Kenya Revenue Authority failed to meet its revenue targets for the first half of this financial year despite posting improved revenues.

Despite the improved revenue from a similar period last year the taxman still fell short by Sh79 billion.

In the period between July-September total revenue collection stood at Sh586.9 billion against a target of Sh665.9 billion.

This is a performance rate of 88.1 percent, however compared to last year it is a growth of 8.4 percent.

This came on the back of increased taxation measures by the state in an effort to raise local collections.

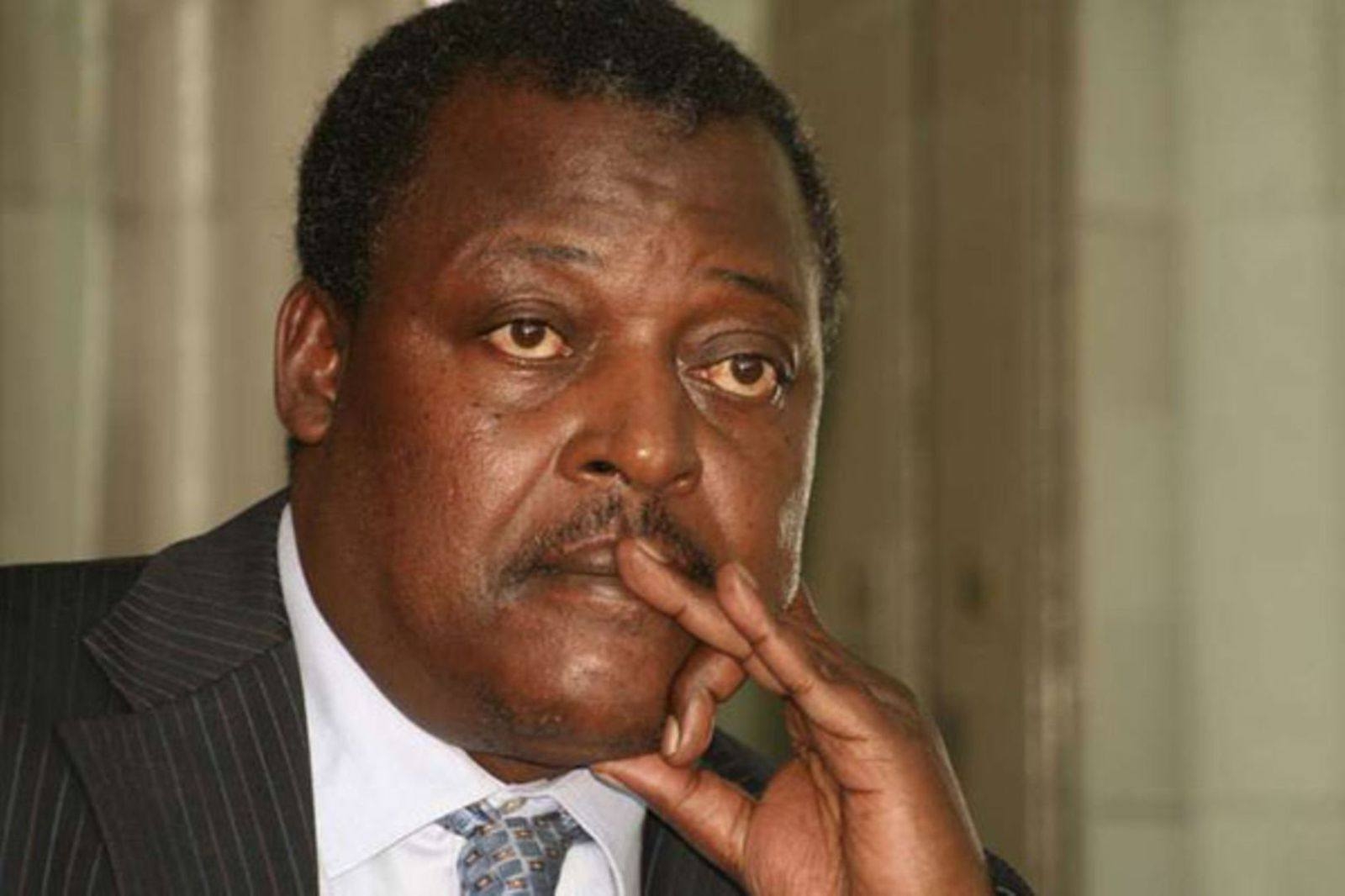

In submissions to the National Assembly's Finance Committee, KRA commissioner general Humphrey Wattanga admitted that inadequate financing of the taxman’s operations is making it hard to hit the target.

According to the commissioner, exchequer revenue totalled Sh545.3 billion during the period July-September 2023/24 against a target of Sh617.8 billion, translating to a deficit of Sh72.5 billion.

“We had requested a budget of Sh61.7 billion to run our operations but we got Sh24 billion. This has made a challenge to run our normal operations optimally,” said Wattanga.

The exchequer revenues recorded a performance rate of 88.3 percent and a growth of 7.9 percent.

During the period under consideration, Domestic Taxes collected Sh389.5 Billion against a target of Sh431.2 billion.

This translates to a performance rate of 90.3percent with a deficit of Sh41.7 billion and a growth of 14.9percent.

Customs and Border Control recorded a total collection of Sh196.1 billion against a target of Sh233.4 billion (a performance rate of 84.0percent) with a revenue deficit of Sh37.3 billion and a decline of 2.7 percent.

First quarter of this year has, however, recorded a slowed growth of 8.4percent resulting from below par performance from both Non-oil and Oil taxes, Corporation tax, PAYE, and domestic VAT.

In the review period domestic VAT registered a growth of 21.7 percent over collection of Sh63.5 billion realised in the period July-September 2022/23.

This reflects a performance rate of 91.9percent (or deficit of Sh6.8 billion). In particular, a number of key sectors (accommodation, administrative & support, agriculture, electricity & gas, finance & insurance, professional, scientific, and wholesale & retail trade) registered impressive growth in VAT remittance averaging at 40.3percent.

