The National Social Security Fund (NSSF) offers a range of benefits to its members with an aim of improving their financial security and providing a safety net for their future.

Under Section 31 of the NSSF Act, one can secure a mortgage loan from a bank, building society or other similar institutions and on such terms and conditions as may be prescribed under the Retirement Benefits Act.

The Retirement Benefits (Mortgage Loans) (Amendment) Regulation, 2020 allows members to utilize up to 40 per cent of their retirement benefits for mortgage loans.

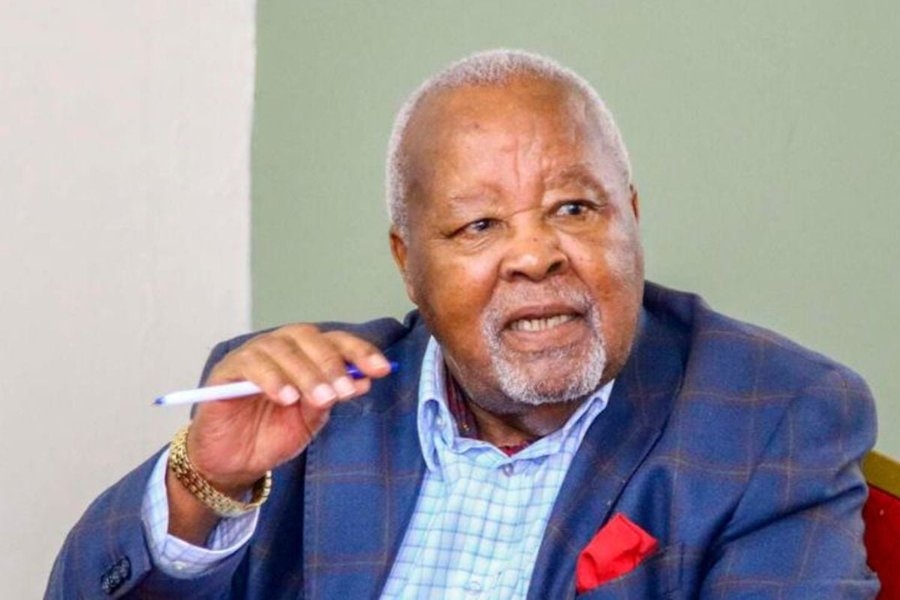

"This is a departure from the norm where money under pension schemes is only released at retirement or in part when a member leaves employment midway," said NSSF CEO David Koross in an exclusive interview with The Star.

Members wishing to utilise their savings for a house purchase must apply in writing to the NSSF CEO.

Beyond housing, NSSF under Section 40 of the NSSF Act offers a funeral grant of up to Sh10, 000 to assist families with immediate expenses upon the death of a member.

The NSSF is also encouraging Kenyans, both in formal and informal sectors to save more with the it, so as to leverage her Sh400 billion financial base to earn guaranteed tax-free interest and benefit from cost-effective management of contributions.

For active members who become permanently or partially incapacitated, NSSF provides invalidity benefits. Contributors under the Pension Fund, receive an enhanced monthly pension.

Survivor benefits are paid to the families of a deceased member if no other claim had been made and paid to the deceased member.

NSSF allows members to transfer or redeem their contributed funds plus accrued interest, upon migration.

Under the "Haba Haba" arrangement, Kenyans in the diaspora may contribute as little as $10 through USSD *303#, the Fund’s mobile phone access.

To ensure accessibility, NSSF has established branches in all 47 counties, including Huduma Centres, and expanded its digital infrastructure.

Koross assures members of the security of their funds, stating that NSSF is guaranteed by the Government of Kenya, audited by the Auditor General, and subject to stringent oversight by the Retirement Benefits Authority.

Transparency is maintained through Annual General Meetings and accessible member account information.

These initiatives demonstrate NSSF's commitment to providing a comprehensive range of benefits and enhancing the financial well being of its members.

![[PHOTOS] Three dead, 15 injured in Mombasa Rd crash](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2Fa5ff4cf9-c4a2-4fd2-b64c-6cabbbf63010.jpeg&w=3840&q=100)