Pan-African business conglomerate, Amsons Group, is

exploring renewable energy opportunities in East Africa, days after sealing a $600 million renewable power generation deal in Zambia.

In a statement, the firm’s managing director, Edha Nahdi, confirmed that the firm is also exploring renewable energy opportunities in Kenya, Tanzania, and Uganda, among other sub-Saharan African countries.

He added that this investment signals a major strategic pivot into utility-scale power generation in strategic markets, including Kenya, leveraging its regional presence and financial strength.

This is part of the firm’s diversification strategy away from its core business in manufacturing and petroleum products distribution across Africa.

The deal in Zambia, billed as the largest power generation deal on the continent in recent times, follows a streak of yearlong investments that have seen it dominate Kenya’s cement industry.

On Monday, Amsons successfully acquired an additional 27 per cent stake in East African Portland Cement (EAPC), owned by the National Social Security Fund (NSSF), making it a majority shareholder.

The firm recently completed the purchase of a 29.2 per cent stake in the local cement maker from Associated International Cement Limited (AIC) and Cementia Holding AG.

Bamburi Cement Plc (a related company to Kalahari Cement) also holds approximately 12.5 per cent of the ordinary shares in EAPC, a move likely to see Amsons Group control a 68.7 per cent shareholding in the cement maker, which recently returned to profitability after almost a decade of financial struggle.

It took over Bamburi Cement, another Kenyan stable, in December last year for Sh23.6 billion.

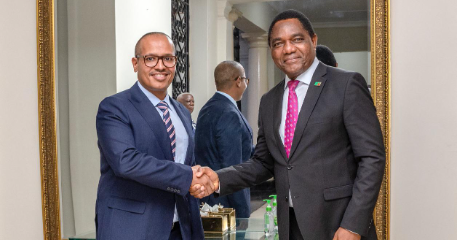

The 1 Gigawatt (GW) deal witnessed by Zambia’s president, Hakainde Hichilema, will be a game-changer, addressing the country’s crisis by providing reliable, clean, and non-hydro dependent power.

According to Hichilema, the sheer scale of this project, facilitated by the government's commitment to efficiency and transparency, ensures that it is decisively on track to meet, and possibly exceed, the country’s target of adding 1,000 megawatts of new solar power to the grid.

“This means an end to load shedding and a stable foundation for the massive economic growth we are pursuing.”

He reaffirmed that foreign direct investments of this nature are central to his administration’s goal of 10 GW of new power capacity by 2030, supporting the regional Mission-300 initiative to power 300 million Africans.

“At Amsons Group and Africa Power Generation, we are immensely proud to partner with the Republic of Zambia on this historic, transformative project as development partners,” Nahdi said.

He added that the project is not merely about generating electricity, but also creating sustainable jobs, building local capacity, and contributing to a resilient energy system that will power homes, schools, and industries for decades to come.