This follows the compliance gains realised post-eTIMS implementation.

On the other hand, transport, storage and construction sectors experienced declines of 15.1percent and 4.2 percent respectively.

Further, subdued performance was experienced in sectors like ICT, Manufacturing, and Real Estate that recorded slow growths in remittance of 2.3percent, 8.6percent and 3.8percent respectively.

This performance comes on the backdrop of high cost of inputs occasioned by high fuel prices and unfavourable exchange rate. Construction sector activities were affected by increased cost of construction materials such as cement, steel, paint, aluminium and Polyvinyl Chloride (PVC).

This is in part affected by continued depreciation of the Kenya Shilling against leading currencies, which has led to an increased import bill for these materials. Transport sector activities affected by overall decline in bulk cargo (that would have been hauled/transported) by 11.3percent, mainly from fertiliser and Iron & Steel products.

Unfavourable business conditions was evidenced by PMI averaging at 48.46 points in January-September 2023, and operating below the 50-point mark in seven out of nine months in 2023.

Corporation Tax collection stood at Sh69.5 billion against a target of Sh89.2 billion. The tax head recorded a decline of 2.1 percent over a similar period in FY 2022/23.

There was significant decline of 20.7 percent in instalment remittance in the Information and Communication Technology sector.

Withholding Income Tax registered a performance of 108.9 percent against the target and a growth of 42.2 percent over collection of Sh34.4 billion realised in the period July-September 2022/23.

The tax head's performance was boosted by increased remittance from public sector that grew by 99.2 percent.

Further, private sector remittance grew by 40.4 percent mainly from interest (42.3% growth); management fees (50.0% growth); dividends (37.0% growth); winnings from betting & gaming (107.3% growth); contractual fees (15.0% growth) and commission (20.6% growth).

Pay As You Earn on the other hand registered a performance of 88.7 percent against the target, having realised a collection of Sh126.5 billion and a growth of 11.2 percent.