Land purchase, school fees and agriculture loans topped lending by Savings and Credit Cooperatives (SACCOs) in the three months to September 2025, new sector data shows.

Latest SACCO Societies Regulatory Authority (SASRA) data indicates that the three sectors collectively account for more than 65 per cent of all loans disbursed by regulated SACCOs in the third quarter of the year.

Overall lending surged to Sh131.84 billion, up from Sh113.79 billion in June, in what the regulator says reflects improved liquidity and sustained loan demand across cooperative societies.

According to the report, land and housing continued to top the list, attracting Sh32.70 billion in disbursements.

This marked a rebound from the previous quarter’s Sh29.10 billion, signalling growing investment in property-related activities despite a sluggish real estate market.

Housing loans accounted for Sh15.33 billion while land purchases drew Sh17.37 billion, as SACCOs’ increasingly hold on to the role of a major financier of home ownership and land acquisition.

“SACCOs are key enablers in the facilitation of credit to their members, who ultimately finance various economic activities in Country,” the report says in part.

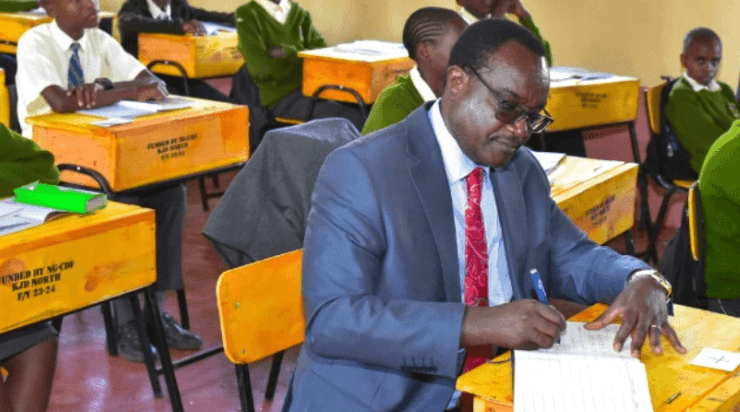

Education financing also saw a sharp upswing, emerging as the second-largest loan category with Sh31.71 billion disbursed, its highest level in the past year.

This represented a significant jump from Sh21.99 billion in June as parents and guardians turned to SACCOs to meet escalating school and university costs.

The spike coincided with fee payment cycles in tertiary institutions and private schools, sectors where families commonly access emergency and top-up education loans.

SASRA notes that the education segment accounted for 24.05 percent of all SACCO credit issued during the period, nearly matching land and housing’s 24.80 percent share.

Agriculture, which is the backbone of rural SACCO membership, ranked third with Sh21.94 billion in loans, a slight increase from Sh20.90 billion in the previous quarter.

While overall agricultural financing dipped in proportional contribution to 16.64 percent, SACCOs remained a key lifeline for farmers seeking capital for production, livestock, input purchases and agro-enterprise ventures.

A deeper look into agricultural financing shows that SACCO members intensified borrowing for animal production, which received Sh9.99 billion.

“This was more than double the Sh4.44 billion disbursed in March reflecting shifts toward dairy, poultry and livestock investments,” data from the report reflects

Crop farming loans, however, fell to Sh9.73 billion, likely influenced by erratic weather patterns and rising input costs that constrained planting activities.

Beyond the three dominant sectors, trade, consumption and social services, and finance and insurance-linked activities also recorded significant lending.

Borrowing in trade rose to Sh16.79 billion, driven by wholesale and retail businesses seeking working capital.

Consumption-related loans slightly dipped to Sh12.52 billion, while financial and investment-related lending increased to Sh7.94 billion, marking a recovery from June’s Sh5.87 billion.

SASRA’s data further points to overall resilience in the SACCO industry despite inflationary pressures and a tight credit environment in the broader financial system.

Gross loans rose to Sh923.69 billion, an annual growth of 12.85 percent, while total assets climbed to Sh1.156 trillion. Deposits crossed Sh814.64 billion, reflecting sustained confidence from members even as economic conditions remained mixed.

The expansion in lending comes at a time when SACCOs are facing increased scrutiny over loan quality.

Non-performing loan (NPL) ratios for deposit-taking SACCOs stood at 7.17 percent, above the recommended 5 percent threshold.

However, the sector maintained strong liquidity, with a 69.56 percent liquidity ratio well above the minimum requirement—allowing SACCOs to continue supporting member borrowing needs.

“Sectoral lending trends show where the real pressures on households lie,” the report states, adding that SACCOs are now central to helping Kenyans navigate the high cost of education, pursue home ownership, and sustain farming operations.

As the year nears its end, the regulator expects lending to remain strong, buoyed by increased demand for school fees loans in January and renewed interest in agribusiness as farmers prepare for the planting season.

SACCOs, however, are urged to strengthen credit risk management to safeguard member deposits amid mounting economic uncertainties.