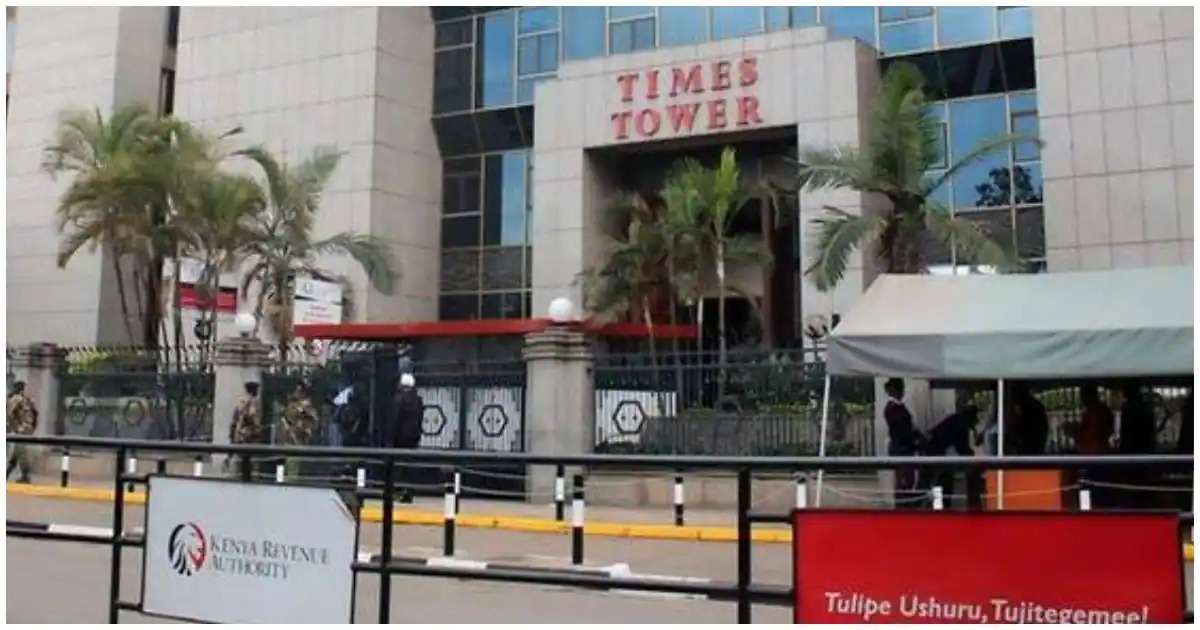

The Kenya Revenue Authority (KRA) has launched a sweeping crackdown on Value Added Tax (VAT) fraud, targeting ghost firms and reinforcing internal controls to curb staff collusion.

The deals involving the traders and KRA staff is known as " The Missing Trader Scheme".

It involves fraudsters registering shell companies to generate fake VAT invoices, enabling illegitimate tax deduction claims without any actual business transactions.

These entities often disappear before remitting any VAT, depriving the exchequer of billions in revenue.

The initiative is a response to staggering monthly revenue losses due to fictitious invoicing and tax evasion.

VAT collections fell by 4.3 per cent in the six months to December 2024, data shows, the first such drop since the Covid-19 pandemic.

The combined collections from both local and import VAT fell to Sh304.1 billion in the period from Sh317.8 billion at the same time in 2023, according to the data by the National Treasury.

In the previous quarter, VAT collection dropped by 26.3 per cent, attributed to decline in key sector remittances.

The decline resulted in a Sh2.37 billion deficit, attributed to lower contributions from sectors such as administrative and support, electricity, oil and gas, finance, professional and scientific, transport, wholesale and retail trade, which typically contribute about 33 per cent of domestic VAT.

These sectors accounted for 14.7 per cent of turnover sales, while inputs showed only a slight growth of 0.5 per cent.

Value Added Tax was one of four tax categories under the Domestic Tax Department (DTD) that recorded weak revenue collection in October.

To counter this scheme, KRA has instituted stringent reforms, including tighter VAT registration protocols.

Physical verification and thorough due diligence are now mandatory for new applicants.

Additionally, the authority has reduced the number of officers authorised to approve VAT obligations from 645 to 170, significantly narrowing the window for internal collusion.

In a major cleanup effort, KRA is reviewing the VAT status of 90,127 entities. Over 20,000 inactive taxpayers have been slated for deregistration to prevent fraudsters from exploiting dormant companies.

The remaining entities are under assessment for dormancy or suspension.

KRA’s data-driven investigations have flagged 4,434 suspected “missing traders.” Of these, over 2,000 entities issued invoices worth Sh19.7 billion but failed to file or filed nil returns since July 2024, posing a potential VAT loss of Sh2.1 billion.

Another 2,354 traders filed VAT returns between January and March 2025 without remitting taxes, resulting in an additional Sh2.5 billion in unpaid liabilities.

All flagged traders have been placed on a special monitoring table, effectively preventing fraudulent claims tied to their invoices. The tax agency has also been homed in high-risk sectors.

According to the statement, several companies supplying the Kenya Power and Lighting Company (KPLC) and those involved in sugar imports have been found to declare VAT obligations without making payments.

“One such group alone owes Sh1.1 billion in outstanding taxes. Despite formal notices, some of these firms have resisted compliance, resorting to threats and intimidation.”

Recognizing internal collusion as a contributing factor, KRA is strengthening internal oversight and intensifying collaboration with its investigation and enforcement department.

These measures aim not only to deter future fraud but also to rebuild public trust in the integrity of the tax system.

The agency has warned that staff found to be collaborating with tax evaders will be apprehended.

“By tightening VAT registration, cleansing the taxpayer roll, and aggressively pursuing defaulters, we are entering a new era of tax accountability and revenue protection,” said a KRA spokesperson said.

“This crackdown is both a technical and ethical recalibration of tax administration in Kenya, one that is essential for sustainable public finance.”

KRA reaffirms its commitment to upholding transparency, accountability, and equity in revenue collection, as part of its broader mandate to support national development.