Kenya plans to adopt debt swaps in the next three years to cushion the country from future economic uncertainties.

The plan will see the National Treasury engage in debt for food swap, debt for medicine swap and debt for nature swap as a debt management strategy.

A debt swap is an arrangement where a foreign debt owed by a developing country is transferred to a particular organisation, typically in return for the country's committing itself to specified set measures.

The exchequer argues that the move is meant to avert scenarios like the ones witnessed ahead of the Eurobond repayment where investors adopted a a wait and see attitude awaiting a clear plan on the repayment of the debt due in June 2024.

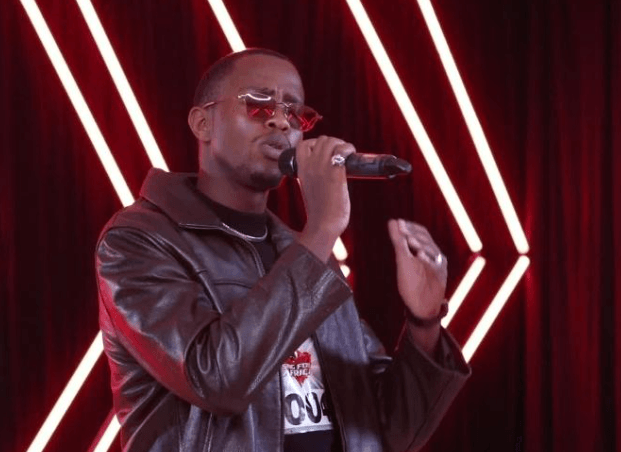

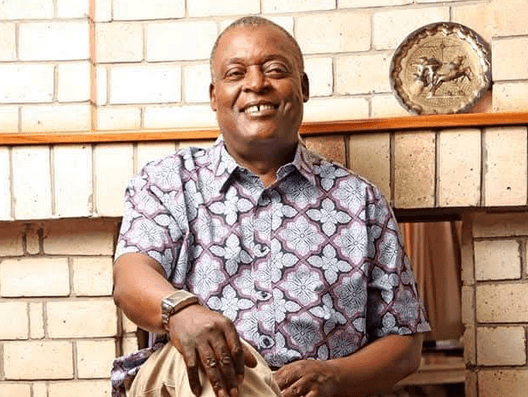

National Treasury Cabinet Secretary Njuguna Ndung’u told MPs that in the next 10 years, Kenya is supposed to pay not less than Sh8 trillion of the Eurobond debts and treasury is pursuing debt swaps to ease the pressure from crucial repayment deadlines.

Treasury is in talks with the World Food Program about the plan to create a debt for food swap. Further engagements are with World Bank over the process of developing a sustainability bond for liability management.

Additionally, Ndung’u added that the Global Fund was working on a debt for medicine swap.

The plan spearheaded by International Monetary Fund will see treasury either raise revenue to the level proposed by the multilateral lender or reduce expenditure to the level agreed by both parties.

“They are going to train our staff on liability management. They are going to start now and say they are targeting the 2028 bonds and they work towards that, "said Ndung'u

He said essentially Kenya will be receiving resources but this will be financing the future bonds to effectively reduce our exposure.

This details emerged during treasury’s submission to the Committee on Public Debt and Privatisation on the 2024 Medium Term Debt Management Strategy.

Debt repayment has been so pronounced in the country with disclosures by the National Treasury showing that Kenya’s debt repayment reached Sh600.73 billion in the period to December 2023.

This meant that despite a rise in revenue collection, Kenyans had little to smile about as debt took 57 percent of the Sh1.05 trillion tax revenues.

This left the government with only 43 percent of the revenue generated, for development, salaries and running of public services.

The CS told the committee that the government is working on revision of the taxation policy to deal with a new structure of taxation.

Kenya still faces a significant risk of debt distress despite a $1.5 billion (Ksh220 billion) new Eurobond issue that helped to calm foreign investor jitters.

The Parliamentary Budget Office (PBO) said the economy is still in danger of a liquidity crisis with its key debt sustainability indicators, including debt service-to-revenue ratio and debt-to-gross domestic product (GDP) ratio headed south.

The government is also contemplating similar strategies at the domestic debt level to standardize debt ratios and mitigate inherent vulnerabilities.

“To reorganise our maturity profile of future debt repayments we negotiated for the amortisation of the last three years in equal installments that will give us space to space our Eurobonds that have already been contracted. Although we have started with liability management, we are also planning to do that on the domestic debt level,” added Ndung’u.