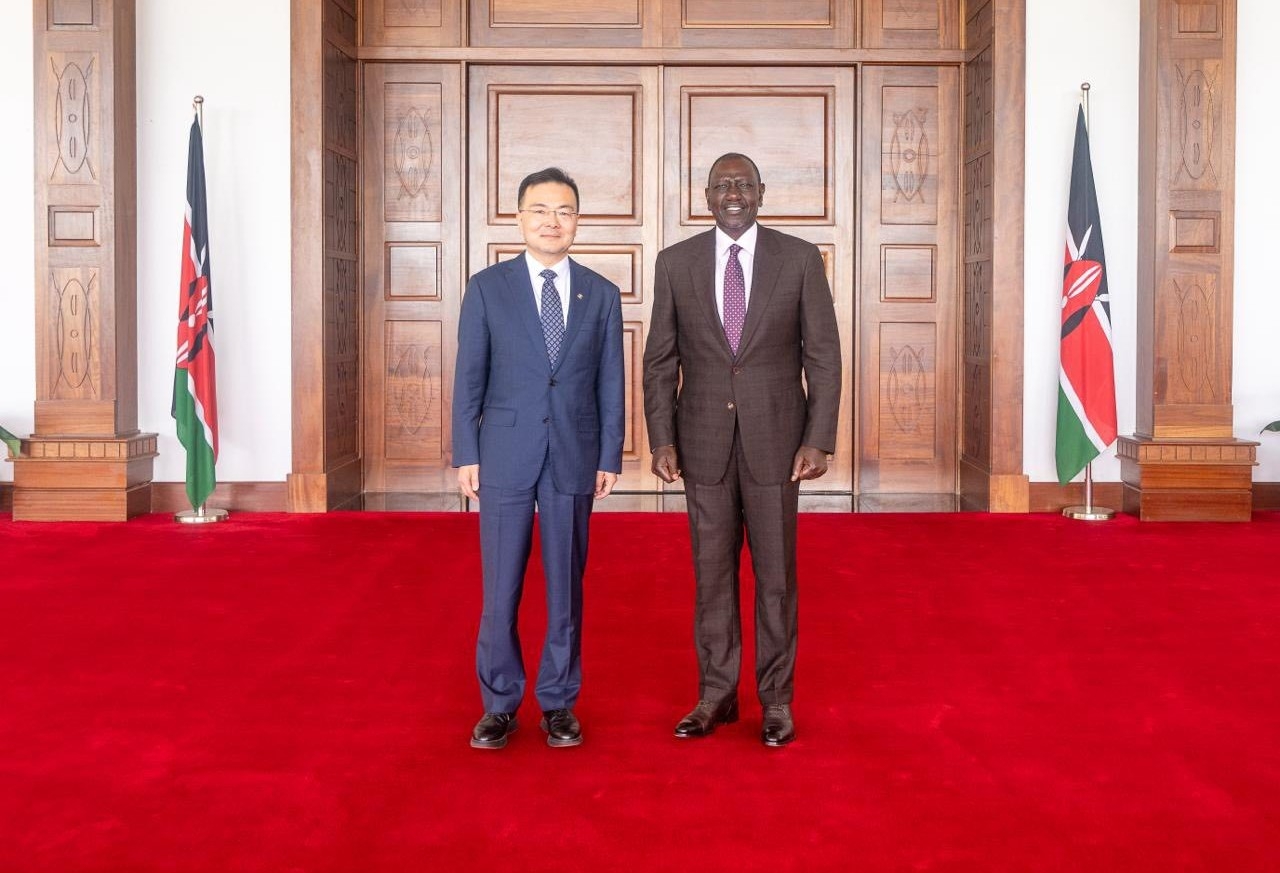

As evident from the current administration’s efforts to market Kenya as a favourable investment destination, FDI plays a significant role in Kenya’s developmental strategy. Particularly, the Kenyan government is eager to attract international development partners that will provide support to Kenya’s accelerated growth strategy through an influx of FDI into the Kenyan market. As noted by the Organisation for Economic Co-operation and Development (OECD), inbound FDI has numerous benefits, including but not limited to, the creation of employment opportunities, the introduction of new technologies and processes into the Kenyan market, and generally the promotion of economic growth.

However, in order to attract FDI, as envisaged above, it is imperative that Kenya strategically leverages itself as the investment destination of choice, with respect to prospective investors in the African market. Key to this is a stable and predictable regulatory environment.

Various economic policies show that a major driver of FDI is the regulatory environment of the host country in question. Specifically, foreign investors looking for investment destinations and opportunities largely focus on the existence of sound and stable public policy and regulatory frameworks, together with strong and efficient governmental institutions that are willing to predictably enforce the prevailing legislative and regulatory conditions. This will feed into the ability of the investor to weigh the competitive advantages of investing in one market over another, and ultimately predict, with some degree of certainty, the viability of an investment opportunity.

This presents an opportunity for Kenya to market herself as the investment destination of choice in the African market, and ultimately gain a competitive edge, viz. a viz. FDI, in the Africa region. In order to achieve this, it lies upon the legislature and policy makers to ensure that Kenyan legislation is modernised to global standards with a degree of certainty and predictability, that regulations are fair to business interests, and not overly aggressive, and that both legislation and regulations are enforced by a free, fair and impartial judicial system.

On the regulatory front, of key importance to potential investors is the prevailing taxation regime. It is imperative that the taxation regime in place adequately supports the growth of businesses in the long run, rather than stifle growth and innovation as a result of punitive taxation measures. Similarly, it is necessary to maintain a stable and predictable taxation environment that enables potential investors make long-term decisions with respect to their investment. The successful codification of Kenya’s proposed National Tax Policy will likely play a prominent role in ensuring certainty within Kenya’s prevailing taxation regime.

Karen Kandie