Kenya misses out on $5.3 billion (Sh684.2 billion) annually in unmet export potential, an industry study shows, amid a widening trade deficit as the country remains a net importer.

This is in addition to nearly $10 billion (Sh1.3 trillion) in broader export opportunities that remain unrealised, with the local market also proving tough for manufacturers whose products continue to face stiff competition from cheaper imports mainly from Asia.

According to the Exports Competitiveness Study by Kenya Association of Manufacturers (KAM), in partnership with the German Embassy in Nairobi and Zusammenarbeit (GIZ Kenya), Kenya’s most accessible and natural growth markets lie within the EAC and COMESA regions.

“Regional markets account for a substantial share of Kenya’s export potential, yet much of this opportunity remains unexploited, with significant unrealised potential in processed food, beverages, construction inputs, pharmaceuticals, plastics and packaging,” the report reads in part.

The value of Kenya's exports to the EAC remained strong at Sh321 billion last year, with Uganda and Tanzania as top destinations.

Earnings from exports to the Comesa region however decreased by 2.8 from Sh341.1 billion in 2023 to Sh331.7 billion in 2024, the Economic Survey 2025 indicates.

Earnings from exports to the African region decreased by 2.2 per cent from Sh435 billion to Sh425.6 billion in 2024.

Kenya's total exports in 2024 was Sh1.1 trillion with key exports being tea, coffee, horticultural produces and mineral fuels, driven by strong demand from Uganda, UAE and the US, despite shifts in trade policy like AGOA expiry.

While the trade deficit slightly narrowed to Sh1.59 trillion, down from Sh1.595 trillion in 2023, due to lower food and fuel import bills, it has widened in quarterly performances this year.

Kenya National Bureau of Statistics latest data indicates the current account balance worsened by 76.6 per cent to a deficit of Sh83.7 billion in the second quarter of 2025 from a deficit of Sh47.4 billion recorded in the same quarter of the previous year.

This was primarily driven by 11.7 per cent widening of the merchandise trade deficit to Sh348.4 billion during the corresponding period.

KAM head of policy and regulatory advocacy, Miriam Bomett, Kenya needs to address challenges in place to reverse the export gap, with manufacturers also concerned over the cost of doing business in Kenya including high electricity bills and tax regime.

“Kenya’s markets exist, demand exists, but we must strengthen our competitiveness to seize our share. With predictable regulation, stronger value chains and sustained reforms, we can narrow the export deficit and grow our footprint across Africa and globally,” she said.

“To unlock these potential calls for accelerating ongoing reforms aimed at streamlining regulations, reducing overlapping mandates, and expanding digital trade systems to make approvals faster and more predictable.”

GIZ Kenya director for sustainable economic development, Christoph Zipfel, emphasised the importance of strengthening value chains as the backbone of competitiveness.

“The study was informed by the need for Kenya to look at opportunities that lie within intra and extra Africa trade. It identifies clear opportunities to enhance competitiveness through improved regulatory efficiency, technology adoption and strengthened skills development,” Zipfel said.

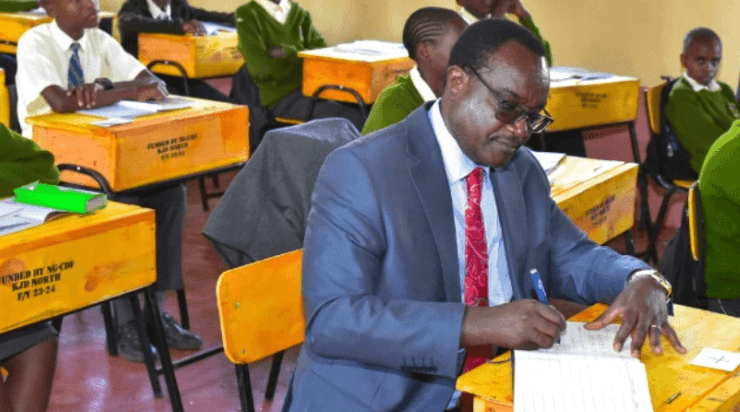

Director of external trade at the State Department for Trade, Peter Njoroge, reaffirmed government commitment to advancing reforms that boost Kenya’s competitiveness.

“We are strengthening the National Export Strategy to promote value addition and fully access and utilise existing preferential markets. Key reforms include upgrading logistics infrastructure, digitising approvals and trade documentation, enhancing the National Electronic Single Window System, and reducing regulatory overlaps,” he said.

The government is also expanding MSME financing and promoting value addition across tea, coffee, textiles, edible oils, fisheries and livestock, he said.

Both Kenya’s private sector and government have been keen to tap opportunities under the African Continental Free Trade Area, which represents one of the most ambitious trade pacts creating an integrated market of over 1.4 billion people, with a combined GDP exceeding $3.4 trillion (Sh483.9 trillion).