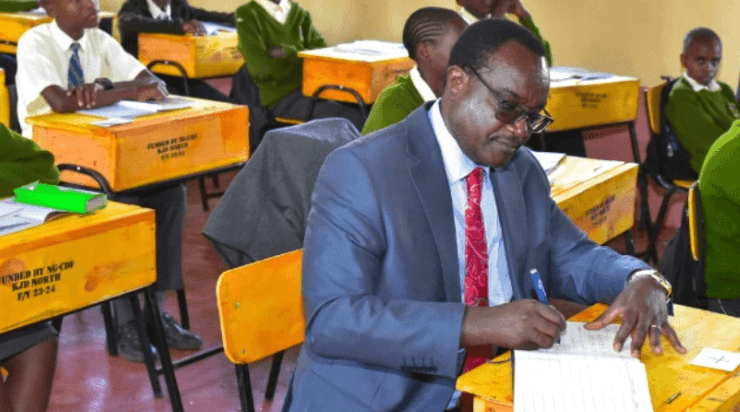

Institute of Public Finance CEO James Muraguri /HANDOUT

Institute of Public Finance CEO James Muraguri /HANDOUT Poor structuring of Kenya's tax system has seen the wealthy escape huge tax payments that would see the Kenya Revenue Authority (KRA) collect up to $1billion (Sh130 billion) in new annual revenue, according to new market findings.

The gap in well-targeted wealth taxation in the country is denying the country an amount equivalent to nearly the entire annual budget of the Ministry of Health.

The analysis by Oxfam and the Institute of Public Finance reveals that despite Kenya’s growing class of dollar millionaires and expanding concentrations of private wealth, the country lacks an effective mechanism to tax high-net-worth individuals, leaving billions in potential revenue untapped each year.

This comes as the government faces growing public pressure to shift away from regressive taxes that disproportionately burden ordinary Kenyans.

It also emerges at a time when Kenya is grappling with rising public debt, widening inequality and an urgent need for more sustainable revenue sources.

“Despite Kenya having various tax measures that target the wealthy, such as capital gains tax and rental income tax, these often are ineffective as they are charged at lower rates compared to income tax and often fail to yield significant revenue,” said IPF CEO, James Muraguri in the report.

The experts point out that this continues to occur against the backdrop of rising wealth inequality, where the top 10 per cent of the population controls 62.8 per cent of net personal wealth.

The bottom 50 per cent collectively hold only 4 per cent. Despite this stark concentration of wealth, Kenya lacks an effective and enforceable framework for taxing the wealthy.

Despite Kenya having progressive income taxes on paper, the reality is starkly different.

The country remains heavily dependent on regressive consumption taxes, like VAT and excise duty, that disproportionately affect low-income households. The World Bank notes that consumption taxes accounted for 56.2 per cent of total revenue in 2022/23.

Meanwhile, wealthy Kenyans continue to accumulate and transfer vast assets through systems that remain largely opaque. The top 10 per cent hold more than 63 per cent of the country’s personal wealth, according to the report.

This disparity is compounded by Kenya's growing millionaire class, where the Africa Wealth Report estimates that the country now hosts 7,200-dollar millionaires and at least 16 centi-millionaires with assets exceeding Sh12.9 billion each.

“Kenya’s tax base leaned more heavily on income taxes, meaning that the current reliance on indirect consumption taxes marks a shift toward more regressive revenue measures,” the report reads in part.

The absence of a comprehensive wealth tax means the government is unable to tap into these large pools of assets.

When translated into revenue potential, the Oxfam-backed study shows that Kenya could collect over $1 billion (Sh130 billion) annually if a well-structured wealth tax were implemented.

Although KRA established a High-Net-Worth Individual (HNWI) unit, experts say it remains constrained by a lack of reliable, centralised data on property, shares, luxury assets, crypto holdings, beneficial ownership structures and bank accounts.

OXFAM and IPF say that the wealth taxation guidelines will need to be created in such a way that they don’t encourage capital flights since Kenyan elites have a long history of holding wealth abroad, often in secrecy jurisdictions.

“Investigations such as the Pandora Papers revealed how key political and business figures use offshore accounts, shell companies, and trusts to shield assets from scrutiny,” the report says.

“A successful wealth tax must be designed to prevent large-scale capital flight. This includes requiring declarations of offshore assets and aligning domestic tax rules with international transparency standards. Without such safeguards, Kenya risks undermining its own investment climate and incentivising avoidance.”