The Kenyan government has been urged to enhance surveillance and seal-off growing illicit trade between the country and neighbouring Uganda, its biggest trading partner in the region.

This follows an explosive documentary that lifts the lid on Kenya’s rampant trade in counterfeit and smuggled goods, with cigarettes topping the list.

Stop Crime Kenya (StoCK), which has a secretariat at the Consumers Federation of Kenya (Cofek), has now called for urgent response from lawmakers.

Investigation by African Uncensored reveals the deep-rooted involvement of law enforcement officers in the smuggling of illicit goods, ranging from cigarettes to sugar, which robs Kenyans of billions of shillings every year.

Insiders, who are filmed speaking on condition of anonymity, tell of high-ranking officers running illicit trade cartels, the bribery of police and border officials and the deadly consequences for anyone who tries to blow the whistle on these destructive activities.

StoCK chairman Stephen Mutoro said: “This chilling expose by African Uncensored illustrates how deeply entrenched the menace of illicit trade has become as consumers struggle to cope with the soaring cost of living.”

“The revelation that large convoys of vehicles are trafficking tax-evading goods into and around our country is alarming enough. To hear that the officers meant to be combating this crimewave are actively colluding in it – and in some cases even control those vehicles, proves that the system is broken and our lawmakers must take urgent action,” Mutoro added.

Kenya’s Anti-Counterfeit Authority (ACA) deputy director John Akoten notes the trade in counterfeit or smuggled goods has reached unprecedented levels and is worth more than Sh800 billion a year.

An estimated, one in every five products sold in Kenya is counterfeit and almost four million Kenyans are using counterfeit goods that include sugar, cigarettes, bottled water and cooking oil, posing a serious threat to health and security and depriving our economy of vital revenue.

Mutoro said: “The message for consumers is clear: buying cheap can have expensive consequences. The message for authorities is even more stark: they cannot afford any delay in action against the cartels who are looting our nation.”

StoCK has since called on the government to “rethink its approach to illicit trade”.

Stop Crime Kenya (StoCK) is campaigning against criminals who make a fortune smuggling and selling illicit goods.

Illicit trade costs Kenyans an estimated Sh153 billion a year in lost taxes and robs the state of resources needed for vital services. It also funds other criminal enterprises, breeds corruption and finances extremism across the region.

BAT Uganda has also called for enhanced action against illicit trade in Uganda, following a 2021 report, which indicates that the illicit trade incidence in cigarettes continues to rise significantly.

The research commissioned by BAT Uganda and conducted by Kantar, covered the second half of 2021 and found that 23.8 per cent of the cigarettes sold in Uganda appear to be illicit, accounting for almost one in four cigarettes smoked.

This represented an increase of 54.5 per cent compared to September 2020 when the number stood at 15.4 per cent .

Further, the Kantar research found that more than half of the illicit cigarettes (51%) in the market appear to be manufactured in Uganda based on pack markings, with the rest being smuggled into Uganda from other countries.

Similar research conducted in Kenya by Kantar also found that Uganda is a major source of illicit cigarettes in neighbouring countries, with 93 per cent of illicit cigarettes found in Kenya believed to originate from Uganda.

These illicit cigarettes are typically branded ‘Supermatch’, though the report makes no claim as to the actual manufacturer of each pack and bases its findings solely on the observable features of the packet.

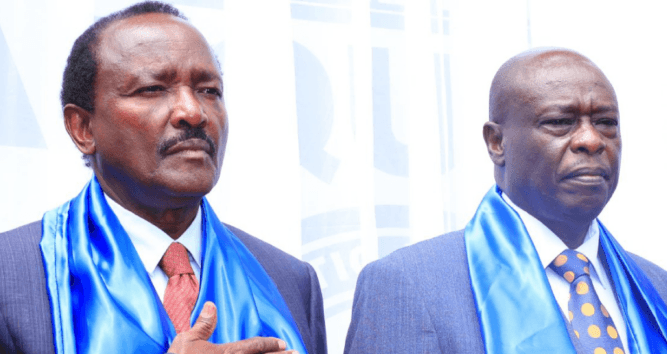

Speaking at a recent media briefing in Kampala, BAT Uganda Chairman Elly Karuhanga said:“BAT Uganda is concerned that illicit trade in cigarettes is allowed to thrive in this country despite the various negative impacts, which include fuelling organised crime.

“While we acknowledge efforts thus far by the Uganda Revenue Authority in tackling this serious issue, including through the introduction of the Digital Tax Stamps System, much more needs to be done,” Karuhanga added.

He said the company is committed to collaborating transparently with all relevant agencies to eradicate illicit trade in Uganda, and the neighbouring markets.

“We urge the business community and industry bodies to jointly fight for the eradication of illicit trade in Uganda, and believe that a unified effort is critical in supporting the Government’s efforts to safeguard legitimate business in Uganda,” Karuhanga said.

Alongside calls for greater collaboration, BAT Uganda detailed a multipronged approach to combat illicit trade, including full enforcement of tobacco product and packaging regulations across the tobacco industry.

It also calls for proper implementation of the Digital Tax Stamps Solution (DTS).

This includes stronger enforcement to prevent under-declaration of local factory production and ensuring that only fully duty-paid products with tax stamps are sold in the Ugandan market.

There is also need for greater information sharing and excise tax harmonisation within the EAC partner states to help reduce excise-led price disparities between countries, which fuels smuggling, the firm says.

EAC member states further need to tighten border controls and enhanced scrutiny of products to ensure they comply with local laws, with more stringent penalties to act as a deterrent, in the form of custodial sentences and forfeiture of factory equipment, real estate and moveable or immoveable assets arising from illicit trade.

The region has also been urged to ratify the 2012 Illicit Trade Protocol (ITP) under the World Health Organisation’s Framework Convention on Tobacco Control.

WATCH: The biggest news in African Business

![[PHOTOS] Ruto launches Rironi-Mau Summit road](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2F6f6601a6-9bec-4bfc-932e-635b7982daf2.jpg&w=3840&q=100)